After almost 4 months of waiting, the moment of truth finally arrives at 12.30pm on Wednesday 30th Oct - when chancellor Rachel Reeves puts the country either out of or into its misery. Depending of course on what she says.

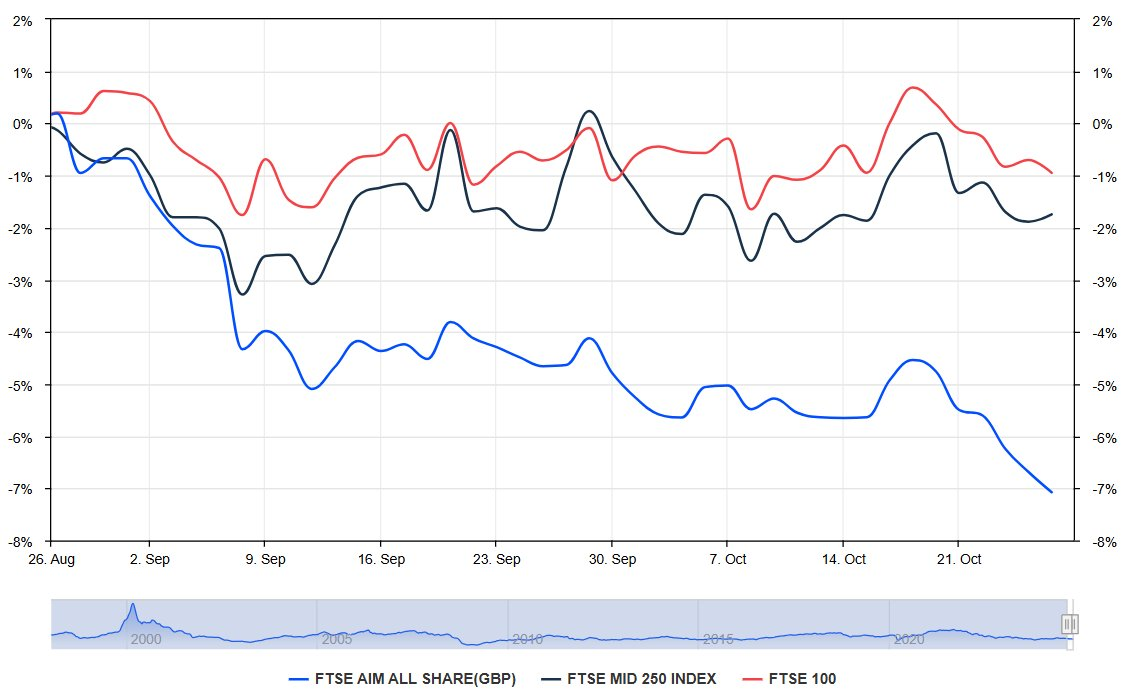

Ok, but what have investors been doing ahead of the Budget, & importantly what's priced into markets?

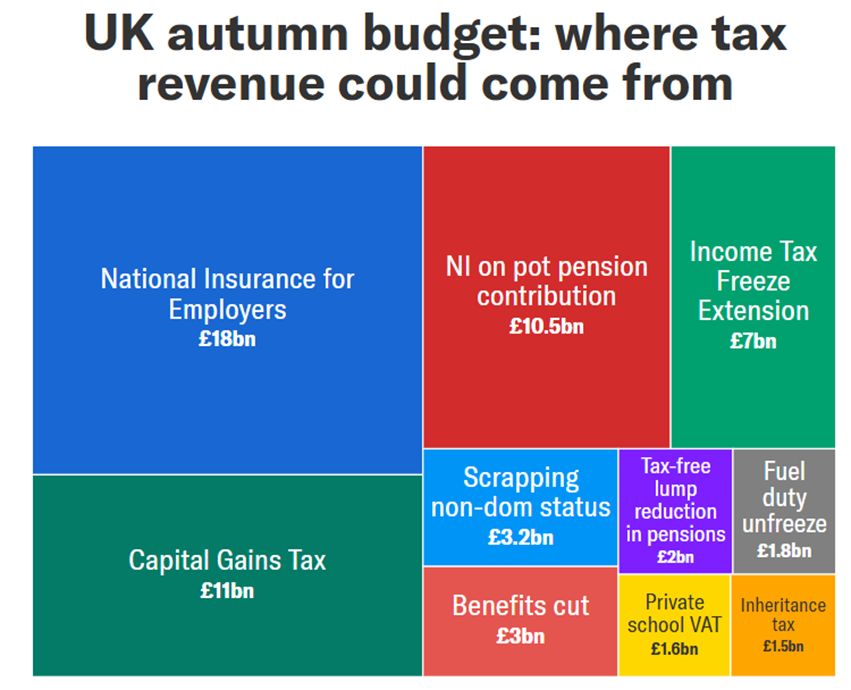

Well given the likely tax raising measures (see below chart), its not surprising that investors have been bearish;

1) Selling profitable assets in order to crystalise gains at a lower CGT rate (ie 20%).

2) Taking their 25% tax free lump sums out of SIPPs (ie more asset disposals).

3) Front running the possibility of IHT relief being removed from AIM. Either by selling stocks early in order to buy them back later at lower levels. Or reducing their exposure, given Peel Hunt estimate there could be an immediate 20%-30% drop on AIM, if IHT relief is removed.

4) Not buying UK equities until the Budget is out the way.

Meaning there’s a ton of bad news already priced into the markets.

So might there be a Santa rally - ie if Wednesday's news isn't quite as catastrophic as expected?

Yes, albeit there's plenty of investors who have been sitting on the side lines - patiently waiting to see what’s actually announced. Indeed many people like myself haven't yet adjusted our portfolios. Hence there’s certainly potential for further downside in a worst case scenario.

Equally though at current depressed prices, there are undoubtedly opportunities, especially in smallcap land. For instance;

1) The government's tax raid on Employers’ NI will accelerate the replacement of human capital by technology (re AI, automation). Weakening the UK labour market but helping software/tech sales.

2) Labour's planned housing boom should also boost building products firms.

3) Relaxing the definition of ‘national debt’ will be sterling bearish & push up inflation on imported goods. Bad for retailers, but positive for UK exporters.

4) The possible introduction of a wealth tax and/or higher IHT will encourage more Brits to sell up & leave the country (aka non-doms). In turn driving money into the hands of UK tax/pension planners, accountants and overseas wealth managers.