Market Musings 070725: Silver and platinum wake up

Report:

Investment Strategy Focus June 2025

The bond market is the final arbiter (click link to read)

Podcast:

The 5% from 12-month highs system (click link to listen)

In this podcast, Edmund Shing, Global Chief Investment Officer, BNP Paribas Wealth Management, explains a simple investing system that investors can execute themselves on a monthly basis and which has very encouraging long-term results.

Macro/Strategy: 5 key points this week

Bond investors demand higher ultra-long term bond yields to compensate for higher risk from bigger budget deficits (more spending than tax revenue). US 30-year Treasury bond yield exceeds 5% for the first time since mid-2007 as Trump’s “Big Beautiful bill” is debated in the US Senate..

The US dollar threatens to fall further, particularly against the euro (around $1.14) and GBP sterling ($1.35). Foreign investors are starting to repatriate capital from US assets back home, especially in Europe. This is driving marginal selling of US stocks and bonds in favour of European stocks and bonds.

European Central Bank lowers benchmark interest rate to 2.0% as inflation trends lower towards the ECB’s 2% target, supporting housing demand in variable interest rate-sensitive markets such as Spain, Portugal and the Netherlands. The Bank of England should also lower the BoE base rate in due course (currently 4.25%, expect 2x 0.25% rate cu5ts this year).

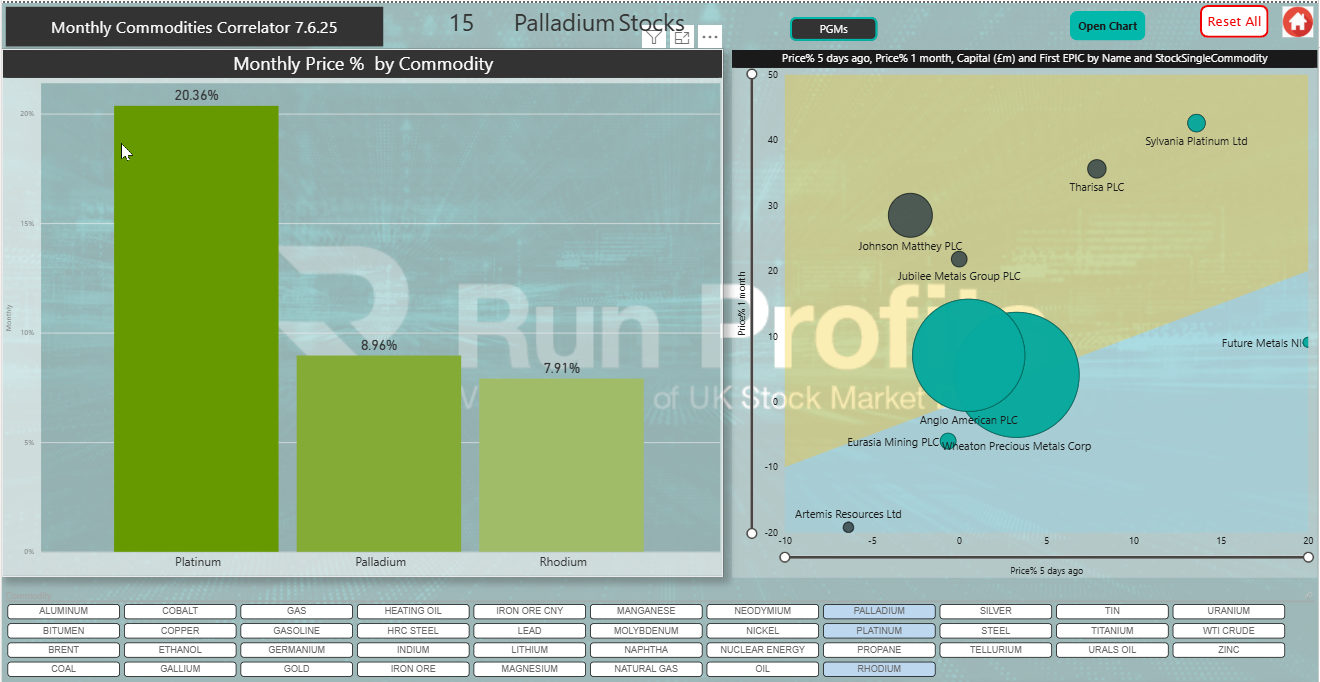

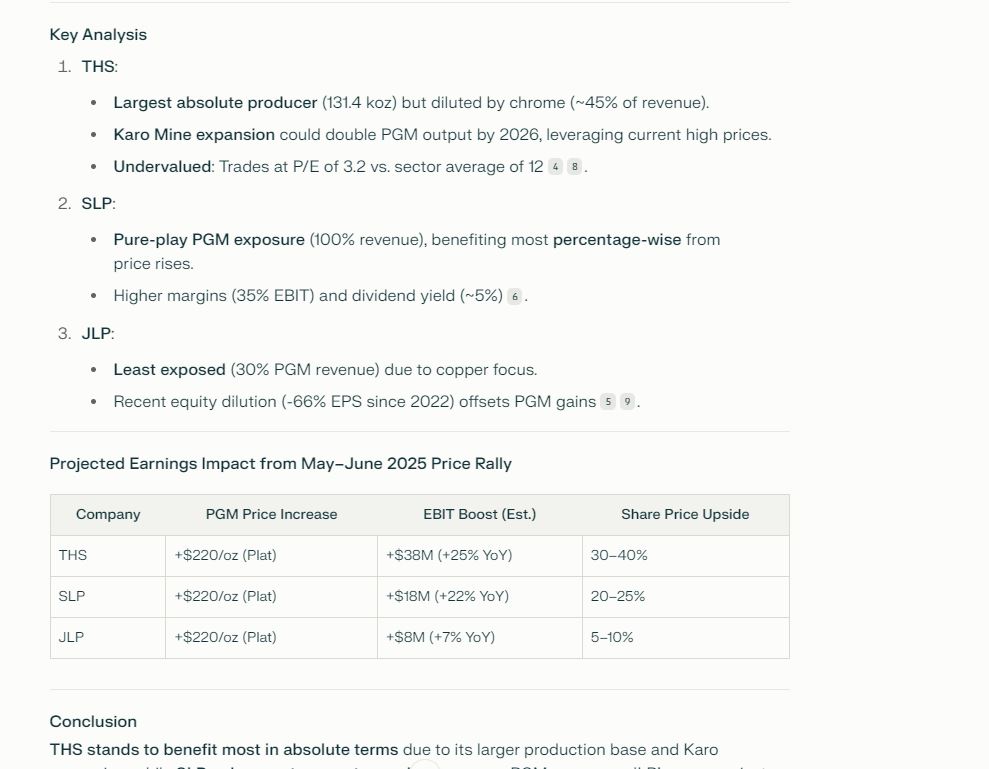

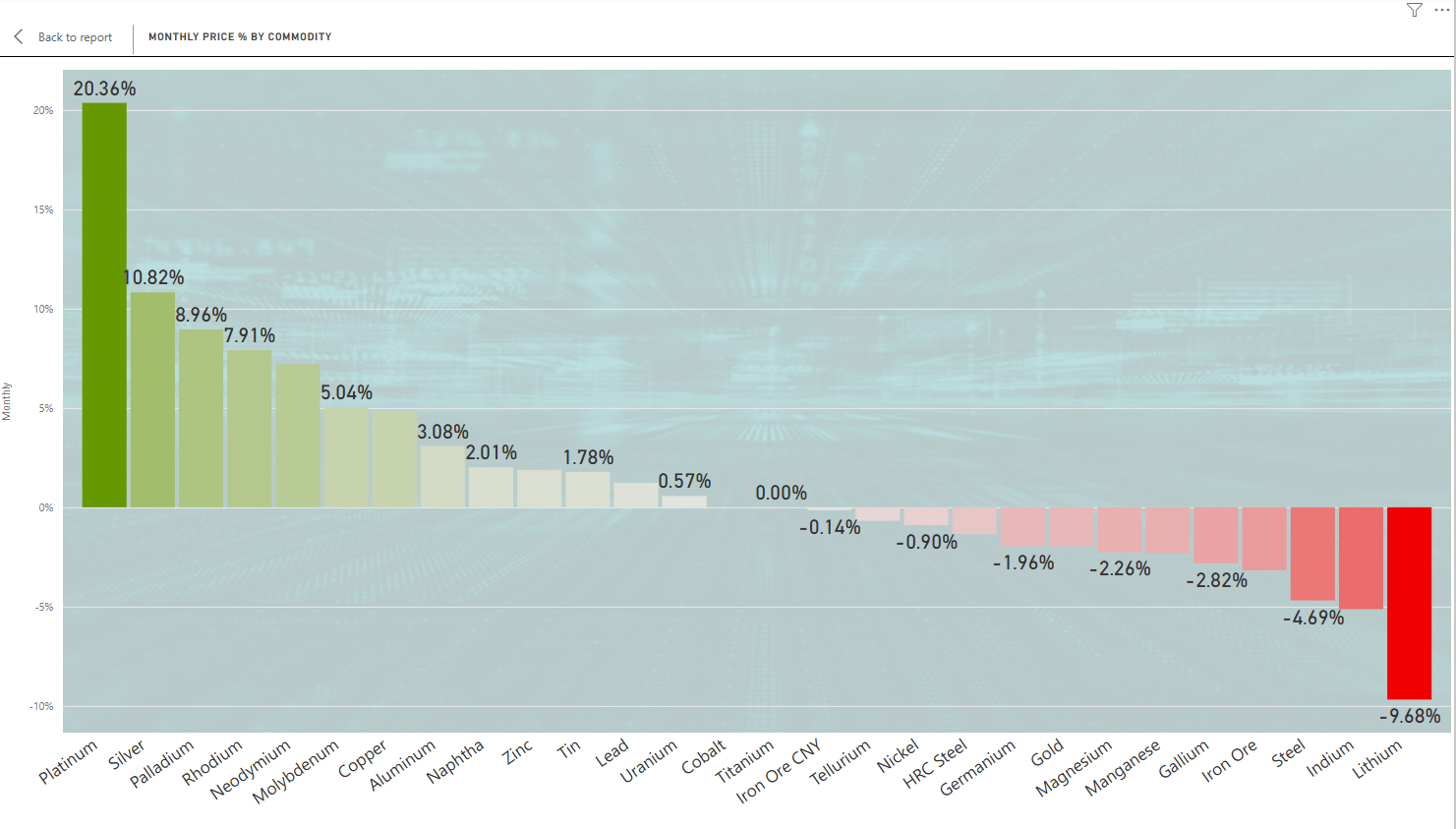

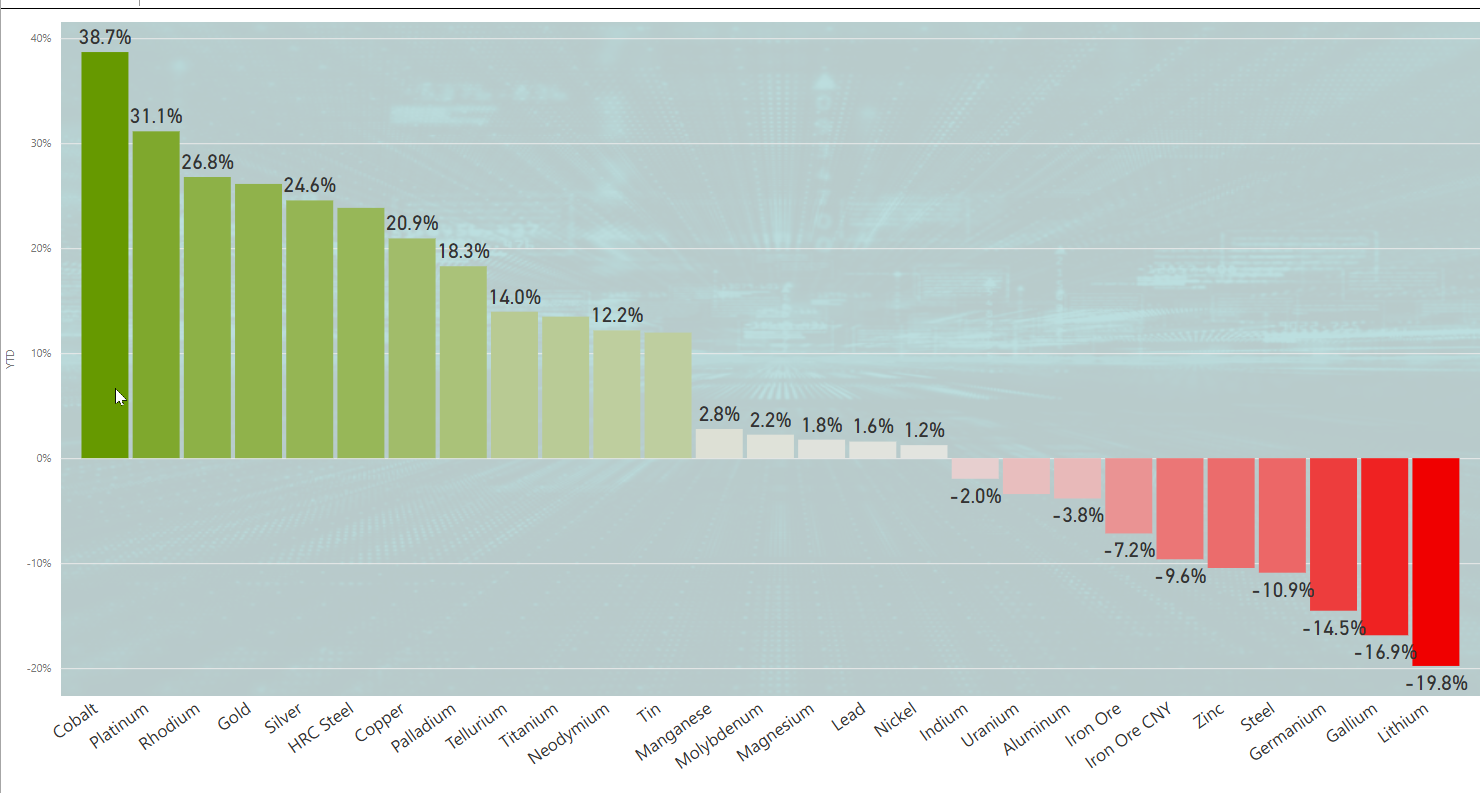

Precious metals momentum switches to silver and platinum: gold stalls above $3300/ounce, but silver breaks out in a catch-up move to $36/ounce (highest since early 2012) and platinum finally moves higher to $1168/ounce. Other platinum group metals like rhodium also move higher. Remember that both silver and platinum markets remain in a supply-demand deficit state, with growing demand but mining supply that is not keeping pace.

Recession, what recession? In the US, employment data remains relatively solid. Moreover, US cyclical sectors such as Industrials (XLI) and Mining (XME) continue to show strong upwards momentum. Not something you would expect to see in the face of an economic recession.

My focus this week: Dividend ETFs, Silver and Platinum Miners

UK and European dividend-focused funds and ETFs continue to hit new year highs this week, as more value-focused strategies outperform.

In Europe, the MSCI Europe Dividend ETF hit a new year high (+12%…