Retail Power a Flash in the Pan, or Structural Shift?

Summary:

- Panic/Euphoria index points to heightened risk of market correction;

- But little sign yet of a crescendo in equity fund flows, with investors still heavy in bonds, credit and cash;

- Monthly EM, Europe stock market charts look bullish with recent moves to new multi-year highs;

- Democratisation of stock market investing can be a good thing - but the use of call options is likely to end in tears for many

- The Biotech sector in focus - a strong momentum play

This chart worries me...

Following up on my comments last week regarding the risk of stock market correction in the near-term, I present as my latest exhibit this chart from Citi:

The Citi Panic/Euphoria Index at a 30+ year high

With the level of euphoria in financial markets apparently so very high, higher than prior to the last big bear markets of 2000-03 and 2007-09, why do I look for only a short-term correction and not something far worse?

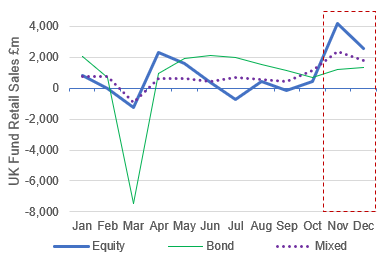

These charts are a key reason for my (relative) optimism that the current bull market is not yet reaching a crescendo: put simply, retail investors have not been pouring huge amounts of new money into the stock markets, at least not until the last four weeks.

Note how back over 2003-07 there were constant strong inflows into US equity mutual funds and ETFs. Contrast that with the data over 2019 and last year, where investors were actually constantly withdrawing money from equity funds, even as the stock markets rose.

The massive investment inflows have gone to government bonds and corporate credit, rather than stocks…

Over the last 2 years, investors have piled into bonds and credit, not stocks

Source: yardeni.com

On top of that, the combination of lockdowns and government handouts (in the form of stimulus checks in the US, and furlough cash in Europe) have led to a surge in the amount of cash held in household savings accounts, earning virtually no interest.

US bank cash savings have exploded over 2020

Source:yardeni.com

While some of this excess cash savings is likely to be spent in the form of pent-up consumption once restrictions are gradually lifted, it is also likely that some…