Don’t Panic! You CAN stay invested in Equities

Summary:

- Podcast: Seeking Sustainable Sustenance in France

- Don’t Panic! You CAN stay invested in Equities (even over summer)

- Seasonality favours Health care, Food & Beverages, Technology now

New Podcast: Seeking Sustainable Sustenance in France

Charlotte and Edmund discuss trends in healthy eating in France.

Seeking Sustainable Sustenance in France

- Why is this trend growing?

- How does France fare in plant-based food compared with other countries?

- How is France adapting to new consumer needs?

- How can people invest in these emerging food trends?

- Is there a future for insect-eating?

26% of Greenhouse gas emissions come from Food Production!

Source: OurWorldInData.org

Don’t Panic! You CAN stay invested in Equities

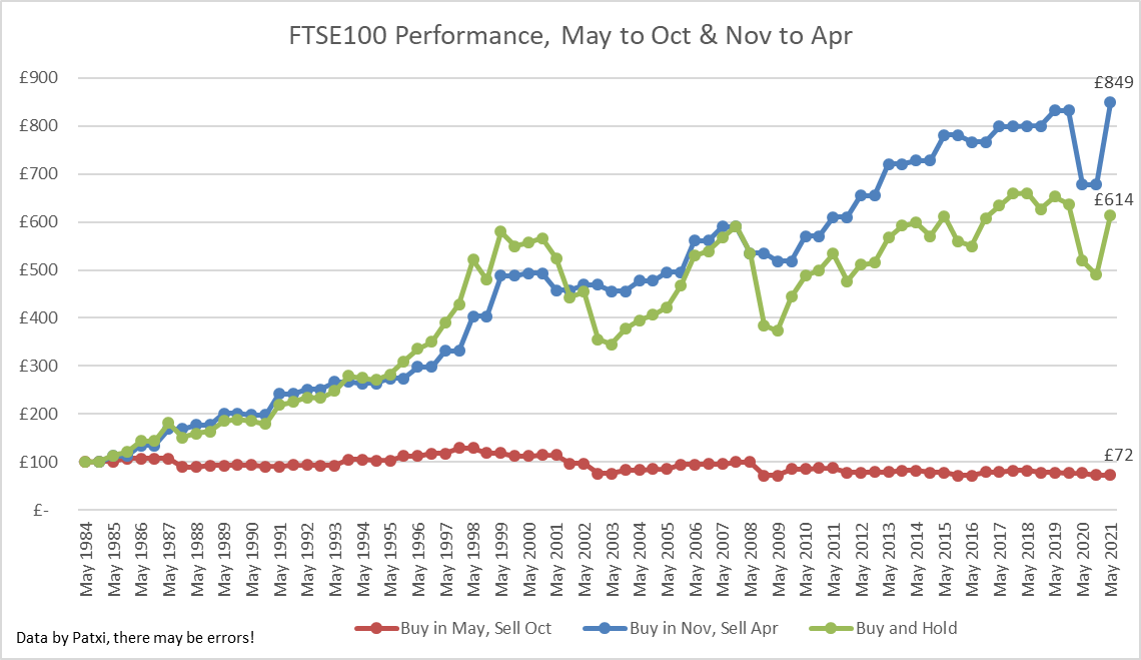

Yes, it is the beginning of May, so keen stock market historians will be crying out: “Sell in May and Go Away” (until the end of September).

This year there are lots of reasons for even calm rational investors to listen to this advice:

- The global stock market has risen 84% in USD terms since the March 2020 market low, and 27% since the beginning of November last year. There is naturally a huge temptation to bank these extraordinary gains…

- Stock market valuations are on the high side, particularly in the US (end-2022 P/E of 22.3x for the S&P 500 index). We know that high valuations today generally lead to lower future long-term returns.

- Retail investor stock market sentiment is on the high side, reflecting widespread optimism (perhaps over-optimism?).

- Fund flows to stock funds and ETFs have been huge these past few months, with US investors putting USD167 billion into stock funds and ETFs since the end of January 2021.

- Negative seasonality: Stock market returns have historically been far worse over the summer (May-September inclusive) than over October-April. So seasonality is negative for equity markets from now until October.

BUT

There are lots of reasons for not rushing to sell your stock market exposure just yet…

1. Climbing the stock market “wall of worry”: there are ALWAYS reasons to worry about the state of the global economy, geopolitical risks, risks to companies from competition or changing end-markets, exogenous shocks like COVID-19 and so on. But more often than not, stock markets continue to motor higher regardless...

S&P 500 has gained impressively despite a myriad of concerns/events

Source: Michael Batnick

2. Momentum begets…