Market Musings 110425:

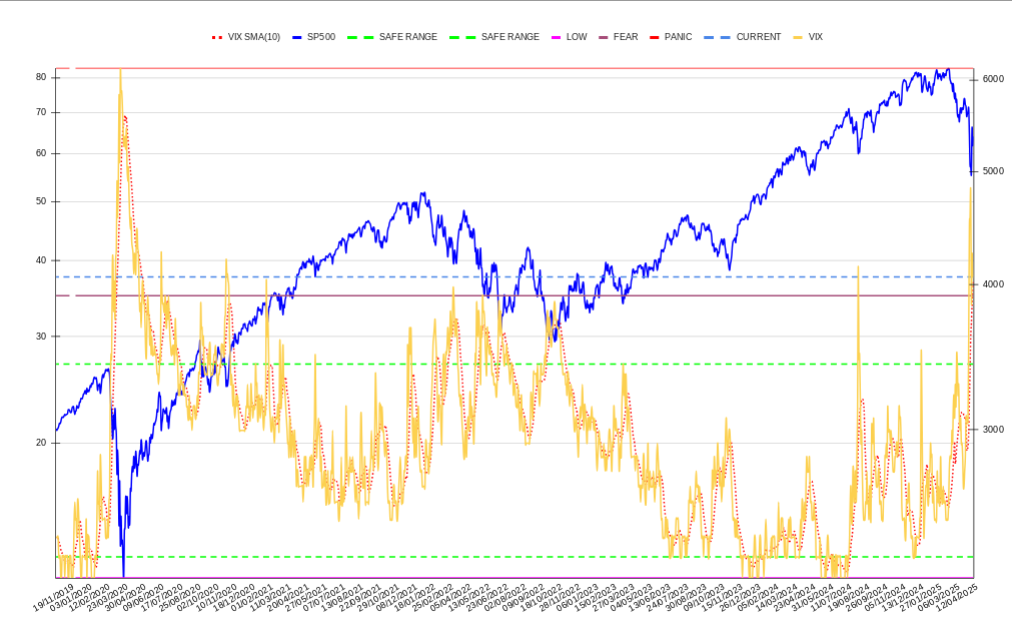

Market Timing with VIX

Video: Macroeconomic and geopolitical outlook

(click underlined text to see video)

The financial markets have recently undergone a significant shift in their outlook for the United States and the rest of the world following the election of Donald Trump in November. This article delves into the underlying reasons for this change, the potential impacts on the global economy, and the strategies that Europe and other economies might adopt in response to these challenges.

Report: US tariffs – a first de-escalation

(click underlined text to read report)

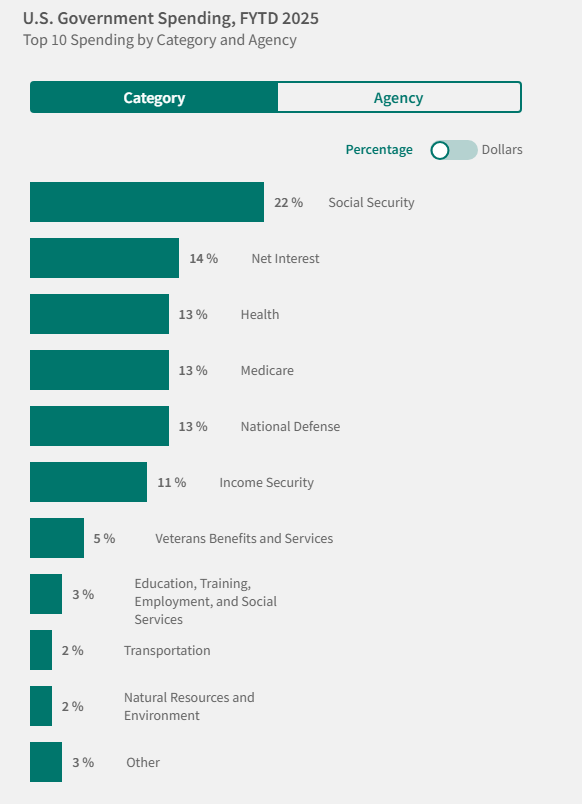

US President de-escalates tariffs: On 9 April, Donald Trump ordered that the higher ‘reciprocal’ tariffs would be paused for 90 days, and a 10% minimum blanket tariff would be applied instead. There is an exception for China that now has an even higher 125% tariff, while Canada and Mexico still face 25% tariffs on goods that are not covered by the existing USMCA. The 25% tariffs on autos, steel, and aluminium are also left in place.

It is key that US Treasury Secretary Scott Bessent is now intimately involved with tariff negotiations – it has been stated that Bessent will lead trade negotiations with Japan. This has served to reassure financial markets, implying that some of the most experienced members of the Trump administration are now closely involved in driving trade policy.

Another View on Market Timing Amidst Volatile Markets

First, I should apologise for not writing anything last weekend. Frankly, with the day job it was exhausting to constantly respond to questions about the economic outlook and conclusions for financial market investments. So I decided to take last weekend off…

In this week’s article, I want to look at a very useful market timing indicator at times when financial markets are very volatile, as has been the case since April 2 (President Trump’s so-called “Liberation Day”). For a discussion of the current state of affairs regarding US import tariffs, please read the report linked above.

Everyone is struggling to absorb the short- and long-term implications of the radical shift in US policy since January, when President Trump began his second mandate.

I believe that there are tectonic shifts in a number of longstanding trends in progress, many of which were already starting to shift even prior to January. But…