Welcome to the latest in our new series of short-format Stock Pitches. Graham recently looked at microfinance firm ASA International, Roland wrote about FTSE 100 home improvement retailer Kingfisher. Today, I’m sticking with the building products theme.

Disclosure: At the time of publication, I have a long position in James Latham PLC.

The Pitch

James Latham (LON:LTHM) is an AIM-listed distributor of timber, panels, and decorative surfaces with a trading history of over 250 years. With a StockRank of 91 and a strong balance sheet, many subscribers will recognise this as a classic quality-value play. Despite recent market headwinds in the UK construction sector, the company's diversified product range, plus long-term and strategic thinking, positions it as a resilient player for patient investors seeking exposure to a sector trading at cyclical lows.

The Big Picture

James Latham can trace its history back to 1757 when the first James Latham began importing hardwoods into Liverpool. While it's not clear if the Latham Family hold a majority of the shares, they are still very significant holders. If the holdings of the various family members are combined, they would represent the largest shareholding in the company. Out of six current directors, Nicholas Latham is Chairman, and Piers Latham is an Executive Director. The current management team includes a number of ninth-generation family members.

- Fortress balance sheet: The company reported £59m in net cash at the half year, which provides a significant buffer against market volatility and capital for strategic actions, such as the recently announced National Distribution Centre. Net assets rose to £225m, of which just £15.9m represented intangible or pension assets, meaning that the company currently trades around Tangible Book Value.

- Cheaply-rated: The shares trade at around 11.5x earnings (just 8x adjusted for cash), during a period of cyclical weakness for UK construction, and close to a decade-low enterprise value-to-sales ratio. The market appears to be pricing in prolonged weakness rather than recognising the company's defensive qualities and the potential for a cyclical upswing in the next few years.

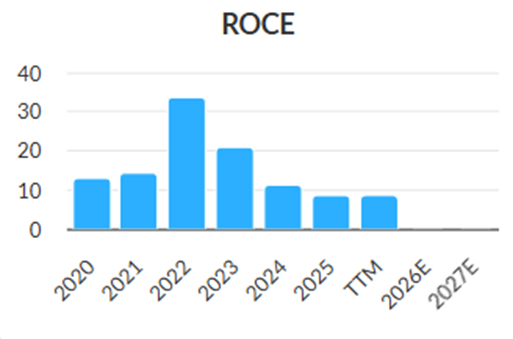

- Shareholder Value: Cyclicality undoubtedly impacts returns on capital, but the average full-cycle ROCE is mid-teens, suggesting a reasonable competitive advantage. Recent figures have been depressed, as the company has been investing in capacity ahead of the next market upswing:

- Super Stock:…

.JPG)