Market Musings 010424: Gold surges yet higher

Gold gallops to new all-time highs

The gold price continues to make a new all time high to over $2,250 per ounce.

Source:TradingView.com

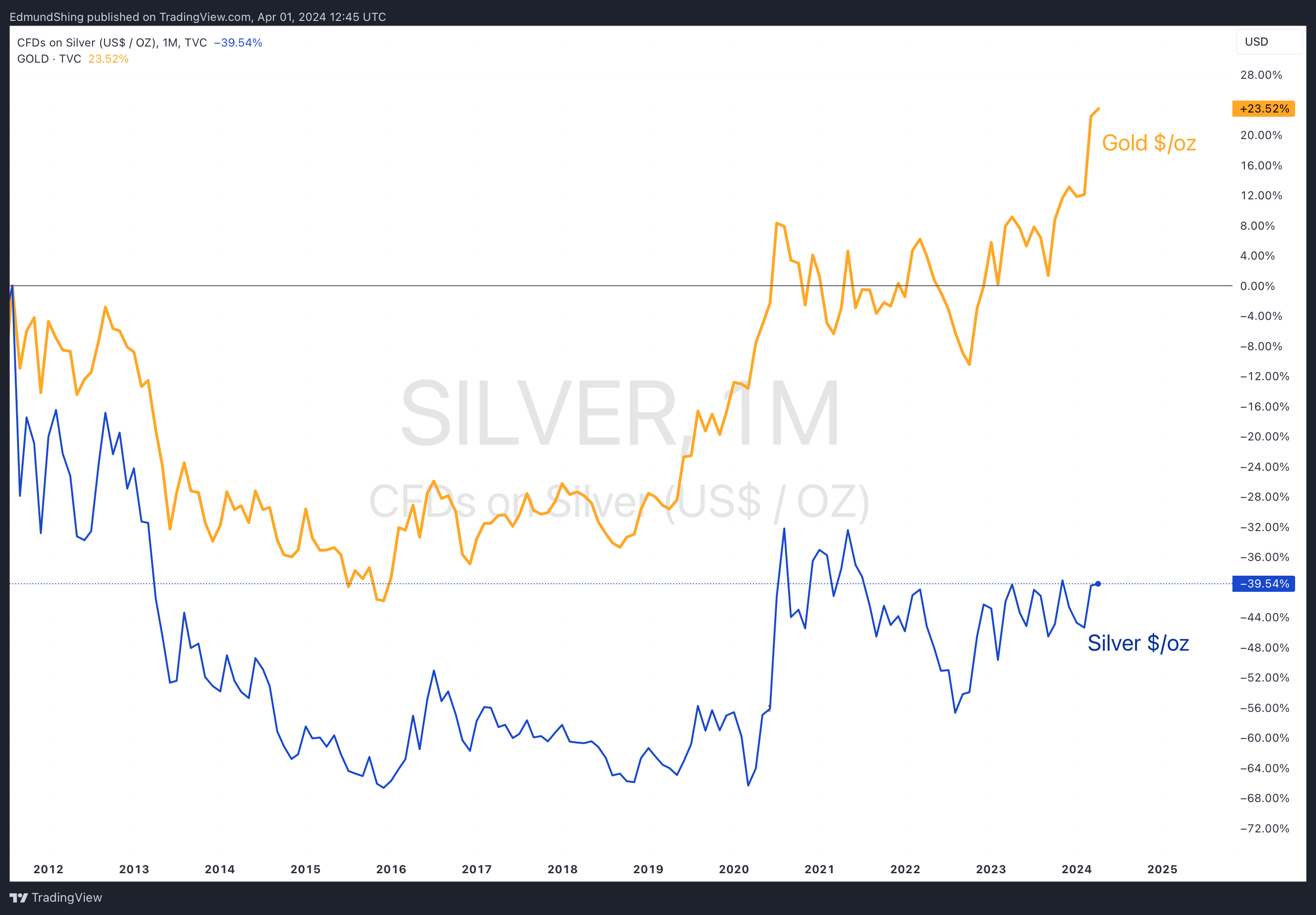

Meanwhile silver, which is also an ancient form of money like gold continues to languish 50% below its all time high reached in 2011 of $50 an ounce today at just over $25 per ounce.

Source: TradingView.com

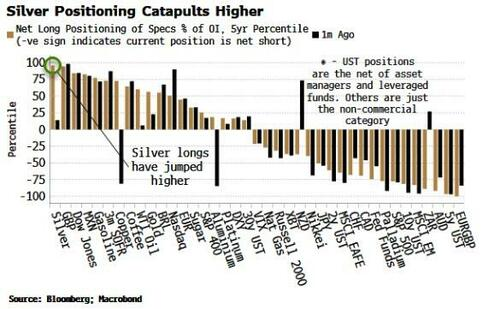

But there are signs that silver may finally be starting to react to the upwards momentum in the gold price,

Over the very long term, the ratio between the gold and the silver price has been around 67, but has varied enormously around this. It has been as low as 14 times and as high as maybe 120 times. Today it hovers at nearly 90 times, so at the higher end of the ratio, suggesting that silver could have an accelerated catch up to the gold price should gold continue to move higher towards $2,300 per ounce. To give some example, at today's price of $2,250 params and at an average Gold Silver ratio of around 67. This would put silver closer to $33 per ounce as opposed to the current 25 and change.

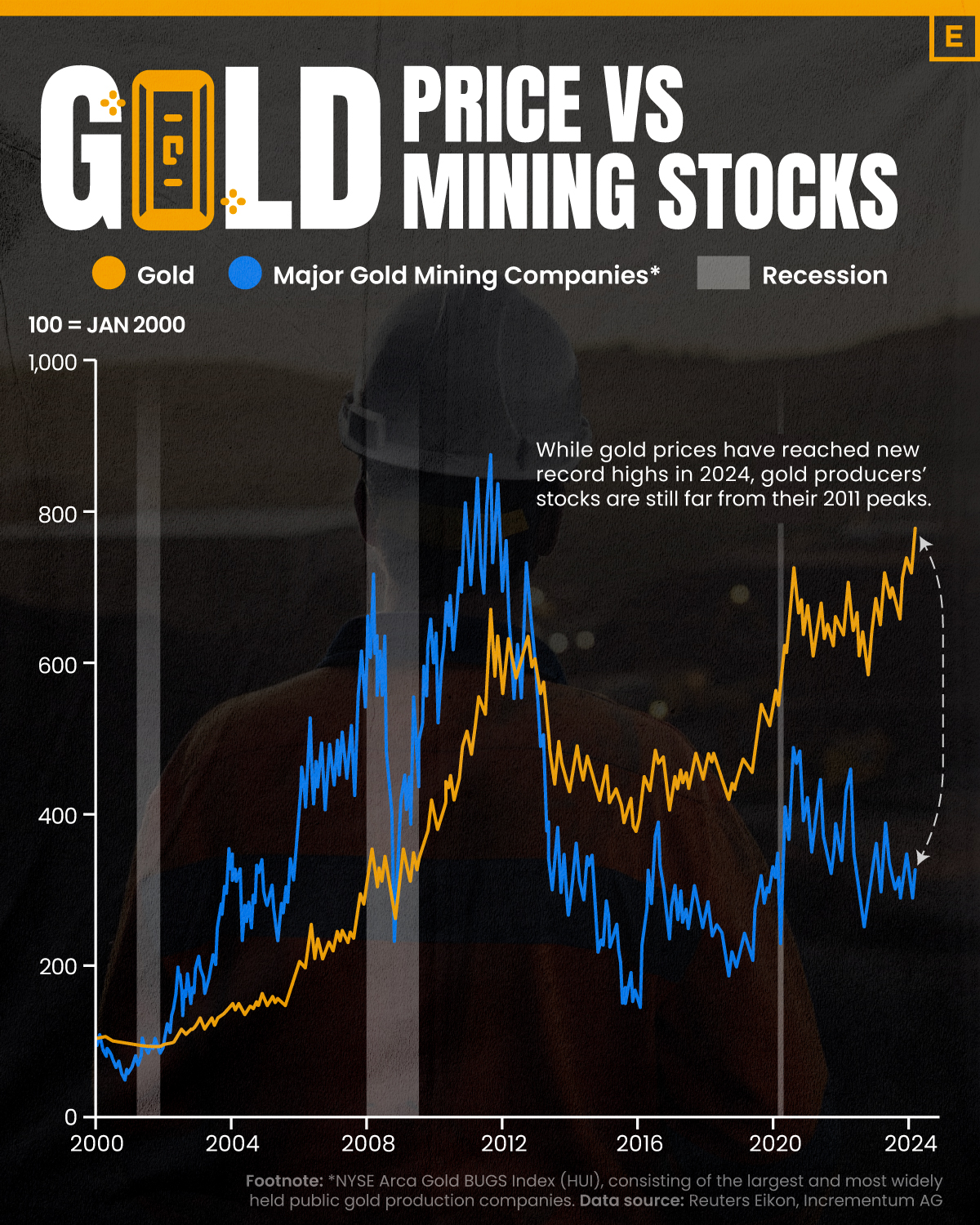

But it's not only silver that lags the gold price. The share price of gold miners has also dramatically lagged physical gold over the last few years.

This is obvious by looking at the relative performance of the HUI gold miners index against the physical gold price, gold miners have dramatically underperformed gold despite offering a gross profit margin (Taking the spot gold price today of $2,250 an ounce and the all in sustaining cost of between $1,300 and $1,400 per ounce) of around 40%, if not more, which is historically very high.

Nevertheless, gold miners continue to languish and valuations are relatively low by historical standards.

In the UK, there are a number of UK listed gold miners of interest including MTL Metals Exploration and PAF Pan African Resources. Of the UK-listed small cap gold miners, these two exhibit the best earnings and price momentum for now and are clearly very cheap on metrics such as free cash flow yield, prospective P E., They are also relatively cash rich…