Market Musings 060925: Bad employment news is good stock market news

Podcast this week:

Investment Strategy Podcast: The stock market: breakouts galore!

(click on title to listen)

Investment Strategy Focus: Summary

Tighter US fiscal policy balanced by looser monetary stance. US tariffs are a tax principally on US households and businesses, thereby slowing growth. Lower interest rates should partially offset this drag. But US corporate profit margins are at risk and could prompt cost-cutting actions. World ex-US stocks have maintained their 2025 outperformance at +10% versus the S&P 500.

Improving Euro activity implies an ECB now on hold. Improving manufacturing activity, positive loan growth and easing energy costs support modest eurozone growth, with the impact from defence & infrastructure spending yet to materialise. We now expect no further ECB rate cuts, with the deposit rate maintained at 2%.

No big shift in bond yields, and credit spreads remain tight. The US 10-year Treasury yield remains at around our 12-month target, i.e. at 4.3%, while eurozone sovereign yields creep higher. Investment grade credit spreads remain at historic lows, offering few compelling fixed income opportunities to investors at present.

New multi-year highs in multiple stock markets around the globe. The MSCI World ex- US index hit new highs in August, led by Japan, Canada, the UK and Emerging Markets ex-China. We continue to prefer exposure to the UK, Japan, China and South Korea. We also like eurozone mid- and small-cap exposure given the improving domestic economic momentum.

No strategic metals, no technology: strategic metals are essential for creating tools for technological progress. Their supply can be at risk due to scarcity and geopolitics, when global demand increases. We favour exposure to copper, silver and rare earth metals via investment in physical metals and via miners.

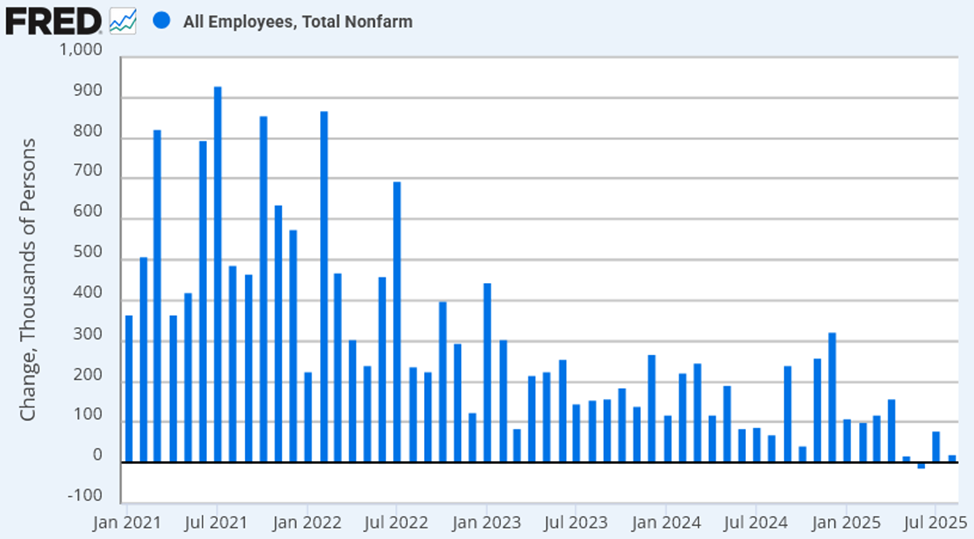

Stock markets shrug off a weak US employment picture

Friday’s US nonfarm payrolls were undoubtedly poor, with just 22,000 jobs added in August.

This represents a sharp slowdown in employment hiring from previous months.

Recall that this year’s nonfarm payroll data have already been revised dramatically lower recently. Another revision lower is likely to occur on September 9, making current trends likely look even weaker.

US nonfarm payroll additions decline to almost nothing