Market Musings 150523:

Stock markets in holding pattern

No big moves last week - waiting for a decisive move either way

Summary:

US recession seems to be delayed for now, given surprising US economic strength

Japanese stocks continue to perform well, particularly on currency-hedged basis

German DAX index close to an all-time high

Contrarians may consider the Energy sector, as crude oil prices may be bottoming

Gold’s long-term chart still looks appealing, with gold resisting well close to its highs

Monthly Video (<5 minutes):

Investment Strategy Focus for May 2023

1.Surprising global economic strength: while several indicators point to future recession, current economic activity remains resilient. Services reflect a robust consumer, given strong employment and wage growth. Any recession may be delayed by this growth rebound.

2.Leading inflation indicators suggest cooling inflation: prices paid components of latest surveys point to lower inflation pressures, employment markets start to cool and energy prices fall. Inflation could fall quickly from here.

3.Euro, gold benefit from US dollar weakness: Euro returns to USD1.10 while gold is hovering at around USD2000/ounce. The last Fed rate hike to come in May? We upgrade our 12-month EUR/USD forecast to USD1.15 per 1 euro.

4.Q1 corporate results hold up well: stronger pricing power is a key feature of quarterly corporate results, especially in Europe. The robust Q1 results season comfort our regional preference for Europe, UK stocks.

5.Pain trade is in Banks: major uncertainty remains over US regional banks, underlined by continued deposit flight concerns. However, investors may have overestimated the immediate risks to the US and European banking sectors. We favour European financials.

What I am focusing on, now

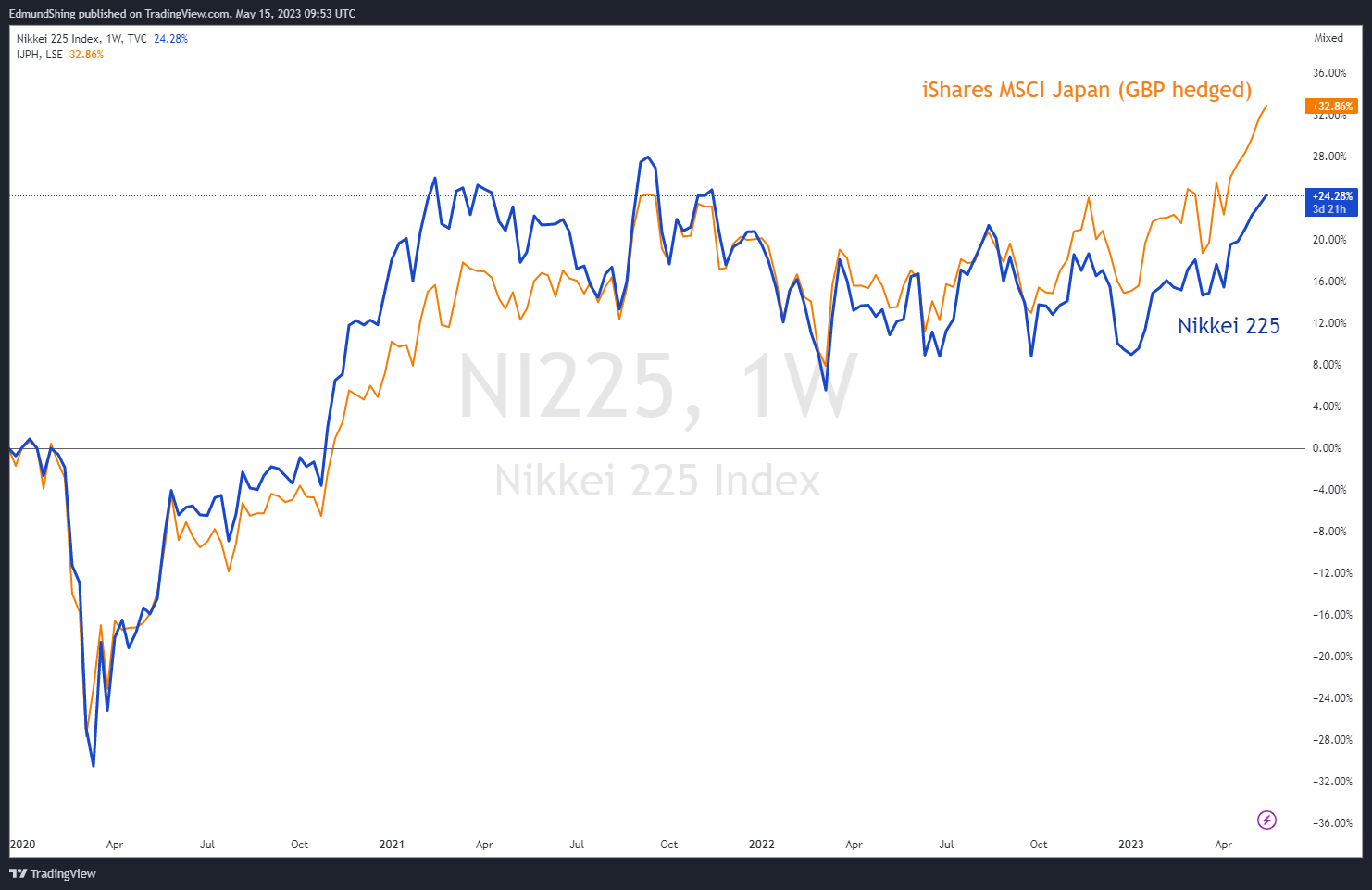

Japanese equities still strong, reflecting improving profitability

The GBP-hedged ETF avoids the pain of a weakening Yen for foreign investors

Source: tradingview.com

German DAX, French CAC 40 indices still lead the way in Europe

DAX is now very close to a new all-time high, as recently achieved by the CAC 40

Source: tradingview.com

Brent crude oil close to bottoming?

Remember that seasonal oil demand should recover prior to US driving season (summer)