The Western financial sector features mature businesses with modest growth prospects. This is certainly the case for the banking and general insurance sectors. However, Legal & General (L&G) offers exposure to 5 long-term macro trends which include ageing demographics and ongoing welfare reforms.

Legal & General (L&G) is a UK focused assurance and savings group that is increasingly moving into global markets. In the first half of 2015 the company saw asset and premium growth in all of its five business divisions.

The business has been supported by five long-term macro trends which are 1) ageing populations, 2) welfare reform, 3) globalisation of asset markets, 4) digital lifestyles and 5) retrenching banks.

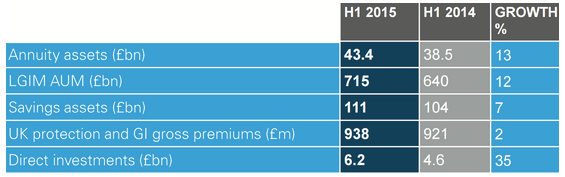

Legal & General’s business growth in H1 2015-09-25

Source – Legal & General investor presentation

1. Ageing demographics

The corporate sector is keen to de-risk the legacy of defined pension benefit schemes as members live longer. There are around US$10 trillion of these schemes globally and £1.8 trillion resides in the UK.

In the UK L&G is a leader in Liability Driven Investment Solutions (LDI) with around 40% of the market. The company states that the “opportunity remains significant” in this market to deliver attractive returns.

The Investment Management division and the Retirement business both benefit from the de-risking trend. Longer life-spans are also increasing demand for pension savings and retirement products.

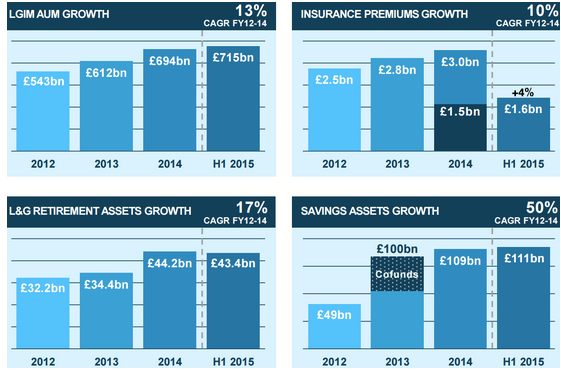

Legal & General business growth

Source – Legal & General investor presentation

2. Welfare reform

The recently elected UK Conservative government is focused on reducing the welfare bill. This generates increased demand for protection products while pension reforms have also created an opportunity.

UK auto-enrolment in pensions has seen around 90% of members staying enrolled in a pension scheme. Defined contribution savings into pensions are therefore expected to triple over the next three years.

Legal & General has been successful in this market with it providing pension schemes to 30 of the largest high street retailers. The group’s small and medium sized enterprise customers increased by 25% in the first half of 2015.

3. Globalisation of asset markets

Legal & General’s Investment Management division is benefiting from the globalisation of asset markets. From 2012 to 2014 its assets have increased from £543bn to £694bn and reached £715bn at mid-2015.

In the first half of 2015 the group won its first multi-billion US index mandate and saw momentum in…