I find it very difficult to reconcile what's going on with the markets in comparison to what's happening in the real economy, and am becoming increasingly convinced that the markets are going to roll over again and that we're going to see another meltdown in the next month or 2 - maybe once the unemployment numbers start reflecting the true state of the US & UK economies.

Some factors that i'm looking at are....

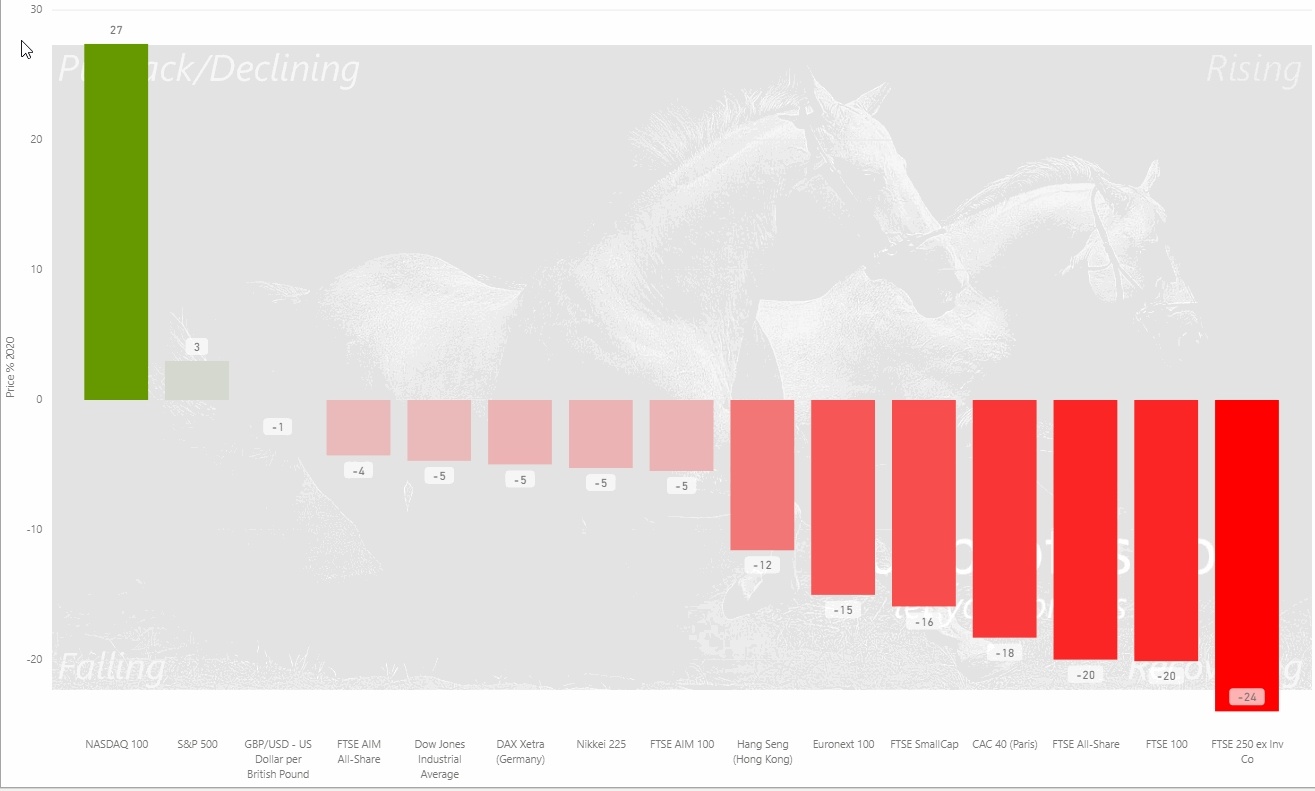

- S&P500 is on the verge of filling the gap from the late Feb covid crash, and is also within touching distance of an all time high (double top?)

- The breadth of the rally (stocks rising vs falling) is dropping indicating that we are near a top

- Volatility has dropped implying that there is little or no fear in the market

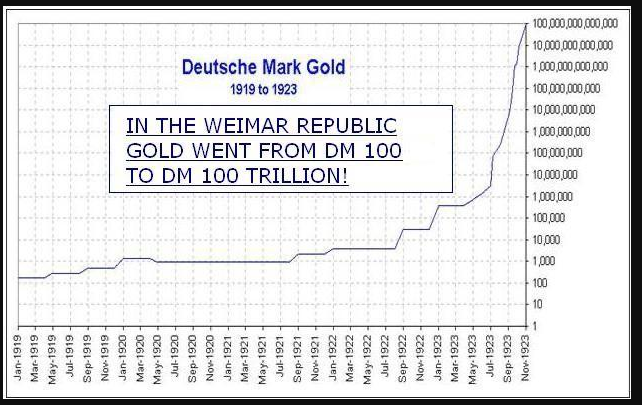

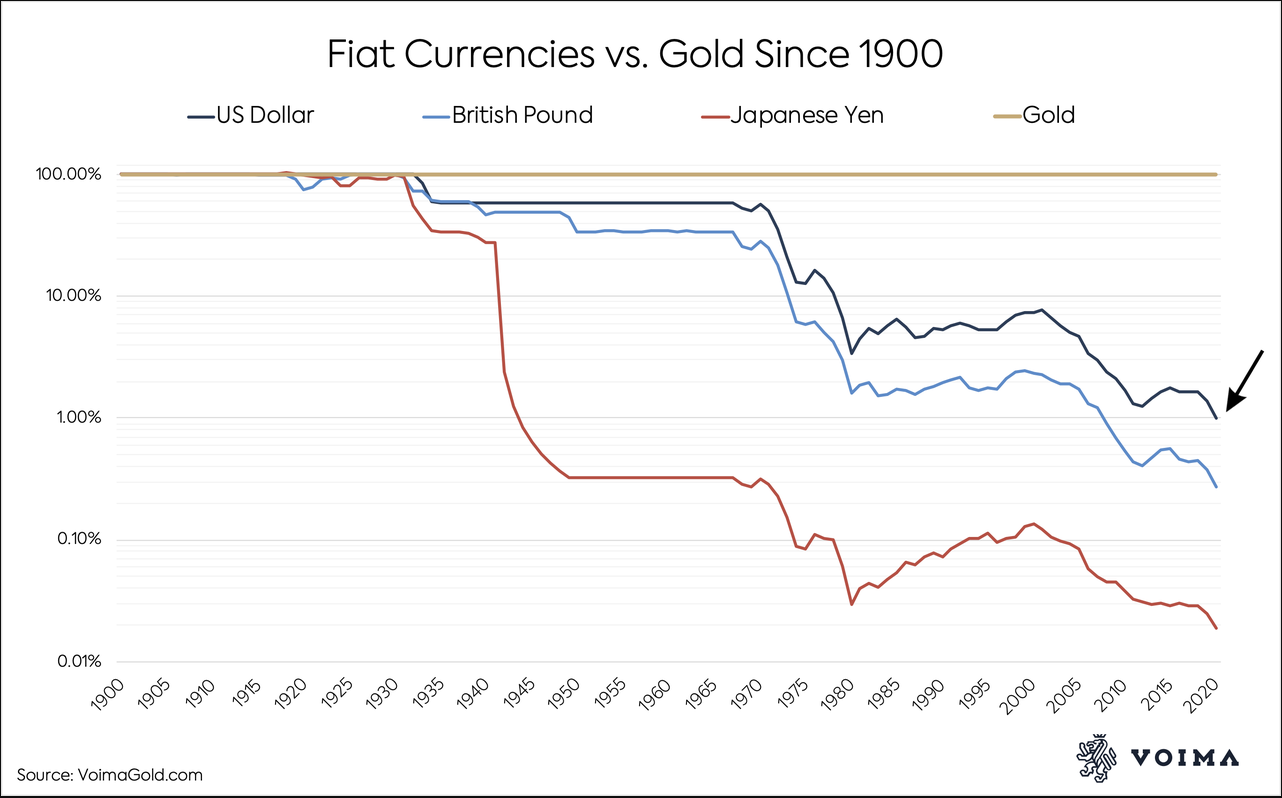

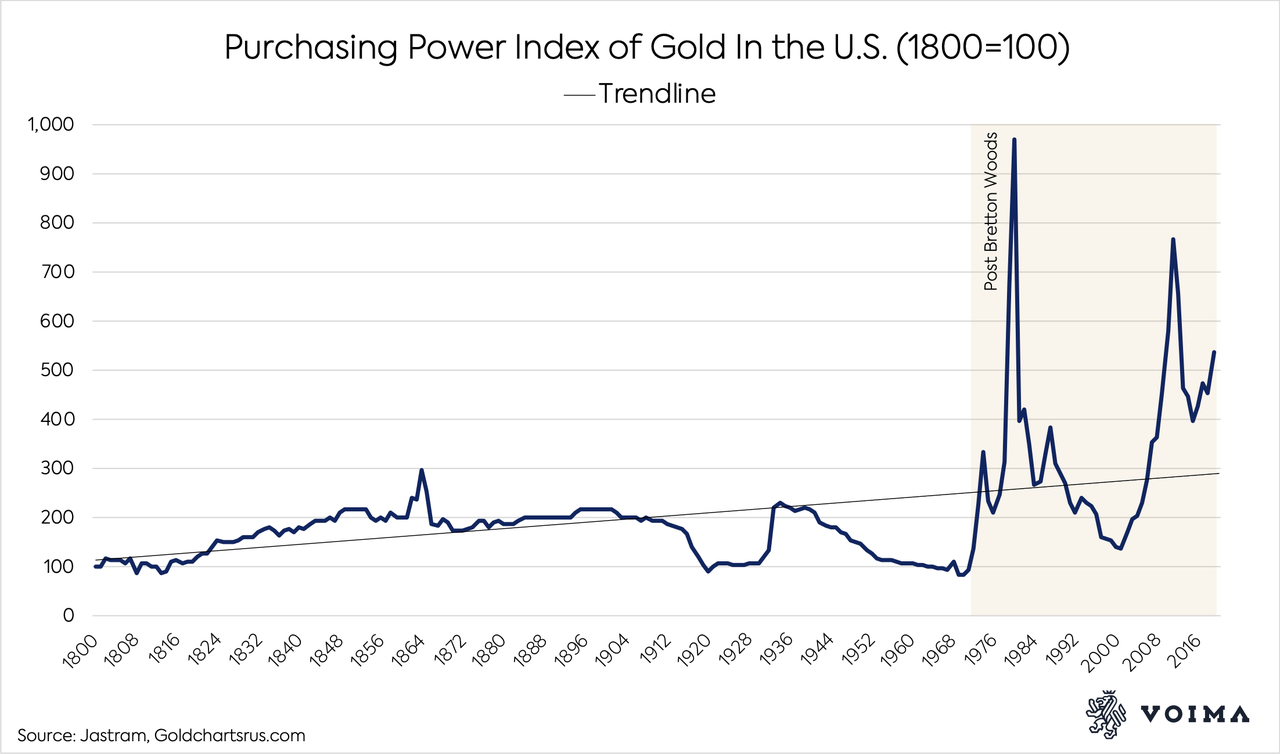

- Gold & Silver hitting new highs indicates there are major problems ahead, and that smart money is looking for alternative means of making money, rather than stocks and bonds.

I've done extremely well riding the Gold/Silver price higher but have this week sold roughly a third of my holdings, whether they be ETF's and miners and will reduce again if I see the market turning. (Medium term these will all go much higher, but there will be major corrections if the markets go into meltdown again).

I've also sold 2/3rds of my regular shares, and have opened some shorts.

My SIPP is now roughly 40% cash, 40% gold/silver, 10 shares (long), 10% etf shorts

What do others think of where the markets stand at the moment? Bullish? Bearish? Neutral?