Where is the market strength today?

The leading market in the world, the tech-heavy Nasdaq index, has continued to consolidate lower after its 75% run-up from the late March lows. Technology is a tricky sector to invest in right now, as the momentum stocks like Tesla, Amazon and Microsoft continue to show weakness in the short-term.

I think Technology is probably still a good place to invest for the long-term, if you can find pockets of “value”, however you choose to define that in a high-growth technology stock.

However, this consolidation of technology momentum might take some time still, so it might instead be worth looking elsewhere for pockets of strength in global stock markets. But where are they?

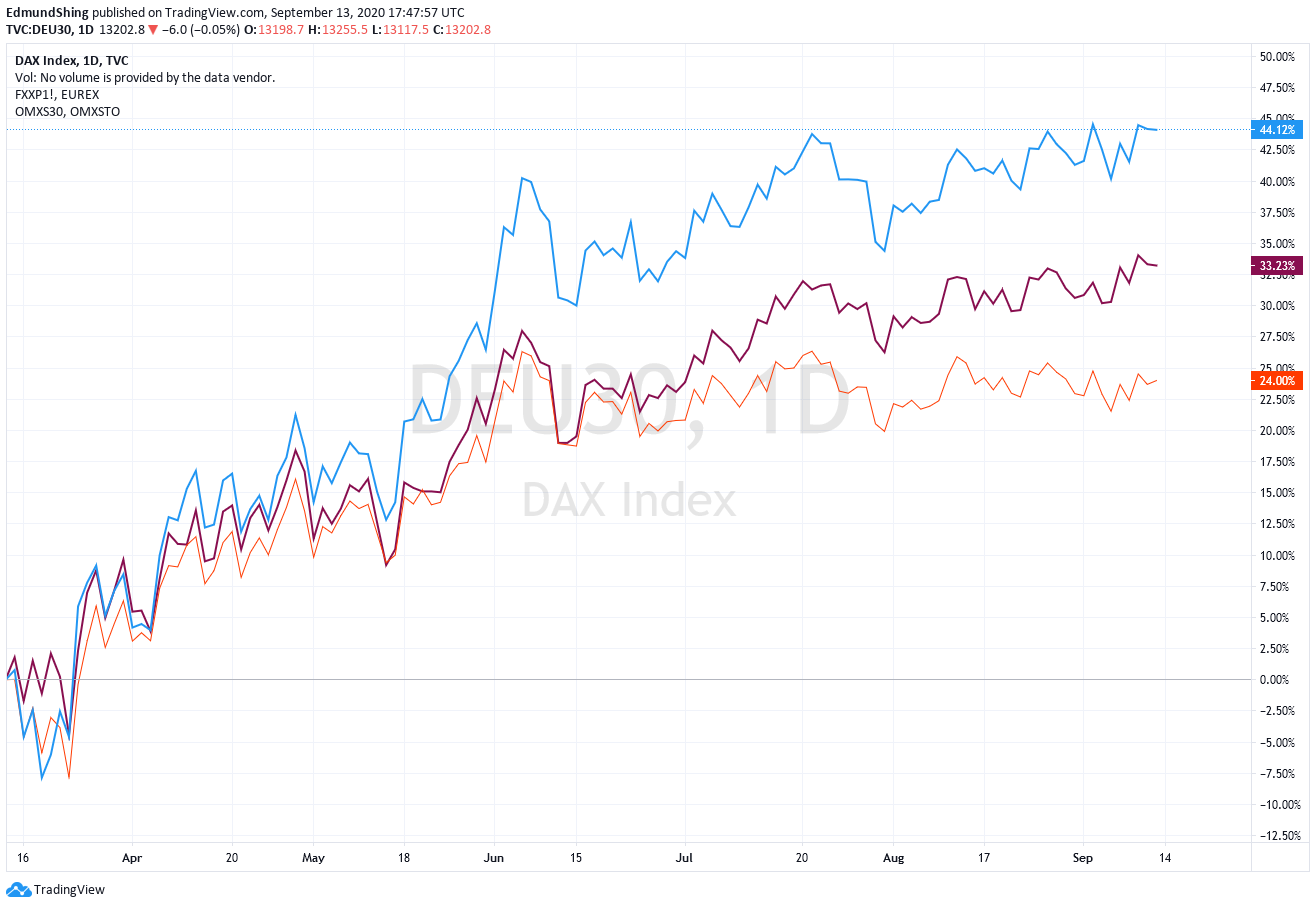

Country indices: Germany, Sweden lead the way in Europe

At a country level, the strongest stock markets from a momentum standpoint remain the German DAX index (in blue) and the Swedish OMX index (in purple). Both continue to mark a strong recovery from the March lows, powered ahead by the strong industrial cyclical sector exposure.

DAX and OMX 30 indices are clearly outperforming the rest of Europe

In the UK, one can buy exposure to the DAX index via the XDAX ETF (in GBP), an Xtrackers ETF that carries a very low annual expense ratio of just 0.09%.

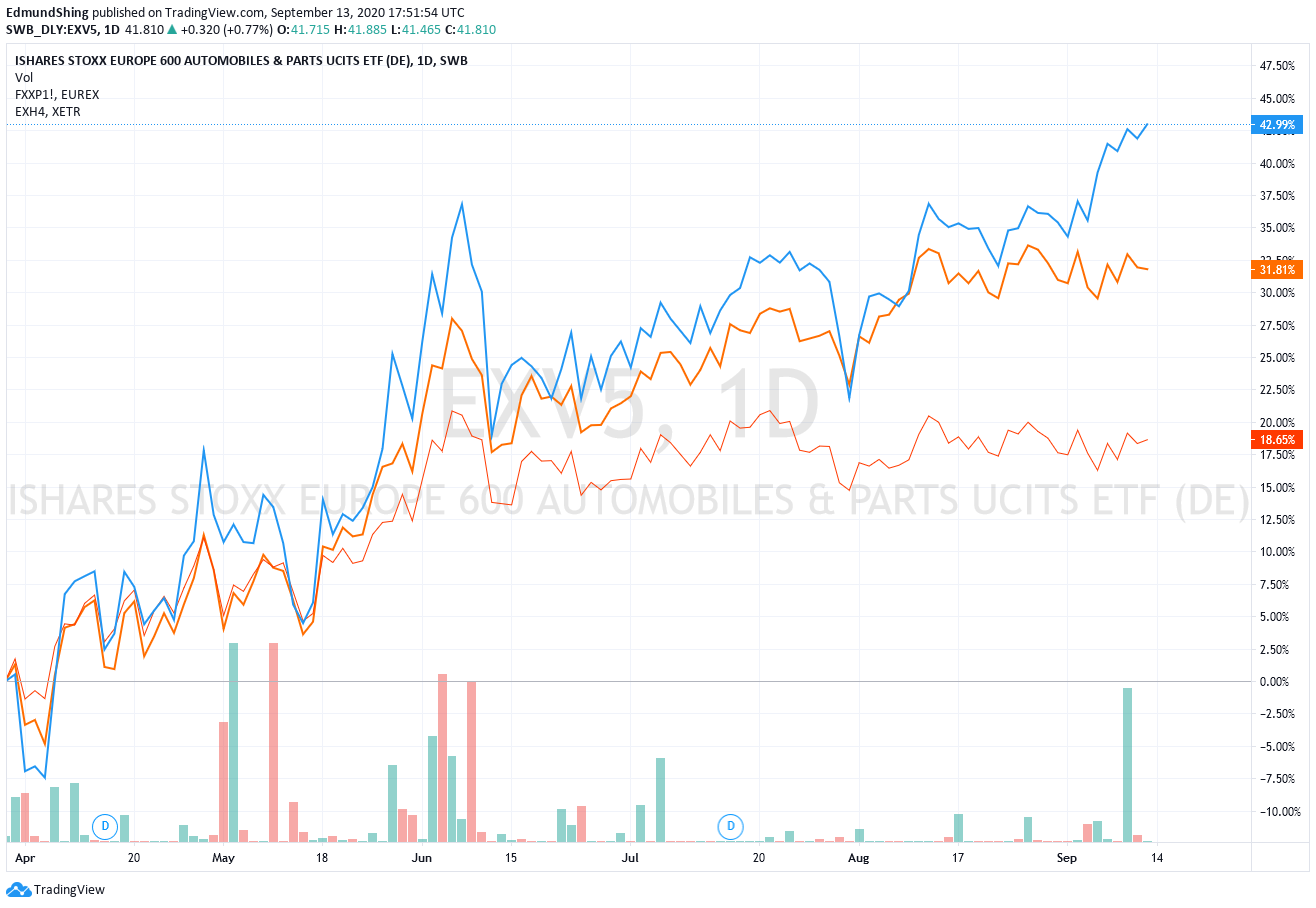

Sector indices: Autos, Industrial Goods, Chemicals

As I said, these two stock markets are dominated by industrial cyclical sectors, including Autos and Capital Goods. Unsurprisingly then, these two European sectors (Autos in blue, Industrial Goods & Services in orange) have outstripped the STOXX Europe benchmark index substantially since March.

Autos and Industrial Goods & Services sectors lead in Europe

At a stock level, the Autos company with the strongest price momentum is Daimler in Germany, while the strongest momentum in Industrial Goods & Services can be found currently in PostNL in the Netherlands and Deutsche Post in logistics, and Luceco (LON:LUCE) in the UK in LED lighting.

iShares offer sector ETFs that replicate the main STOXX Europe Autos sector (EXV5) and the STOXX Industrial Goods & Services sector (EXH4), both quoted in euros and listed in Germany.

But in actual fact, the European sector with the strongest momentum at present is neither of these, but the Chemicals sector…