Market Musings 070226:

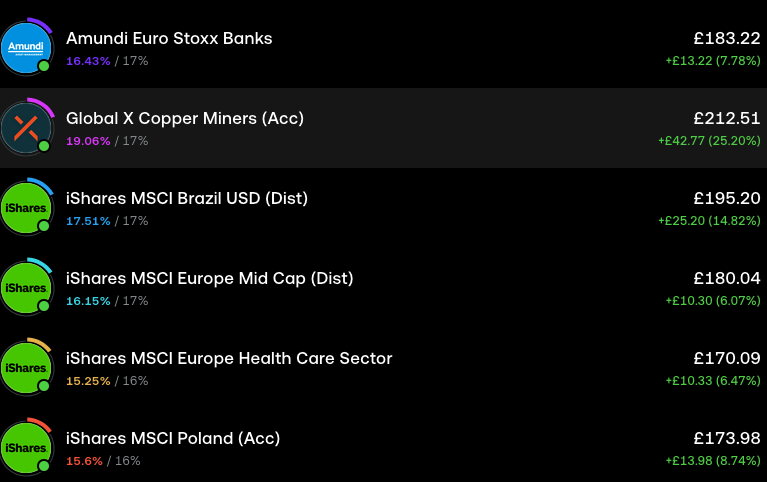

My ETF Model Portfolio

Podcast: After the correction, is gold still a safe haven? (click on link to listen)

In this podcast, Edmund Shing, Global Chief Investment Officer, reviews the recent performance and volatility of gold and gives his outlook.

My ETF Model Portfolio

How have I gone about creating an ETF model portfolio?

First, some basic principles.

I have deliberately taken a relatively high risk approach at the moment, as I judge that we are in a sweet spot for financial market risk.

You will thus not find any defensive choices in the 8 ETFs I have chosen for this model portfolio - no bond ETFs, for instance.

This will change over time, as my assessment of market risk changes.

I have adopted a dual momentum approach, selecting the 8 ETFs according to:

- Do they have strong absolute positive price momentum over the last 6 months?

- Do they have strong relative price momentum (versus the broad global stock market) over the last 6 months?

- Do they give some measure of regional and sector diversification from other ETFs in the selection?

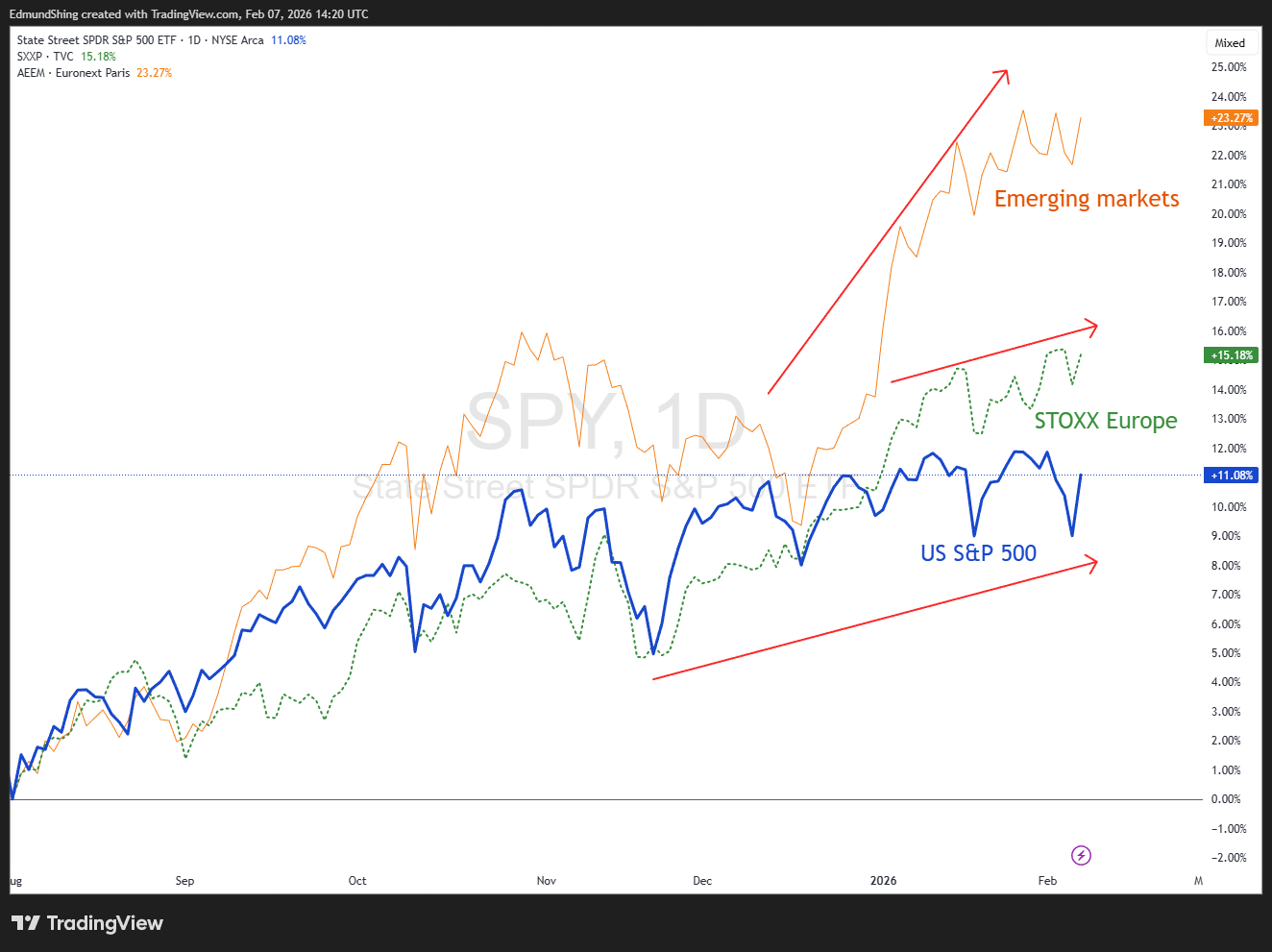

Is the global stock market trending higher? Yes

All major stock markets are trending higher over the last 6 months - but it is clear that the US is now lagging behind other regions such as Emerging Markets and Europe.

This should be unsurprising, as we have an positive environment of:

- Solid/accelerating economic growth

- Falling or low inflation

- Abundant global macro liquidity

- Low or falling central bank interest rates

- Earnings growth projected to be 10%+ for each region's stock market in 2026

- Valuations that are pretty reasonable outside of US mega-cap tech stocks

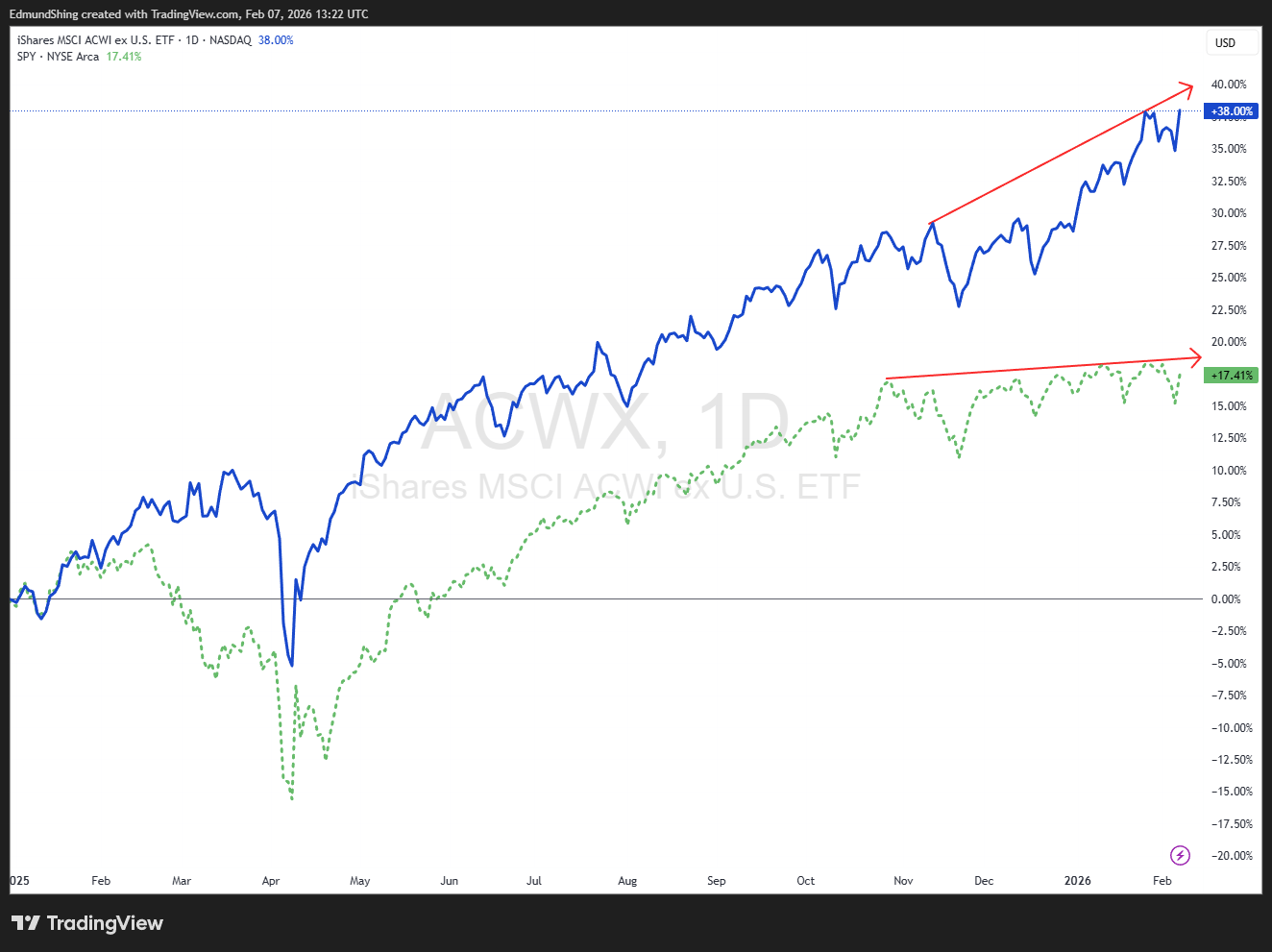

In recent months, the MSCI All Country World ex US index (in blue) has shown much stronger performance than US large-caps (in green), a continuation of the 2025 outperformance trend.

This has been helped by a renewed bout of US dollar weakness against most major and emerging market currencies.

Which regional stock markets are outperforming the global stock index?

Emerging markets have been strong, led by Asian markets such as the tech-heavy Korean KOSPI index and cheap commodity-linked Latin American markets such as Brazil and Mexico.