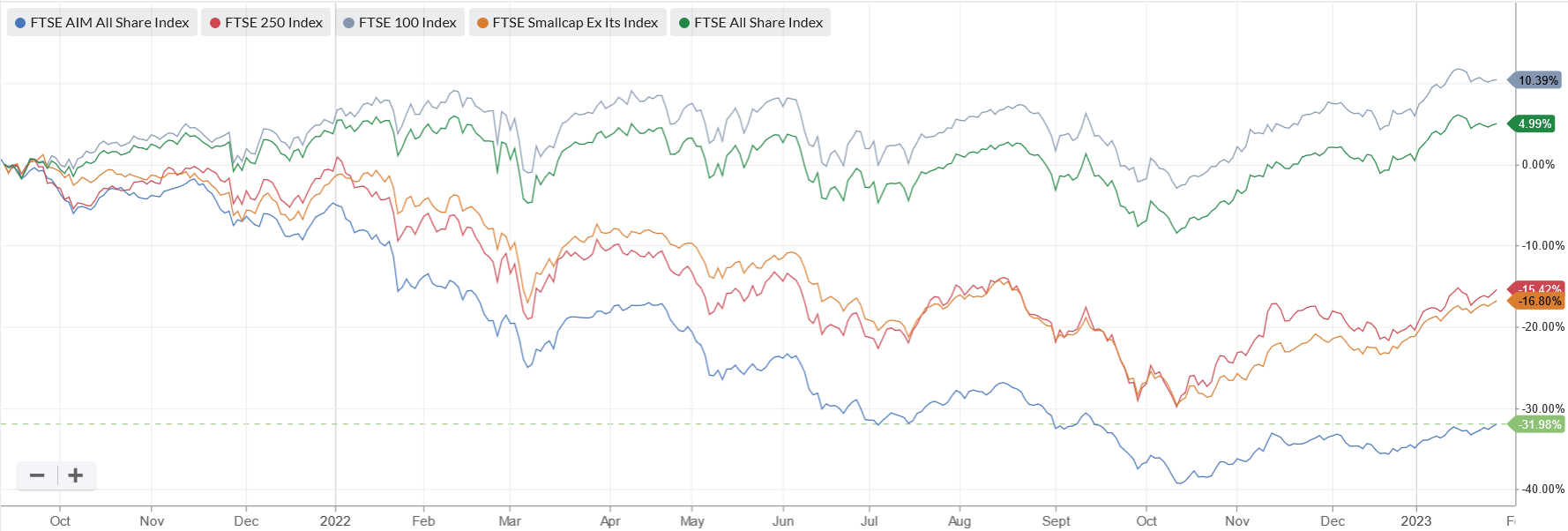

“Enjoy it while it lasts” would be my rough assessment of January's positive returns across most risk assets. So why do I suspect this is a bear market rally?

Well firstly, because many of the biggest gains have come from volatile, high beta plays - such as consumer discretionary, long-duration tech & of course #bitcoin. Largely thanks to lower inflation expectations, a weaker dollar and falling bond yields.

Sure China’s reopening & improved prospects in Europe (re warmer weather) has boosted animal spirits. Yet equally, this may actually elongate the hoped-for decline in inflation back to 2%.

Worse still, corporate earnings are likely to fall too (say 5-10% in 2023) due to deteriorating operating leverage. Here softer demand & pricing power, alongside higher inventory levels & sticky input costs (eg salaries) will almost certainly challenge the record profit margins enjoyed in 2021-22 (re Intel & Tesla).

Hence overall, I remain cautious on the near-term outlook for the benchmark indices, but bullish wrt active stock picking. Particularly where investors have thick skins & longer-term time horizons (eg small/midcaps).

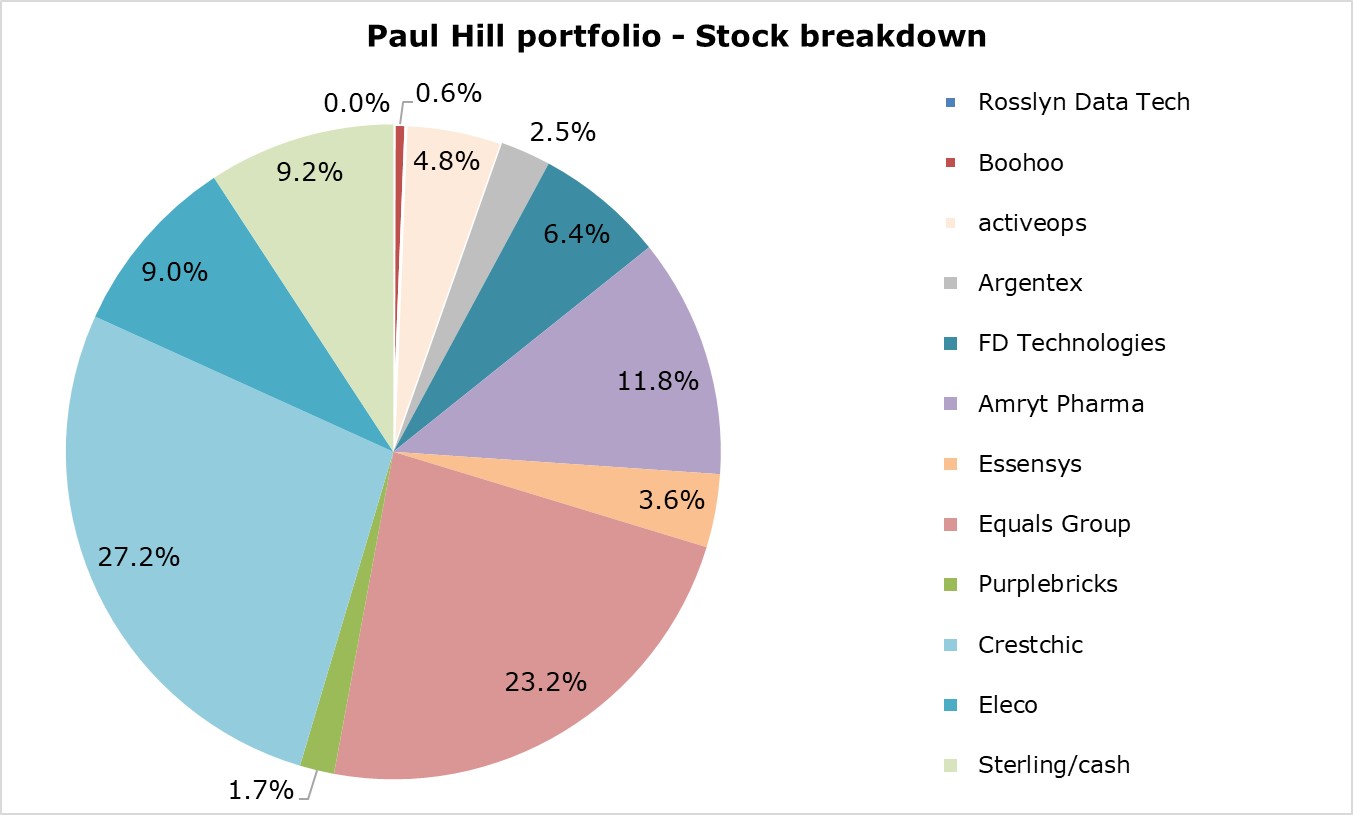

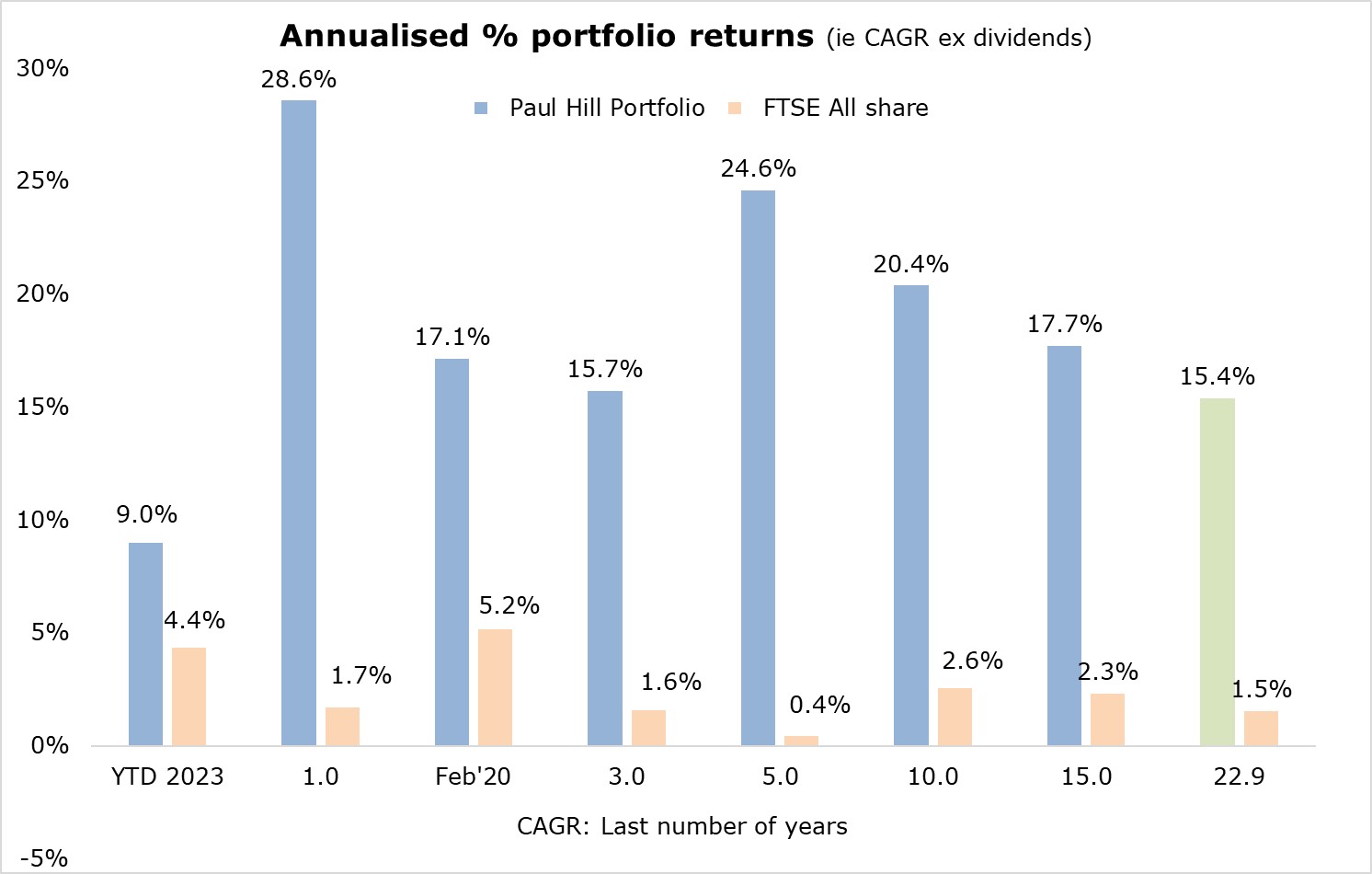

Indeed despite being delighted with a 9% gain from my own portfolio this month (see charts below), I nonetheless believe this is a one-off & UNSUSTAINABLE.

Clearly I would love to be proved wrong. Albeit regardless of the longevity of consumers’ spending habits (re covid savings, rising wages & low unemployment), there are cracks starting to appear in the labour market.

For example, there are now far more temporary job openings vs permanent vacancies, and even non-tech firms have begun laying off staff (eg Hasbro, Dow, 3M, Goldmans, etc).

Meaning unfortunately, I suspect there will be far more damage done to the wider economy, than has currently been priced into the capital markets (re VIX <19).

So how much could the #SP500 fall in a 'normal mild' recession?

Well assuming the equity risk premium rose to 4% (vs <3% today) and the 10 year US treasury settled at 3% (re CPI 2%) - then this would equate to a theoretical PER of 14.3x. Which hypothetically would in 12 months’ time, push the #SP500 down 12% to 3,500 vs 4,000 - based on 2024 EPS expectations of circa $245/share,.

Time to prepare for choppier waters ahead.