Market Musings 140226: Continued Rotation to Cyclicals from Tech

Podcast this week:

Our Investment Strategy for February 2026 (click on link to listen)

1 Continued breakdown in US mega-cap tech

As estimates rise for AI/data centre investment spending by US hyperscalers (including Oracle) to over $650bn for this year - far in excess of the huge amount already spent in 2025 - concerns rise over the rise in debt funding necessary and the long-term profitability to come from this massive wave of investment.

Breakdown in Mag 7 momentum

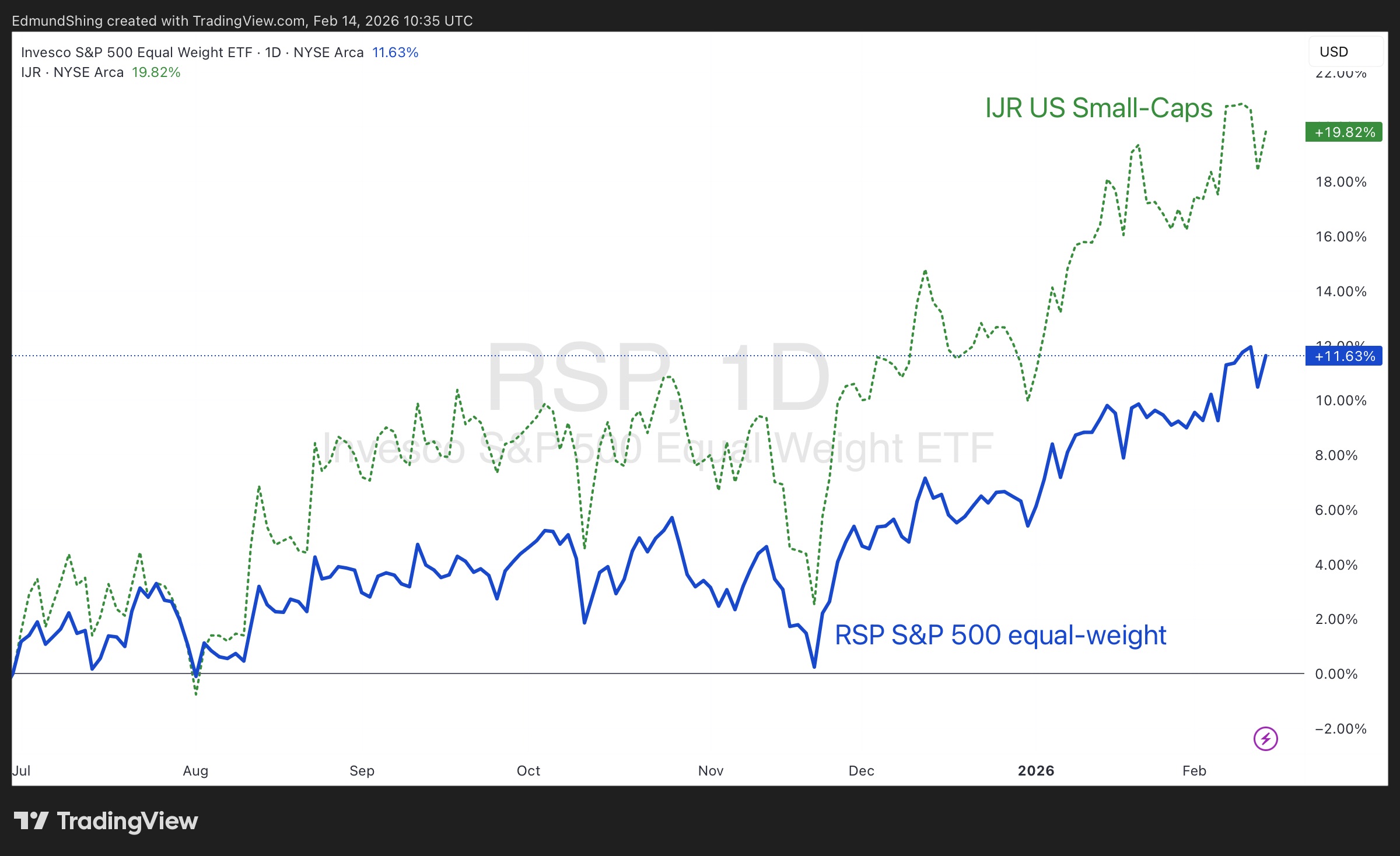

2 Rotation in US stocks to Equal-Weight S&P 500, Small-Caps

With under-performance of the US mega-cap tech and software stocks comes a rotation in performance towards other sectors and small-cap segments of the US stock market. The equal-weight version of the S&P 500 index is outperforming its classic market cap-weighted version given its broader diversification and lower weighting to Tech. Note that over time, equal-weight indices typically outperform their cap-weighted cousins by 0.5%-1%,but that this has not been true over the last few years in the case of the US.

US Leadership moves to rest of S&P 500, Small-Caps

3 Despite the recent correction , commodity-related themes still show strong momentum

While gold, silver, copper and uranium have all suffered price corrections since January 28, they remain in solid long-term uptrends.

My favourite commodity-related themes remain the following:

Industrial metals such as copper,aluminium and tin and associated miners.

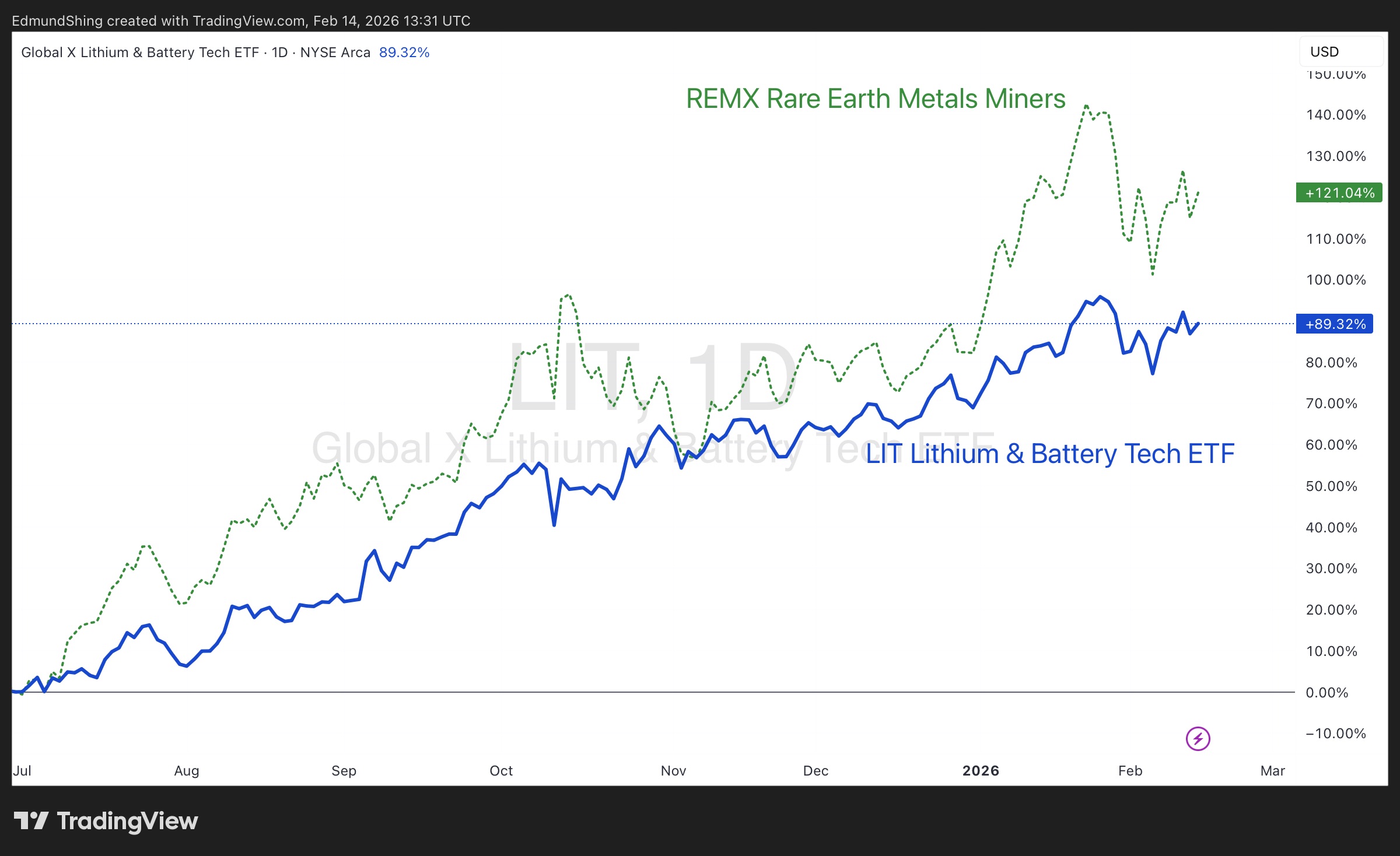

Lithium and rare earth metals

Agribusiness and fertiliser exposure

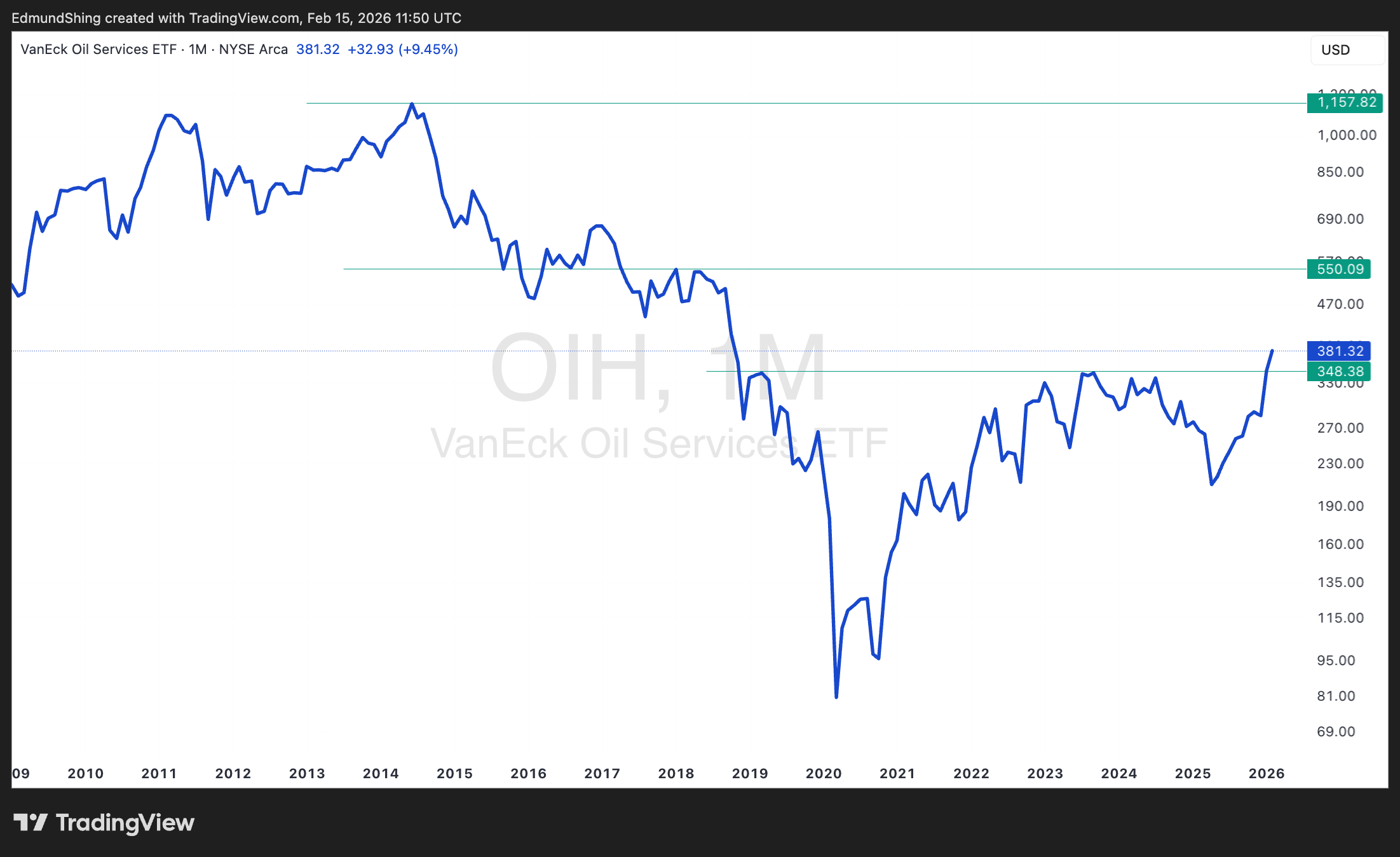

Oil & Gas, specifically Canadian and European oil majors and global oil services

Rare Earth, Lithium miners remain in uptrend despite correction

Oil Services Break out despite weak oil price

But could go a lot further given the scale of long-term under-performance

Agribusiness and fertilisers are the latest to ride the commodities bull cycle

Global miners, junior…