Link below to MGW's 2017 bucket list picks for the Oil and Gas sector together with a review of the selections made in 2016.

http://www.malcysblog.com/2017/02/2017-bucket-list-2016-results/

Stockopedia metrics don't really work so well with these kind of mainly exploration and development energy stocks - just take a look at the stock ranks of the top 5 in the list - but together with the mining/other natural resource stocks 2016 was a particularly good year (fully accepting the previous three were pretty dire) for these sectors.

Gus.

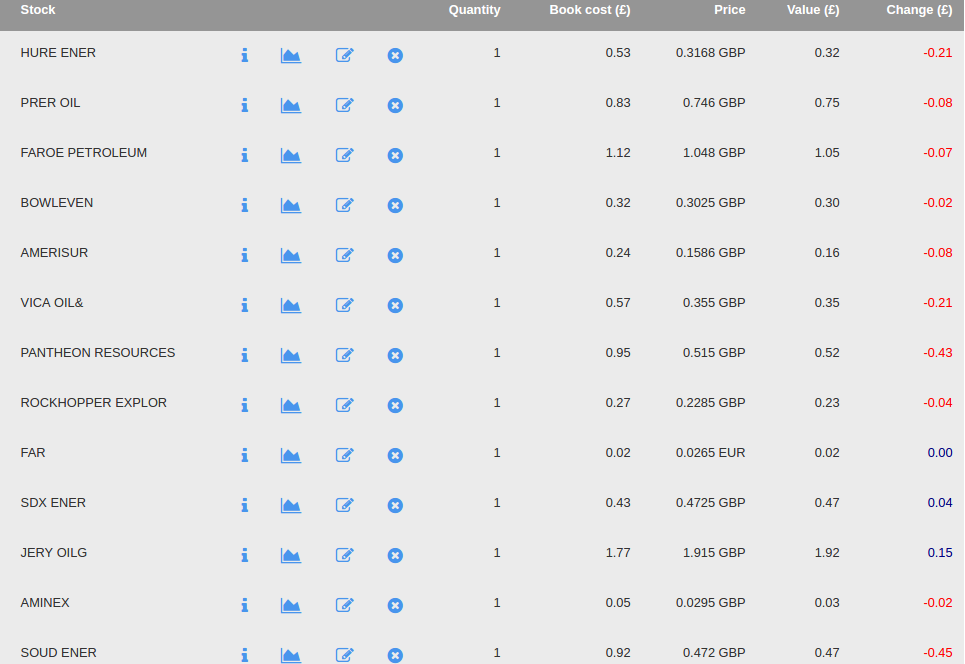

I followed Malcy's selections last year using a dummy Stockopedia portfolio (I was too chicken to commit any real money). I bought a (fantasy) equal amount of each of the stocks.

Its up almost exactly 100% in the year since then.

The only loser was Pantheon Resources (LON:PANR) which is 4.26% down and has the lowest stockrank. The biggest gainer ( Hurricane Energy (LON:HUR) ) is up 395% and Ithaca Energy Inc (LON:IAE) is also up 394%. Both have ranks between 20 and 45.

I don't think I can post a link to the folio here that people can see but it was an interesting experiment. Mostly I think it was down to timing as oil was at a real low at that point and has steadily gone up since then.

However, i can see that a bucket of Oil shares could work as a geared oil price portfolio a bit like NAPS but horrifically riskier!