Been making simple turbine blades and other airframe parts for several decades. In the "Metals & Mining" sector... and exactly the reason why I don't hard-filter out that industry group, even though I usually want to avoid actual miners and ore processors.

ValueRank was 99 before the price surge. Now 88.

PE using basic earnings was 4, now 7.

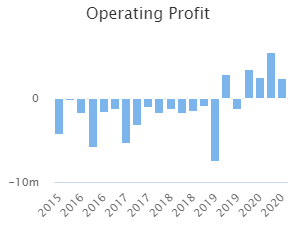

Return to profitability in last few quarters.

Big volume surge

Similar dynamic in Japan with Cross Plus Inc, a fashion company that is selling way more fashionable [covid] masks than they expected.

I bought one to see what the fuss was about. And because... appealing marketing....

https://pastelmask.net/

PE = 7. VR = 88. Strong Q earnings growth.

Working a bid there, but my gut says I wont get filled unless I step up. Not sure how sustainable just a line of masks really is.