Market Musings 030922:

What if… inflation fell sharply?

Search for the chinks in the consensus narrative - that is where money can be made.

Summary:

- The consensus narrative: Inflation is everywhere, and will be persistent

- The causes of today’s inflation: COVID, employment growth, supply chains, Ukraine conflict

- Sowing the seeds of lower inflation rates tomorrow: higher interest rates, renormalised inventories, lower demand

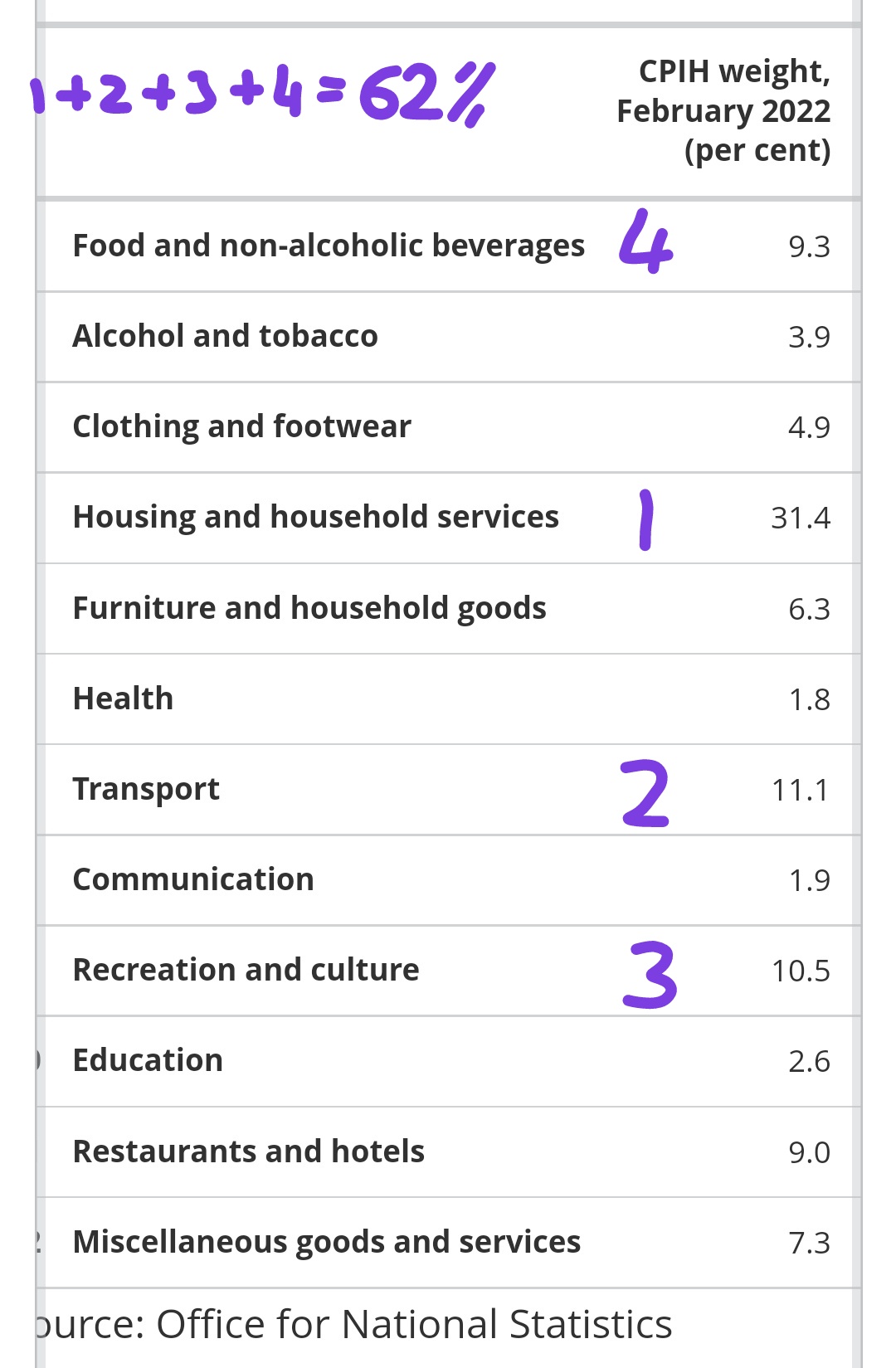

- How could inflation fall faster than expected? Petrol/diesel prices fall, housing markets cool, unemployment rises, discounting of surplus goods

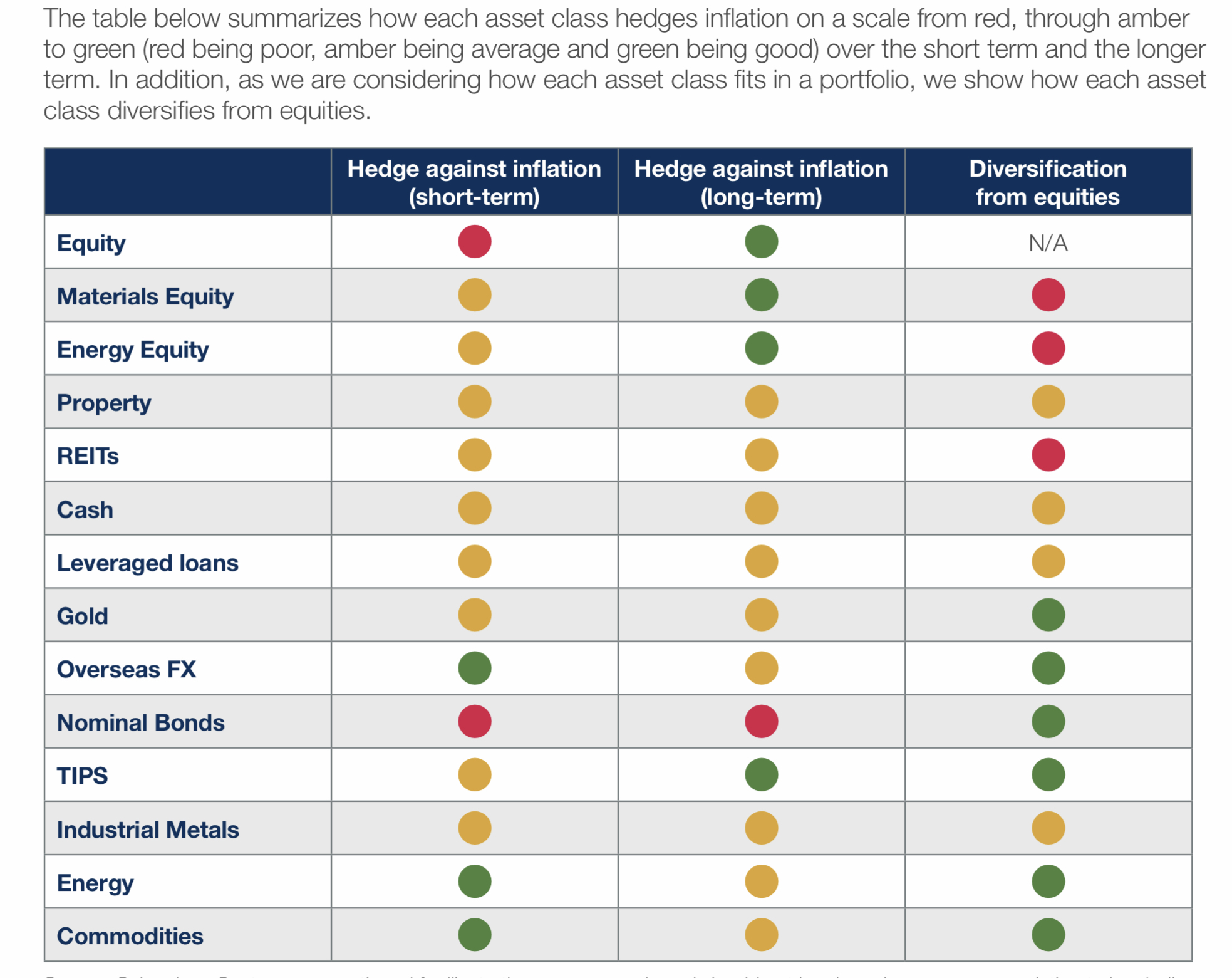

- Investment conclusion: where to benefit, what to avoid

Podcast this week: Are we in a bull or bear market?

- Will the mini-rally continue or could stock markets post further falls this year?

- Has all the bad news been priced in?

- In today’s morose environment, what hope is there for investors?

- What evidence are you looking for before turning bullish on equities?

- What are your favourite stock markets and sectors?

Recent (short) article: Talking Themes: Income from the corporate world

The consensus narrative: Inflation is everywhere, and will be persistent

The spectre of inflation haunts everyone, both households and companies, with daily reports of sky-rocketing energy bills, rising supermarket food prices and rising rents in major cities everywhere.

As investors, we need to focus more on how we think the future will evolve, as opposed to just what the current environment is today. No-one would claim that this is an easy exercise, but that essentially is what we are doing when we invest.

The causes of today’s inflation

There is of course no single cause of today’s explosion in prices across the board - there are several root causes. But we cannot lay the blame for today’s price shocks solely at the feet of the Russian President.

Let’s lay out some of these inflation precursors:

- The COVID-19 pandemic, lockdowns and government + central bank response to lockdowns to prevent the global economy from melting down. The combination of government handouts (direct to households and companies, plus tax cuts and other forms of government support) and zero or negative interest rates (to stimulate borrowing for investment in growth) were very successful in spurring economic recovery post lockdowns. But perhaps too successful in encouraging demand, to the point where we have had too much demand chasing too few available goods and services.

- The success in driving employment growth to new highs. The European Union registered its highest level of total employment in…