A very interesting and potentially lucrative share price versus value anomaly has materialised in Manolete Partners (LON:MANO) . I thought I’d highlight this ahead of their first half figures which will be announced this Tuesday 10th Nov. (The table below has now been updated with the figs reported on the 10th - presentation available here)

About the Business

Manolete Partners (LON:MANO) is a litigation finance company (as are AIM listed Burford Capital (LON:BUR) and Litigation Capital Management (LON:LIT)) but only deals with insolvency cases in the UK and is thus likely to benefit from the Covid-19 lockdowns and any consequential corporate distress, or indeed Brexit fallout. Manolete Partners (LON:MANO) buys cases from insolvency practitioners, thus in effect becoming the claimant, which gives them full control over how to pursue the case. The outcome is that 97% of cases are settled, rather than taken to court, and thus resolved far more quickly (c. 11 months on average). This is a key point of difference between Manolete Partners (LON:MANO) and Burford Capital (LON:BUR) and Litigation Capital Management (LON:LIT), says chief executive Steven Cooklin. "If you’re funding someone else, the decision to settle is that party’s decision".

High Quality characteristics

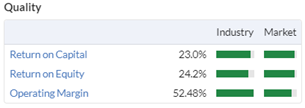

In this specialist niche they are dominant with a 67% market share. To quote Steve Cooklin (31 Mar 20 unaudited interims) “we continue to deliver outstanding investment returns, yielding an average Money Multiple of 2.7x and ROI of 174% on 257 completed cases since inception.” These are exceptionally attractive returns and reflected in Stockopedia’s metrics:

Strong Growth Profile

Since its floation in Dec 2018 (at 175p Mkt Cap £76m) Manolete Partners (LON:MANO) has been deploying the £14.7m net funds raised to scale-up the firm’s capacity to ramp up its business significantly: Below are the six month period key metrics and leading indicators.

| Period-end | 30Sep18 | 31Mar19 | 30Sep19 | 31Mar20 | 30Sep20 updated Actuals |

| 6 month periods | 1H19 | 2H19 | 1H20 | …

About the Author

Working as a consultant in the FinTech Sector I also have two non-exec positions . One of these is a very exciting early stage SportsTech start-up . Strategic business transformation is the theme running through my career typically applying technology to create strategic advantage. I've been an investor for over twenty years starting from scratch to build a seven figure portfolio. I'm fascinated by eMarkets, payments, financial crime and identity management. more »

32 comments

Hi abtan,

Appreciate your contribution - I know that you've previously done a lot of analysis on MANO and was disappointed to see that you'd sold.

The figures are distorted by the significant case reported on 15 Sept. In short, they had previously attributed an unrealised gain for this case. So these results are taking the increased final settlement figure, less the previously declared gain - and then discounted it further for the expended collection period. They are collecting on behalf of HMRC so the full debt is unfortunately going into the 'Trade Receivables' figure.

So this single case generated £4.1m gain for an outlay investment of only c. £250k - an exceptional return of 17.4x or ROI of 1,640%. They had included £2m in prior years profit so the additional £2.1m is attributable to these results, but after heavily discounting the full amount for the extended 10 year collection period, as I understand it, only £800k is attributable to this period.

On your other point the c. 11 months average settlement period (11.5 months in 1H21) specifically excludes the 'significant large cases' - that is the 22 cartel cases. However, they are now expecting these to start dropping into the next reporting periods at a rate of about one per period.

Having waded through the accounts, you'll appreciate that it is often difficult to see the word from the trees, and I'm not suggesting that I have the definitive view.

Cheers Maddox

Hi Maddox

Thanks for taking the time to respond.

I did rush through the results, so apologies for any ignorance, but just for my understanding, did 51 cases not generate £4.2m of realised revenue this period (£80k per case, before costs)? If I'm correct, it does seem a little on the low side. Or maybe this has always been the case (lots of small returns combined with a small number of large ones) and I just haven't noticed?

I can't see any reference to the cost of the large case being £250k so sorry for missing this; presumably it's somewhere in the report or one of the presentations. An impressive result no doubt.

I'm aware of the cartel cases, however, these do not appear in the £171m in the 2019 table I posted earlier, which is why I was expecting more significant results by now.

For clarity I did like the numbers for this company (aside from a few unexplained differences/changes to published tables between periods), but I can't bear to deal with rude management, even if they are competent. Hopefully I won't regret my stubbornness too much.

Thanks again and best of luck.

A

Hi Abtan,

The Significant Case was first reported in a Trading Update as well as in the CFO's update in the 1H21 results. I believe it to be £19m 1H revenue, less £9.3m for the Significant Case, leaves £9.7m for the rest of the cases. They 'closed' 54 cases but only 48 appear in the Vintage Table (so I'm assuming they lost or abandoned 6 of them). So, that would average out as £202,083 returned per case. This average does vary a lot from year-to-year but if you average the whole table I get £211,160 per case - so near enough.

As you say, the Vintage Table of cases excludes (thankfully) the larger more complex cases that will, by their nature, run on for years. IF and WHEN they start to drop they will undoubtedly deliver substantial gains.

But looking just at the base case: With Manolete Partners (LON:MANO) on a p/e of 9.8 and PEG of 0.3 yet growing EPS +49% and still accelerating (based on the leading indicators in my table above) I find the investment case is compelling.

Hi Maddox

We need to be careful here.

£19m of TOTAL 1H revenue includes £5.4m of unrealised revenue, ie cases that have not been completed yet.

When a case is completed (52 cases in this case) the entire revenue is recognised as Realised Revenue (£13.6m)

Stripping out the large case revenue (£9.3m) does indeed imply £80k revenue per case on the remaining cases, or maybe a little more if you're assumption of only 48 cases actually closing (NB: it's little discrepancies like this - 48 vs 52 - that put me off).

And then we need to take away Manolete costs and any funds due to 3rd parties.

Again, I'm not sure if this has always been the case, but it's worth bearing in mind that in the last reporting period at least there appear to be a lot of very very small winners in the portfolio.

A

Hi abtan,

Good points, which is why its so useful debate shares with insightful investors like yourself, unfortunately we can't see the books but have to interpret them from the outside. I guess, as you say at least one of those six (48 v 52) is the Significant Case RNS'd today and that £2.6m of the £5.4m unrealised profit has just moved to realsed.

Hi Maddox

I’ve returned to your article as I still have nagging doubts. I continue to hold for now.

There is little doubt that Steve Cooklin has built a good business in Manolete which is developing well. Pretty much all the key performance indicators seem to be moving in the right direction. The key question in my mind is how to value the business.

If the cases are stated at a prudent assessment of fair value then this would indicate a small premium to fair value to remove the prudence? There is then a rationale that the established business with a good market position should command an additional premium. Using this logic it is difficult to value the business at its current market value of 3.8x fair net asset value.

Looking at Burford Capital (LON:BUR) and Litigation Capital Management (LON:LIT) they are valued at 1.2x and 1.45x (although LIT does not fair value its cases – although I’m not sure why) respectively, so there does appear to be some logic to applying this valuation methodology. It is also the way many investment businesses are valued.

The counterargument seems to be that you don’t value the majority of businesses at the fair value of their assets. The use of some multiple of profits is more usual for trading businesses. Given that the average duration of Manolete’s investments is stated at c11 months should it be classified as a trading rather than an investment business? I can see arguments for and against this. The anticipated collection of the proceeds of the recent large cases over many years is a definite argument against. It also adds uncertainty as to whether the full amount will ever be collected.

If we do use a multiple of profits basis then the current PE of 10x does not appear unreasonably expensive, especially for a business growing strongly as evidenced by the PEG of 0.3.

As Abtan noted in his comments, the value of the small cases that have settled does seem small at around £84k (down from £105k in H1.20) but perhaps this adds to the “trading” as opposed to “investment” argument.

Hi Steve,

Good points to consider. I hold both Burford Capital (LON:BUR) and Litigation Capital Management (LON:LIT) - because I think that they are also ridiculously cheap. Valuing a company on its Balance Sheet is more usual in the 'Deep Value' investor territory whereas all three are fast growing companies that are better valued on that basis.

I'd argue that taking a Growth Valuation approach is more appropriate and Jim Slater's PEG is the classic. As you say Manolete Partners (LON:MANO) is on a PEG of 0.3, Burford Capital (LON:BUR) is also on 0.3 whilst Litigation Capital Management (LON:LIT) is on 0.1 whereas a fair value would be a PEG of 1.0. On this basis MANO and BUR should be three times their current share price and LIT ten times!

Sooner or later, Mr Market will I think recognise this disparity and a re-rating will take place.

Hi Maddox,

A good bit of analysis suggesting Mano is significantly undervalued. But what about Broker recommendations, are there any that support your price vs value disconnect, and if not why not?

Hi Geomarker,

I'm aware that Liberum have a BUY rating and a share price target of 710p, Arden have a BUY rating as do Investors Chronicle but no sp targets. If anyone else can share other brokers' views that would be very welcome.

Just to flag that Manolete Partners (LON:MANO) is featuring in the #MelloMonday show online this evening. In the MelloBASH a panel of experienced analysts and successful personal investors BASH a small selection of shares giving a BASH (Buy, Avoid, Sell or Hold) verdict. It's going to be fascinating to get their views on MANO. Stockopedia are offering a discount:

'If you would like to join we have a special 50% discounted rate for Stockopedia subscribers making this just £10.15 per ticket (simply enter the promo code MMStocko21 at the checkout). You can register here.'

Https://melloevents.com/mellomonday-11th-january-2021/

The introduction and analysis of Manolete Partners (LON:MANO) is by the MelloBASH regular Kevin Taylor. He is quite brilliant in assessing what is good, bad and ugly within each company but also known as 'Mr Negative' so if he give it a clean bill of health all holders will be able to sleep a little easier.

Does anyone have any indication as to why Litigation Capital Management (LON:LIT) is up5% today in a down market?

Big reaction to today's Q3 trading update from Manolete Partners (LON:MANO) commiserations to holders. Here is the RNS https://www.stockopedia.com/sh... goodness know why it was released during market hours and not at 0700 as usual, given the obvious price sensitivity.

While clearly disappointing, it seems to me the price fall has been overdone. Insolvencies have been low for some time, that will reverse during 2021 and I think it's likely that looking back this will have been a buying opportunity on a 2-3 year view. Manolete Partners (LON:MANO) has its national network in place and it's a matter of waiting for the cases to keep that network busy. Sadly I don't think it will be long...

Some chunky selling going on, I saw two lots of 750,000 shares going through at the close, at 195p... it's difficult to recover one's reputation when an institution has taken that kind of hit. That will probably be the most lasting damage in my view.

More destructive potentially is that it reinforces the bear view of those that question its accounting for unrealized profits.

Whilst I don't agree with that view it does show the impact when the volume of new cases coming in falls. This seems to be in stark contrast to Begbies Traynor (LON:BEG) and Frp Advisory (LON:FRP) which are still buoyant according to their latest TU's.

Just watching this (missed a bullet really) but the other concern I have is cash collection. They point to the (relatively) quick turnover in cases but getting the cash can stretch out a considerable period of time. One wonders if this would require an equity raise if liquidations increase.

Phil

Well this is either one of those fantastic opportunities (the best trades feeling uncomfortable and all that) or it's just a dog. I admit I'm not sure which.

It's only a small position for me thankfully so I may just wait and see rather than topping up or bailing. The fact the CEO is dumping loads of stock hardly fills one with confidence.

The CEO selling 1 million shares in Manolete Partners (LON:MANO) is hardly a vote of confidence. Admittedly he still owns quite a bit of the company.

Steven Cooklin is presenting to ShareSoc on 17 February, is anyone planning to attend? Here's the link https://www.sharesoc.org/event...

The profit warning is one thing, but I was unsettled by Steven selling 1m shares. That was new and unexpected. He has presumably been planning this for a while, so he has at least done the honourable thing by issuing the profit warning first. The announcement implies he is going to sell more, after a 3-month pause. I'd certainly like to understand the reasons and his plans for future sales.

I think you have to remember there is a lot of director selling more generally at the moment as insiders with large holdings, who have maybe not realised any capital gains for a while, decide that the wind is about to change. If CGT doesn't take a big hit to pay for the pandemic costs, since it is essentially a wealth tax, I'd be amazed. I would assume that is likely the reason for large sales, particularly if you look at the chart.

BTW I have no interest in this company. Man has not yet made a bargepole long enough.

All the best, Si

Yeah, you'd think I'd learn, especially as the BUR bargepole hit me on the head on the way down!

Good point on CGT which seems a likely casualty to me. Divi allowance too maybe?

Just noticed that under allocation Stockopedia lists MANO under industrials????

I always thought traditional sector allocations were crap. Most of my industrials I would class as at least quasi tech.

Worth looking at the Share soc deck on their I R page. Says CEO sold to allow another investor to take a stake. Need to look closely at 1) growth in cases 2) quality of cases acquired 3) quality of unrealized pnl, that in how to appraise this company.