The global luxury goods giant LVMH saw revenue and profit hit a new record in 2015. The wealthy clearly haven’t lost their taste for luxury and are unlikely to do so anytime soon. With LVMH covering the full range of the luxury sector it is well placed to withstand market volatility and the fickle nature of fashion.

LVMH describes itself as “the world leader in luxury” and is the only company present across all of the five major luxury sectors. The group’s portfolio includes over 60 prestigious brands and a 3,680 strong store network.

This means that LVMH is not a bet on particular luxury brand unlike its UK listed peers Burberry, Jimmy Choo and Mulberry. Many of LVMH’s brands appear to be timeless such as the cognac Hennessy and the champagne Krug.

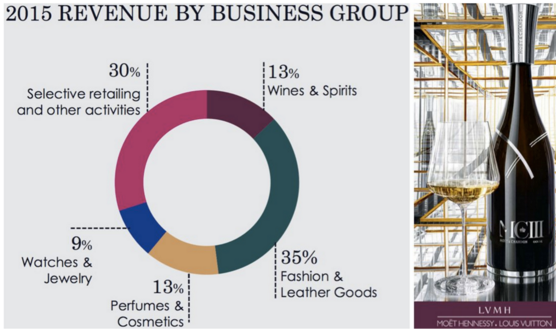

However, the group’s Fashion & Leather Goods division does need to remain in fashion and includes brands like DKNY and Louis Vuitton. It is the mainstay of the business with it generating 35% of revenue and 53% of profit in 2015.

Source: LVMH investor website

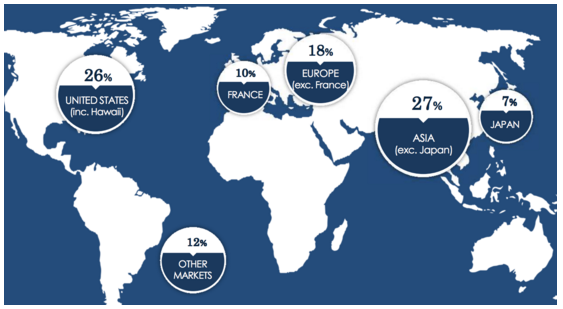

LVMH’s is well diversified on a geographic mix basis with the three main geographic areas being the US, Europe and Asia (excluding Japan). These accounted for 26%, 28% and 27% of revenue in 2015 respectively.

LVMH revenue generation in 2015

Source: LVMH investor presentation

The company has grown through acquisitions with recent deals including the Italian jeweler Bulgari in 2011 and Loro Piana in 2013. LVMH is decentralized so that each business is both “autonomous and responsive.”

The model is similar to Berkshire Hathaway with cashflow from established units used for new areas. LVMH is the creation of Bernard Arnault (Chairman and CEO) and the Arnault family owns the majority of the voting rights.

LVMH Group brands

Source: LVMH investor website

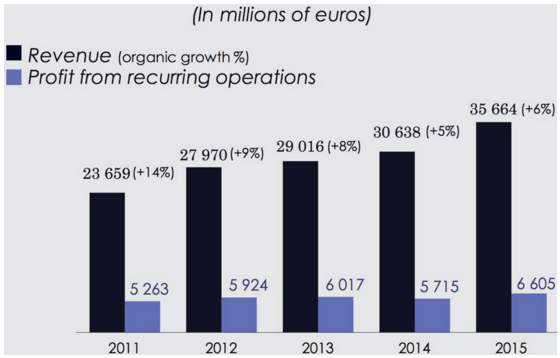

The company’s approach appears to be working with organic revenue growing in all but one year from 2007 to 2015. The global financial crisis saw revenue decline of 4% in 2009 and profit from recurring operations fell 7.6%.

However, the group quickly bounced back with organic revenue up by 13% in 2010 and profit from recurring operations increasing by 29%. This resilience has seen the business offset the Chinese slowdown in recent years.

LVMH five-year track record

Source: LVMH investor website

LVMH Performance in…