Over the last 3 months I have conducted an experiment to mimic the long-short strategy of the early hedge funds. I selected 15 long shares and 15 short shares and invested as close as possible to £2000 in each company on a spreadsheet. The long and short shares were matched by sectors.

Criteria for going long:

Price > 200MA

Low debt (<1x net profit)

Stock rank >80

Criteria for going short:

Price <200MA

High debt (>3 x net profit)

Stock rank <50

Benchmark

My bench mark was the FTSE All Share Index. In the course of this experiment it fell from 4093 to 3933 (a drop of 4%).

Results

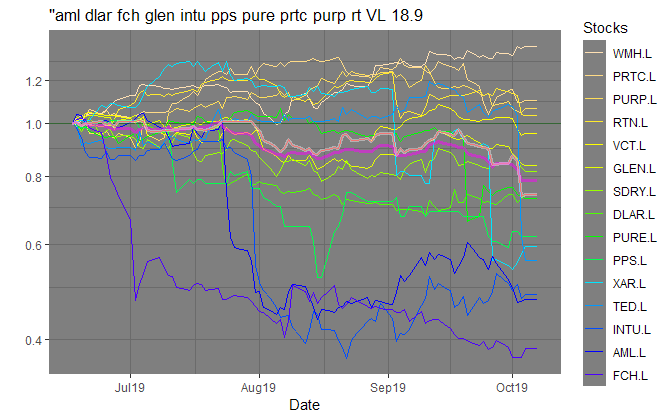

The long investments now have a mean value of £2,010 (range £1,353-£2,944) whilst the short investments now have a mean value of £1,582 (range £908-£2,651).

The long investments have beaten the benchmark by 4.6%.

The short investments have fallen 16% below the benchmark.

Statistics

The probability that these results could have arisen by chance (unpaired Student-T test) is 1.2%.

Conclusion

Whilst this experiment doesn’t actually prove anything at all since the time frame was short and the samples were small, it suggests that predicting price falls is easier than predicting gains, especially in a volatile market overshadowed by Brexit and the Trade Wars. I plan to repeat this work with somewhat more rigorous academic discipline and over a longer period.