I came across this great seekingalpha article today, looking at the work of noted stock market historian Roger Ibbotson.

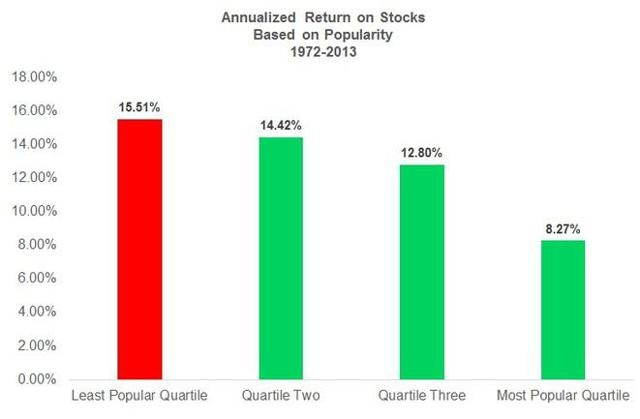

The thesis is simple: that Popular stocks perform least well, while little-traded, "unpopular" stocks perform best over the long-term.

This is a great chart from the above article that illustrates the outperformance neatly:

Source: Victor Wendl

Extending this concept to the UK stock market, which stocks are least "popular", as judged by average yearly share turnover?

UK stocks out of the FTSE All-Share index that come up as having the lowest proportion of their market cap. traded over the last 12 months include:

Euromoney Institutional Investor (LON:ERM)

Town Centre Securities (LON:TCSC)

Daejan Holdings (LON:DJAN)

NMC Health (LON:NMC)

Goodwin (LON:GDWN)

SThree (LON:STHR)

Laura Ashley Holdings (LON:ALY)

Mountview Estates (LON:MTVW)

A.G.Barr (LON:BAG)

Management Consulting (LON:MMC)

Interestingly, these names also overlap with another well-known stock market outperformance phenomenon, that of the outperformance of companies with large founder or family shareholdings.

.JPG)