This has been something of a curious week for financial markets - before looking at stock markets, let’s take quick stock of other asset classes first.

Bonds: a mixed bag, Eurozone leading

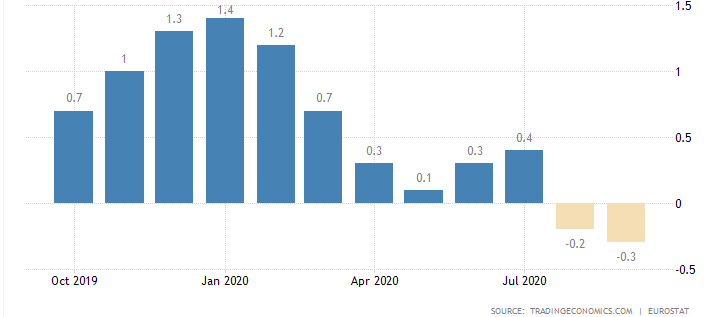

One thing is sure; there is no inflation in the Eurozone! The latest monthly inflation print saw Eurozone inflation sink into negative territory, underlining the deflationary forces still at work in the services sector.

Eurozone CPI down to -0.3% y/y in September, matching the 2016 low

Eurozone sovereign bonds did well out of this despite offering largely negative yields, with sovereign bond ETFs moving higher on the week. In the US, however, there was little movement over the week, while Gilts in the UK actually sold off a little. So on the bond side of things, no clear direction to report.

FX: US dollar resumes downtrend

On the currency front, the US dollar could not sustain its recent bounce, and started once again to decline, notably against the Chinese renminbi and the euro.

Continued US dollar weakness should be good for Emerging Markets and also for US exporters, but does slightly diminish the appeals of US equities for a UK or European investor. Remember, though, that there are currency-hedged ETFs for US indices, should you wish to invest in the US but avoid the risk of a weaker US dollar on your returns.

The Materials sector leads the way

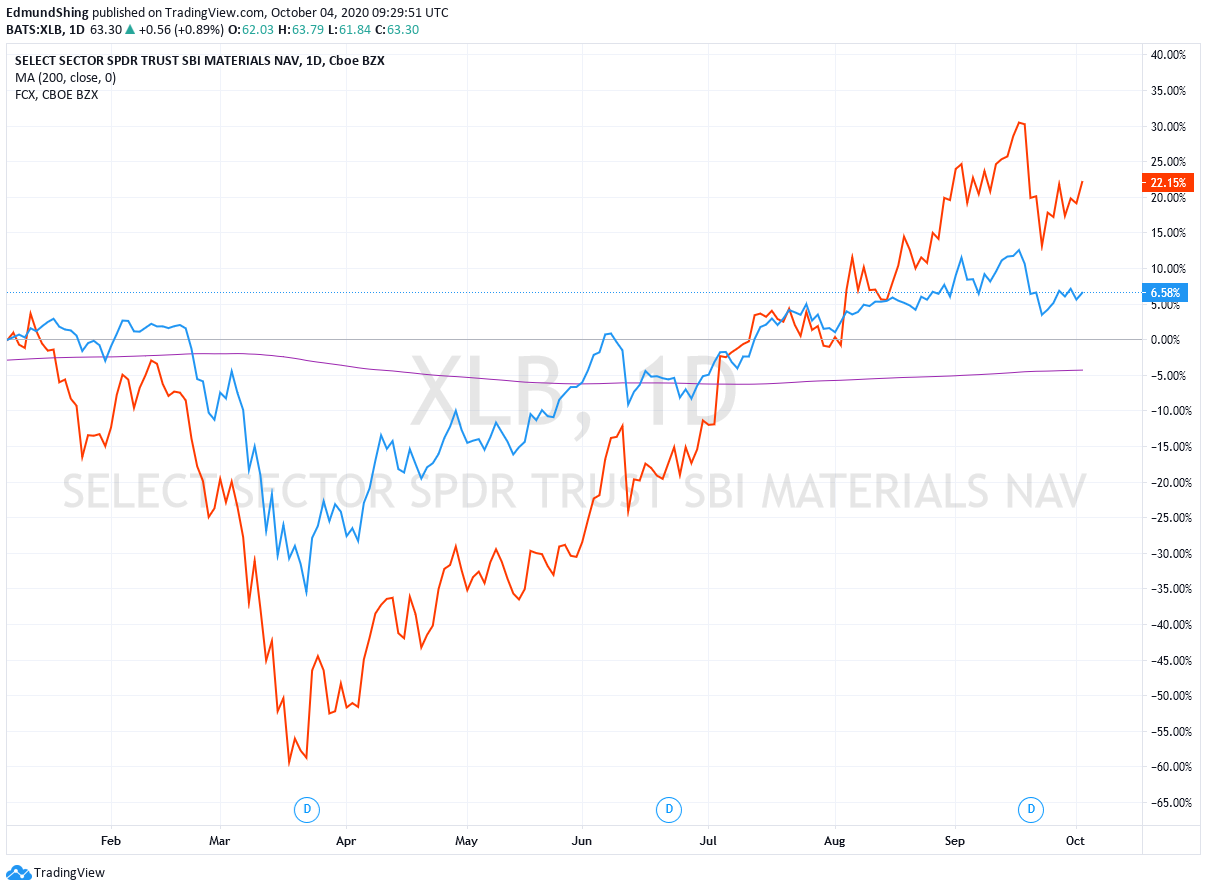

So my citation of a classic 1980s Madonna hit in the article title was not random, but refers to the leading position of the Materials sector in the US stock market, outperforming even Tech.

The pullback in the copper price back under $3/lb in the US has not seemed to dent the strength in FCX Freeport McMoran (in orange), which continues to lead the XLB materials sector ETF (in blue).

XLB Materials ETF is led by copper producer FCX

But US homebuilders are the new leaders

But perhaps surprisingly, it is the US homebuilding sector that takes the crown for the strongest price momentum at the sector level. Post-lockdown, there has been a surge in homebuying from the low point in April, fuelled in large part by lower long-term fixed mortgage rates. Note that residential house prices have been rising for similar reasons in…