Market Musings 010226:

End-month commodity reversal

Weekly Podcast and Snapshot - Asia: Disruption by Design (click to listen)

Asia: It is all about policy not politics

- Taking advantage of a high approval rating, Prime minister Sanae Takaichi has called for a snap general election to take place on 8 February. This led to the yen weakening and JGB rising with long term yields hitting multi years highs.

- Following this, the Bank of Japan (BoJ) meeting kept the policy rate unchanged. But after a hawkish press conference, markets saw a move in dollar-yen strengthening. This has led to speculations about a possible although not confirmed intervention from the BoJ and or from the Fed. To note that Asian currencies have been in the past managed by local governments to be weaker compared to the US dollar in order to boost export competitiveness.

- Lately, a boost of re-industrialization in the US and the West is taking place. This restructuring could lead over time to a lower populism, rising real wages and higher incomes. It also helps reduce trade deficits, thereby lowering global imbalances. Furthermore, appreciating currencies and equity markets go together allowing Asian equities, including Japan, of benefiting from improving corporate governance.

Precious metals hit the skids

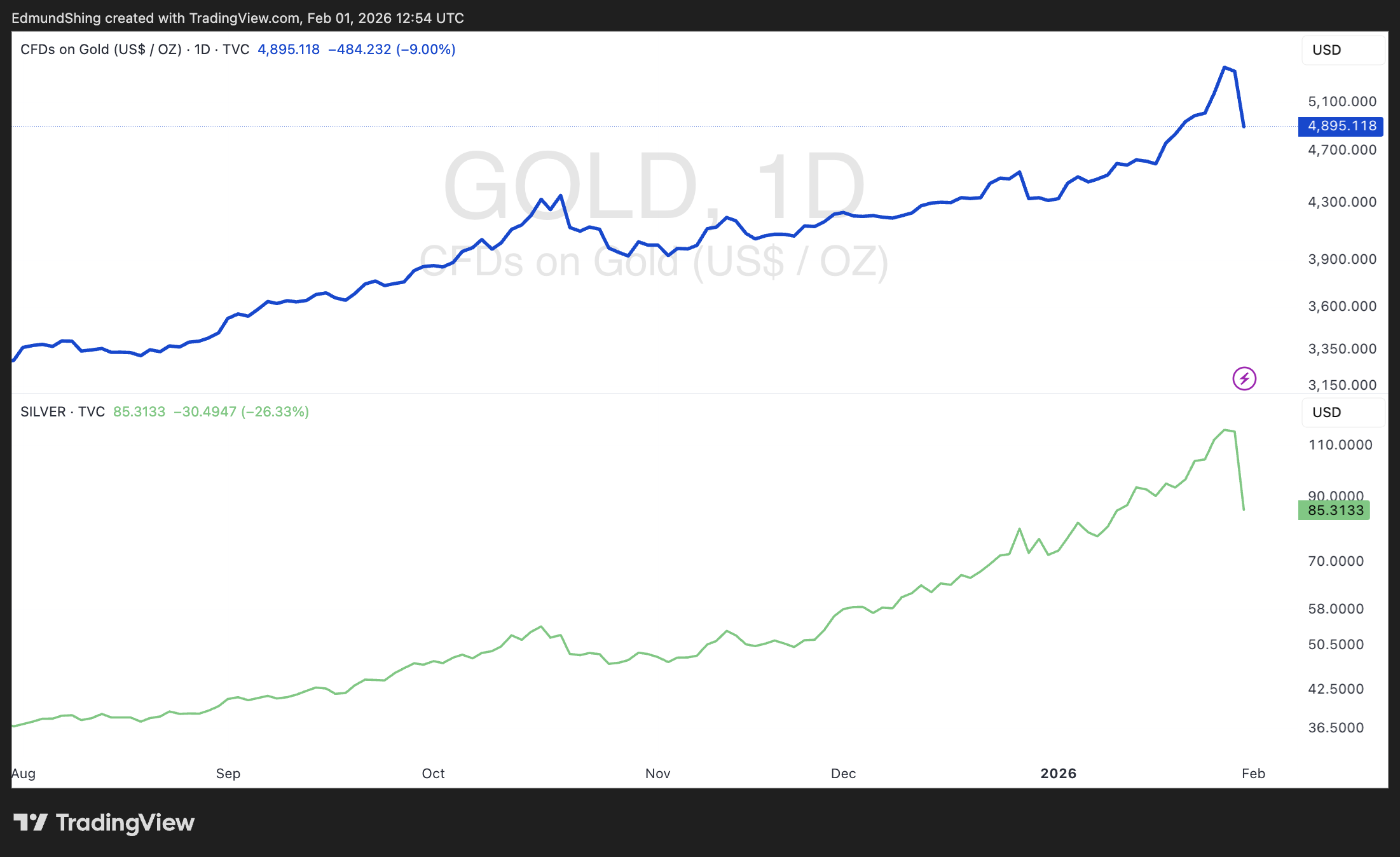

The seemingly unstoppable upwards momentum in gold, silver and platinum over the last few months came to shuddering stop on Thursday and Friday of last week.

On an intraday basis, gold dropped over 10% to dip back under $5000/ounce by the end of last week, while silver took a more hefty 30% hit from $120/ounce all the way back down to $85/ounce. Despite these huge 2-day drops, both gold and silver still posted respectable gains over January as a whole, which is quite impressive given the scale of these drops.

Gold and silver: up in January but hit hard on Thursday/Friday

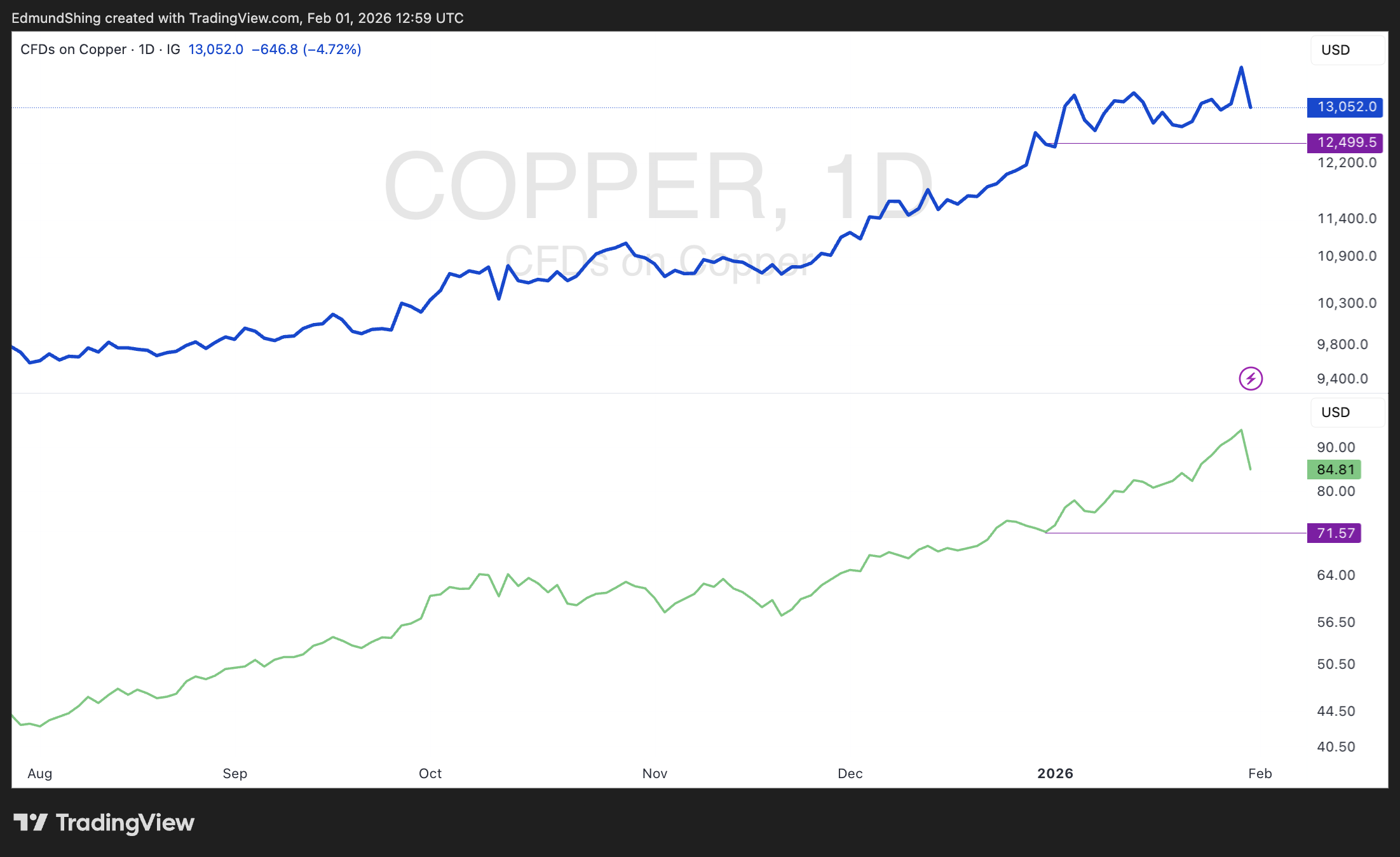

Other trending commodities also took a hit at the end of last week, most notably copper:

Copper (blue) and copper miners (green) take damage, but up overJanuary

What to do about commodities exposure? I continue to hold despite the precipitous drops of the last few days, as I see a correction in speculative excess in the short term but no meaningful change to the bullish fundamentals for these metals in the…