Market Musings 15/01/22:

Echoes of Y2K: the dot-com bubble

Recent podcasts that might interest you:

Summary:

- The behaviour of US retail investors, the mini-bubbles and busts in certain segments of the technology sector and “meme” stocks, and the rampant over-valuations evident in many non-profitable thematic stocks have echoes of the year 2000 and its Technology “dot-com” bubble and bust.

- There is an eerie parallel between the Nasdaq Composite index in 2000, and the behaviour of the ARK Innovation ETF and non-profitable US tech stocks today

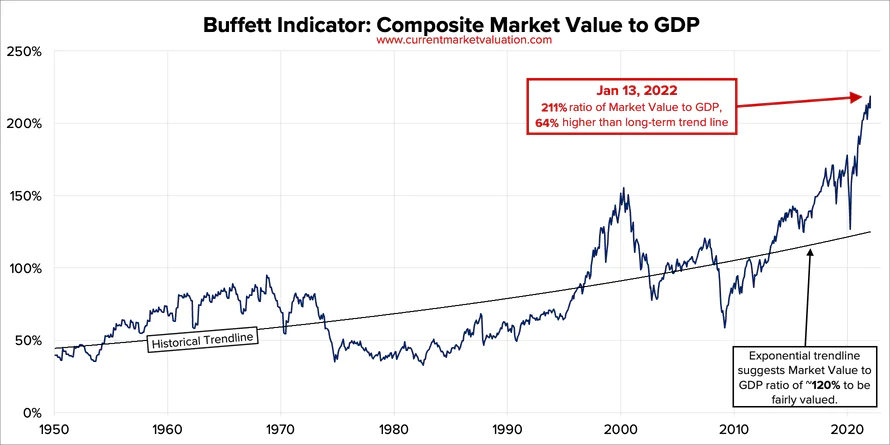

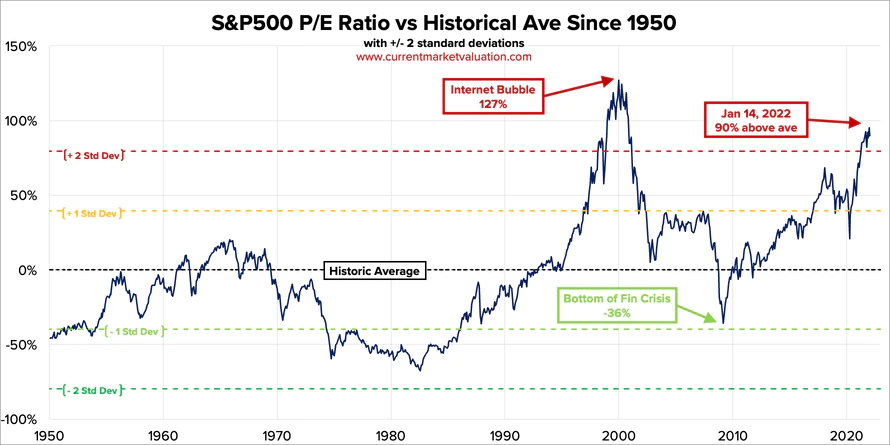

- Now, as in 2000, US stock market valuations are extremely rich by historical standards.

- Now, as in 2000, the retail investor has become a driving force behind these hyped sectors of the stock market, aided by easy access to trading apps such as Robinhood for millennials who have no memory of Y2K.

- But clearly, not everything is the same - history rhymes, but does not repeat. Technology is far more dominant in our everyday lives today than 21 years ago - the smartphone (a pocket computer in essence) is proof of that.

- The good news (so far) is that many overhyped areas of the stock market have already deflated substantially, without taking the overall stock market down with it.

- The year 2000 was the trigger for economic recession in 2001, followed by the 9/11 shock that led to a further leg down in the US economy. In contrast, this time, we still expect strong economic growth in 2022.

- The value style is performing well of late - if the 2000 experience is anything to go by, small-cap value could have a great time for the next few years.

Meme stocks and the dot-com bubble

We all know that stocks have received huge inflows over 2021 from retail investors, particularly in the US. We have heard the mantra TINA - there is no alternative - many times to explain the popularity of stocks today, at a time when cash and bonds are relatively unattractive in terms of their yield.

On top of that, we also know that younger investors have been attracted to stock investing by the ease of investing via Apps such as Robin Hood. So I suppose that it should come as no surprise to see that retail investing, particularly in the States, has become a driving force behind many elements of the stock markets,…