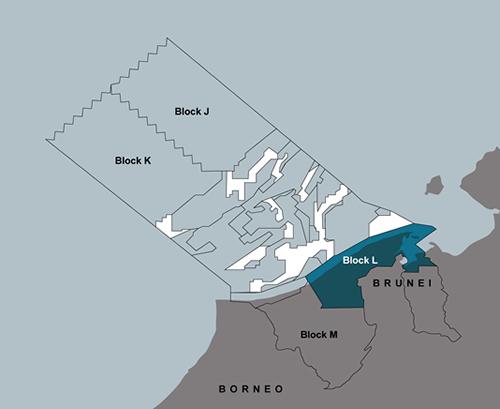

Here's a quick summary of the assets:

BRUNEI

- Four wells drilled this year, two on each block.

- Lukut-1: Ten zones of interest identified during drilling, with up to three to be tested early next year. Aggregate…

Here's a quick summary of the assets:

Not connected directly to KOV, but an example of other things Dr. Kulczyk is doing - trying to buy one of Poland's largest utilities.

http://in.reuters.com/article/idINLDE6B20VP20101207

WARSAW, Dec 3 (Reuters) - There is a high risk the ongoing sale of Polish state-controlled utility Enea ENAE.WA, worth as much as 11 billion zlotys ($3.6 billion), will fall apart, market sources familiar with the situation told Reuters.

Poland, which has stepped up its sell-off drive this year to help troubled public finances, wants to sell its 51 percent stake in the country's No.3 utility for over 5.6 billion zlotys, but the buyer would have to also buyout minority shareholders.

The deal was almost sealed when the ministry awarded exclusivity to the country's richest man Jan Kulczyk in late October, banking sources told Reuters. But the process took a twist when the ministry invited Czech Elektrycky a Prumyslovy Holding and French utility EDF (EDF.PA) back to the negotiating table, delaying the transaction's deadline to end-March. [ID:nLDE6A923L]

If, as it would seem, he has the capacity to raise US $ 3.6 billion to buy ENEA, then one assumes he might have aspirations to grow KOV - IF some of its current activities are successful.

Kulczyk's Syrian partners, MENA, have completed discussions on a reverse takeover of a TSX.V cash shell, Skana (SKN), giving them a listing.

MENA also have assets in Egypt.

Might be worth watching.

First well on the Syrian acreage still due in Q1 2011:

MENA has also executed a 30% participation interest in Syria Block IX with a subsidiary of Kulczyk Oil Ventures Inc. ("Kulczyk"). Block IX is a large 10,032 square kilometer exploration Block in Northwest Syria. MENA has a 30% economic interest in Block IX and is working with the Syrian Government and Kulczyk to be recognized on title in due course. Under the terms of the Block IX PSC, the remaining work commitment is to drill two exploration wells for a minimum of $2 million for each well, and the farm-in agreement requires MENA to pay 60% of the cost of the first exploration well and its pro-rata 30% portion of the second well. MENA has also paid US$1.0 million in back costs to Kulczyk and will pay a further US$2.0 million in remaining back costs. The first well is expected to spud in the first quarter of 2011

Man Siarad

An interesting tie-up announcement today between KOV's parent, Kulczyk Investments, and FX Energy for exploration in Poland.

SALT LAKE CITY, Dec. 21, 2010 /PRNewswire-FirstCall/ -- FX Energy, Inc. (Nasdaq: FXEN) today announced that it signed a Letter of Intent with Kulczyk Investments S.A., ("Kulczyk Investments") in connection with the Company's Kutno project in central Poland. The agreement provides for Kulczyk Investments to join FX Energy and the Polish Oil and Gas Company ("PGNiG") in drilling the first well to test the Kutno prospect. The Letter of Intent is subject to negotiation and execution of a definitive Joint Operating Agreement, approval by the boards of both companies and other matters.

The parties plan to test a previously undrilled 35,000 acre (140 square kilometer) 2-D defined Rotliegend structure at a depth of approximately 21,000 feet (6,500 meters). The prospect is believed to be the largest undrilled Rotliegend structure on-shore Europe. Well design and engineering are currently underway. The well is scheduled to begin drilling during the second half of 2011.

I wonder why Dr. Kulczyk is doing this through his holding company and not KOV.

This gives a bit more information about his various energy interests:

Kulczyk Investments is an international investment company based in Luxembourg. The company is a long-term investor focused on transactions where it can add value through local knowledge, relationships, international expertise in transforming economies and access to its own capital. Kulczyk Investments' strategic sectors include energy and infrastructure. It also holds significant assets in the real estate, brewing, automotive and the chemical industries. The company invests in the energy sector broadly, from exploration and production, through power generation to power and gas distribution and trading. Kulczyk Investments' objective is to create a balanced portfolio of energy assets around the world. The company's energy portfolio includes, inter alia, Kulczyk Oil Ventures, Aurelian Oil and Gas, Loon Energy Corporation, Ophir Energy Plc, KI Energy Trading, Elektrownia Polnoc and Strata Limited. Website www.kulczykinvestments.com.

Man Siarad

A bit of re-organisation for one of the minority shareholders in KOV's Syrian Block 9, Triton Energy - a merger agreement and Put & Call options with Australian firm Agri Energy, according to this 21st December statement.

http://www.bourseinvestor.com/bi4/pdfnews/default.asp?d=01134989&f=20101221

Two new directors for Agri - Triton's chairman Joseph Naeimi as a Non-Exec, and Triton's MD Stuart Smith as Executive Director and CFO. Smith is also a Non-Exec director of Kulczyk.

Two wells still planned for H1 2011, with targets of 100+ mmboe, following completion of new 3D seismic data. Apropos of which, the statement notes:

'The initial interpretation of the new 3D data has identified new target zones that are deeper and larger than previous estimates. This has resulted in the depth of the first well being increased from 2400 m to 3200 m. The revised prospect sizes will be known at the end of the 2010 year post the completion of the interpretation of the 3D seismic data.'

Man Siarad

A good gas discovery in Kulczyk's M-19 well in Ukraine

http://www.kulczykoilventures.com/en/press_releases_2/artykuly/ukraine_m_19_discovery_test_gas/

HIGHLIGHTS

- The M-19 well tested gas at a rate of approximately 5 million standard cubic feet per day (“MMscf/d”) at 11 MPa (1,600 psig) through a 10 mm choke

- The well is expected to be tied-in to the Makeevskoye field processing facilities during the second quarter with a production target of approximately 2 MMscf/d for the remainder of 2011

- Based on average KUB-Gas production of 6.2 MMscf/d in December 2010 the new production from the successful tie-in of the M-19 well could increase overall production from KUB-Gas wells more than 30%

This is worth noting:

The well was logged with locally available logging tools as well as western logging tools so that the Company can compare the results between the two sets of logging data over the same formations and gain a better understanding of the old logs. The M-19 well is the first well within the 4 fields operated by KUB-Gas in Ukraine to be logged with modern logging tools.

The logs indicated that, while the Triassic target was not present, the seismic anomaly was an approximately 18 metre thick sandstone unit that appeared to contain hydrocarbons. It was this sandstone unit that was produced at 5 MMscf/d of natural gas through a 10 mm choke when tested in December. In addition, several zones which appear to contain hydrocarbons were identified within the underlying Muscovian target section.

The successful testing of the newly discovered zone in the M-19 well has confirmed the effectiveness of modern seismic interpretation techniques in the identification of new exploration targets.

Man Siarad

Kulczyk have followed up their M-19 discovery in Ukraine (# 5 above), by announcing acquisition of a new exploration licence nearby:

http://www.sys-con.com/node/1676399

Kulczyk Oil Ventures Inc. ("Kulczyk Oil", "KOV" or the "Company") (WARSAW: KOV) is pleased to announce that its 70% owned subsidiary, KUB-Gas LLC ("KUB-Gas") has been awarded another exploration license area in Ukraine.

The North Makeevskoye Exploration License is located adjacent to the KUB-Gas Makeevskoye and Olgovskoye licenses, near the City of Lugansk in eastern Ukraine. Similar to the KUB-Gas Makeevskoye and Olgovskoye licenses which lie along the primary southeastern Dneiper-Donets Basin gas/condensate structural trend, the 19,050 hectare (47,073 acre) North Makeevskoye license area is prospective for gas production from multiple zones within the Muscovian and Bashkirian sedimentary section. The award of this license to KUB-Gas increases their total holdings to five license areas and increases their total area under license by more than 110% to 36,315 hectares (89,736 acres)...

To view the map associated with this press release, please visit the following link: http://media3.marketwire.com/docs/113kov1.pdf

The North Makeevskoye Exploration License has a 5-year term effective 29 December 2010. It is located adjacent to the Makeevskoye License and 4 kilometres east of the KUB-Gas M-19 gas discovery which was production tested in late December at 5 million standard cubic feet per day ("MMscf/d") through a 10 mm choke.

KOV and its joint venture partner KUB-Gas will incorporate all available subsurface data at North Makeevskoye into an exploration model similar to that which was successfully constructed for the Makeevskoye and Olgovskoye licenses. This will be followed by the acquisition of a 2D seismic survey over the North Makeevskoye Exploration License in mid-2011. The first wells to be drilled on the new license might be expected in late 2011 or early 2012 depending on results of the 2011 seismic program.

Only a short, 5-year, term, but presumably this can be extended somehow in the event of successful exploration?

I note that the share price on the Warsaw Exchange has still trading in the same range, despite the M-19 discovery, with its promise of increasing KOV's Ukrainian gas production by more than 30%. Investors still focussed more on the Brunei opportunities? The Lukut-1 test should be getting under way fairly soon.

Man Siarad

The testing programme on the Brunei Lempuyang-1 well has commenced, to be followed by testing of Lukut-1

http://www.energy-pedia.com/article.aspx?articleid=143775

AED Oil has provided an update on the testing program for Lempuyang-1 and Lukut-1 exploration wells in Brunei Block L, drilling of which was completed in late 2010.

Testing operations were scheduled to commence 18 January 2011. All equipment, contractors and approvals have now been obtained and will be progressively mobilised as required. The testing of the Lukut-1 well is scheduled to commence immediately following completion of the testing of Lempuyang-1 and will utilise the same testing equipment, rig and contractors. All approvals for this test have also been obtained.

In respect of the Lempuyang-1 testing, AED expects that, barring unforeseen circumstances, it will be in the position to make announcements to the market on progress in accordance with the following indicative timetable: 28 January 2011 Maximum gas flow rate achieved, condensate rate, choke size and flowing well-head pressure; 7 February 2011 Cumulative gas and condensate produced and / or average flow rate over

test period, information as to the nature of the Multi Layer testing carried out.

Not long to wait for results from Le,puyan-1 then.

The results from these two wells are likely to be fairly important, IMO, and will show whether KOV's Brunei acreage is as significant as they seem to hope.

A slight hiccup on the Lempuyang testing, but nothing to worry about - it's only the weather

http://www.upstreamonline.com/live/article243258.ece

Initial perforation for flow testing to start on Friday

Man Siarad

Pottering on in the Ukraine, with another successful gas well, O-8, on the Olgovskoye field

up to 135 metres of gas pay across 35 reservoir zones and the well will be tied in as a producer.

the four producing wells in the field all produce from a dfifferent horizon, which should offer considerable scope for further development

Man Siarad

A disappointing test result, from the first zone, at Lempuyang-1 in Brunei, with a high water flow. A Production Logging Tool now to be used to see whether the water inflow is caused by poor isolation of another zone in the well

http://www.live-pr.com/en/kulczyk-oil-ventures-inc-testing-update-r1048730880.htm

Man Siarad

KOV have opted to enter the second phase of exploration in Brunei's Block M

http://www.upstreamonline.com/live/article244009.ece

Under the terms of the Block M production sharing agreement, Kulczyk and its partners will acquire and process at least 80 kilometres of onshore and 500 kilometres of offshore 2D seismic data.

Kulczyk and its partners are also obligated to drill at least three onshore exploration wells, each to a minimum depth of 1150 metres.

The partners have the option of replacing two shallow wells with one well to at least 2300 metres.

The one-year term of Phase 2 will commence 28 August, Kulczyk said in a release.

As noted in the header, there are also two wells ready for testing in the block: Mawar-1 and Markisa-1

Man Siarad

KOV have announced an upgrade of Ukraine reserves

http://newsblaze.com/story/2011021012215800001.mwir/topstory.html

summary:

Kulczyk Oil Ventures Inc. (WARSAW: KOV) ("Kulczyk Oil", "KOV" or the "Company") is pleased to announce a substantial increase in the Contingent Resources attributable to the Company's 70% interest in KUB-Gas LLC ("KUB-Gas").

HIGHLIGHTS

-- Total Net Best Estimate Contingent Resource increased by 434 percent from 14.6 Billion Cubic Feet ("BCF") of natural gas to 77.9 BCF or 13.0 million barrels of oil equivalent ("MMboe"); -- Total Net High Estimate Contingent Resource to 211.5 BCF or 35.2 MMboe.

Kulczyk hope to spud their first exploration well in Syria by the end of June

Kulczyk Oil Ventures Inc., an exploration company controlled by Polish billionaire Jan Kulczyk, may start drilling Syria’s Block 9 by the end of June, a company official said.

“We plan to start the two-well drilling program in Block 9 in the second quarter, provided we secure a drilling rig and all other necessary equipment on time,” Jakub Korczak, the company’s deputy chief executive officer, said today in an e- mailed statement. “Tenders for these have been initiated and the process is ongoing.”

An update from the Brunei Lempuyang-1 testing

http://www.bt.com.bn/business-national/2011/02/19/aed-finds-mobile-hydrocarbons-lempuyang-well

gas in the Pink zone - now on to the Blue Zone

The targeted clinoform sands therefore warrant further evaluation in assessing the field potential. Information and petrophysical analysis also suggests that the upper Blue zone has the strongest hydrocarbon potential within the entire Lempuyang-1 well.

"The Blue zone test is set to commence shortly, once additional testing equipment becomes available," AED said.

Though what they're really after is oil, rather than gas, of course.

Man Siarad

An update on testing at the Lempuyang-1 well on Brunei Black L

Equipment failure, just as the gas started to flow from the Blue Zone, so they've got to bring in some more...

... The Lempuyang-1 well tests have so far identified gas in both the target intervals, being the Blue and Pink zones. Testing will resume at a future date after all required replacement testing equipment has been delivered. The operator has estimated that it will take up to 4 weeks to source the required equipment. The joint venture partners in Brunei Block L will revisit the testing plan and timetable for the Lukut-1 well test, following an internal assessment of the best way to achieve efficiency in testing and management of costs...

Man Siarad

By OGJ editors

HOUSTON, Mar. 21 – Consulting engineers issued best estimates of 135 million bbl of oil and 101 bcf of gas to the Itheria prospect and 20 million bbl and 8 bcf to the Bashaer prospect on Block 9 in Syria, said Kulczyk Oil Ventures Inc., Calgary.

The resource estimates are attributable to Kulczyk’s 45% effective interest in the block. The company holds 100% participating interest in the block and has agreements to assign 55% to third parties subject to Syrian approval. The block covers 2.48 million acres in northwestern Syria.

Geological evaluation and the interpretation of a 420 sq km 3D seismic survey shot by Kulczyk Oil over the southeastern part of Block 9 in 2010 led to identification of the two prospects and an improved understanding of the subsurface.

The planned total depth of Itheria-1 is 3,200 m, and estimated drilling time is 66 days. The well will evaluate a four-way dip closure and is expected to spud in June 2011. Bashaer-1 has a planned total depth of 2,600 m about 10 km northwest of Itheria-1.

Another update

first, it looks as though KOV have won in the race for Shell's OML 42 assets in Nigeria:

Interesting to see KOV stumping up that kind of money. Im surprised since all the notes I had this morning were saying that Conoil (could anyone seriously invest in a company with that name??) were the front runner so it definitely was a very last minute bid by KOV....

Did I see the other day that theres been a further interruption in testing out in Bruei??