Market Musings 09/04/22:

Security is the New Watchword

Podcasts that might interest you:

ARE OIL PRICES SPIRALLING OUT OF CONTROL?

- Are we heading towards $200 for a barrel of oil?

- Will higher oil prices lead to a global recession?

- Are the IEA’s proposals to cut global oil demand feasible?

- What about alternative energy sources?

- How can investors play this space?

Also available in Apple Podcasts, Podcast Addict, Spotify podcast platforms

(search for “BNP Paribas Wealth”)

Weekly Summary:

- The New World: Forget the last 20 years!

- Lowflation is now a trend of the past

- All about energy, food, and raw materials security

- Technology security: Chip production, cybersecurity

- How to invest in this new strategic assets theme

- Idea; of the Week: APF Anglo-Pacific, commodity royalty company

1. The New World: Forget the last 20 years!

In a little over two years since the beginning of 2020, I would say that the world has changed structurally, firstly with the impact of the global COVID-19 pandemic, and now with the conflict in Ukraine.

These global shocks have triggered a shift in economic and political tectonic plates across the globe. The result is that new long-term structural trends have been set into motion, or at least given a huge boost.

What are these new long-term global trends that I speak of? I am thinking of the following trends (not an exhaustive list):

- A shift away from globalisation trends in manufacturing and production, back towards relocalisation and near-shoring of this economic activity, with a determination to reinforce the robustness of supply chains of goods and components in the face of current COVID-related supply chain disruptions.

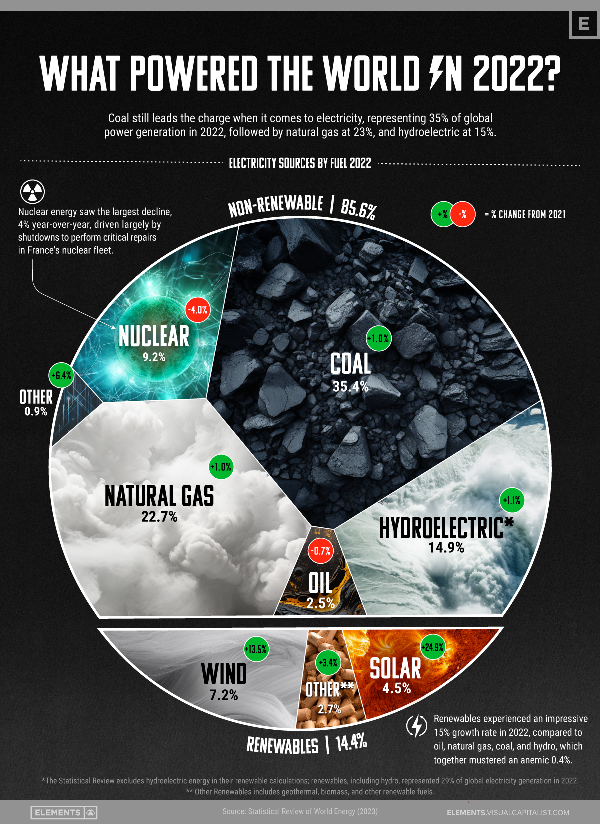

- Renewed focus on energy security, in terms of electricity production from alternative energy sources, securing fossil fuel supplies and acceleration of investment in energy transition away from geopolitically-vulnerable and high carbon-emitting oil, gas and coal towards more geopolitically secure, low carbon sources of energy including renewables, biomass and nuclear. Linked to this is a renewed focus on energy efficiency, as it is far easier and more productive to reduce our energy usage than to find alternative ways to generate this energy.

- Focus on food and water security. The current lack of formerly bountiful grain- and seed-based food exports and also of potassium- and nitrogen-based fertilisers from Central and Eastern Europe has led to a surge in global food prices. This, together with elevated energy prices, increases political uncertainty given the essential nature of food and energy,…