As we enter a new year, it is a good time to reconsider investment themes and portfolio holdings for the year ahead.

My convictions remain centred on the resurgence of a whole range of commodities on the basis of growing demand and restricted supply. This is true for precious metals such as silver,industrial metals such as copper and aluminium, and for energy-related metals such as uranium and lithium.

Outside of this commodity-focused exposure, I have been looking for new themes in which I have a high degree of conviction and where there is a potentially interesting entry point at present. This is not easy given that many stock markets have ended 2025 at or very close to multi-year or even all-time highs.

Time to look again at Chinese tech

One such area I am interested in is Chinese technology exposure, predominantly Chinese internet and e-commerce companies. At a broad level, Chinese mega-cap technology companies have been on the recovery trail since early 2024, after a brutal 3-year bear market that had started back at the beginning of 2021. They received a boost in January 2025 when the DeepSeek large language model (LLM) was launched globally, offering a Chinese challenge to US-domiciled LLMs. Chinese mega-cap technology companies such as Alibaba have benefited from resurgent interest related to Artificial Intelligence, as Chinese LLMs have focused more on efficiency and smaller-scale models in contrast to the processing-heavy brute force approach adopted by US LLM developers.

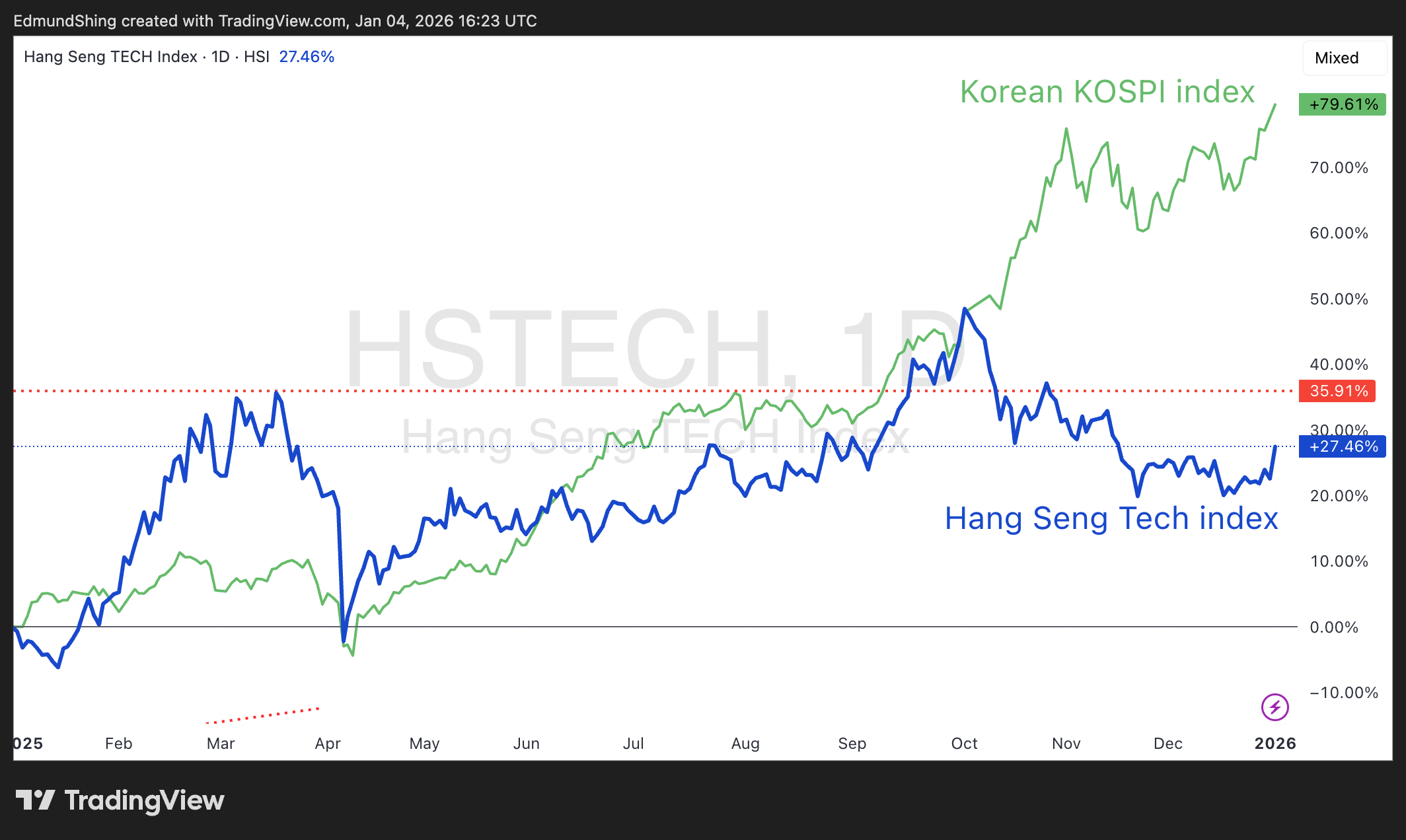

However, since October the Chinese technology sector has cooled, not following other Asian technology-oriented indices such as the South Korean KOSPI to fresh multi-year highs. Over the last 3 months of 2025, the KOSPI index has added over 20% propelled by AI demand for the high bandwidth memory chips produced by Korean companies Samsung and SK Hynix. In contrast, the Hang Seng Technology index has fallen over 10% over this same period, due in part to question marks over Chinese domestic consumption growth which remains relatively weak.

I believe that the Chinese government will introduce further measures to stimulate both domestic consumption and domestic investment in the stock market (as opposed to property and cash). Given that the average Chinese household financial exposure to the domestic stock market remains relatively low, there is still huge scope for…