Market Musings 16/04/22:

Unpicking the Inflation and Recession Narratives

Weekly Summary:

- Inflation remains high, but should start to decline very soon

- Consumer demand is already cooling off fast, online in particular

- Inventories are back to normal, supply chain shortages are less evident

- Food & Energy pressures other consumer spending, but US gasoline prices ease

- Commodities remain very well placed given the lack of investment growth

- Recession can still be avoided despite gloomy business surveys

- US & European employment at pre-pandemic highs, supporting consumption

- Company and household finances still in good health, loan growth decent

- Housing construction activity still robust, a key economic sector

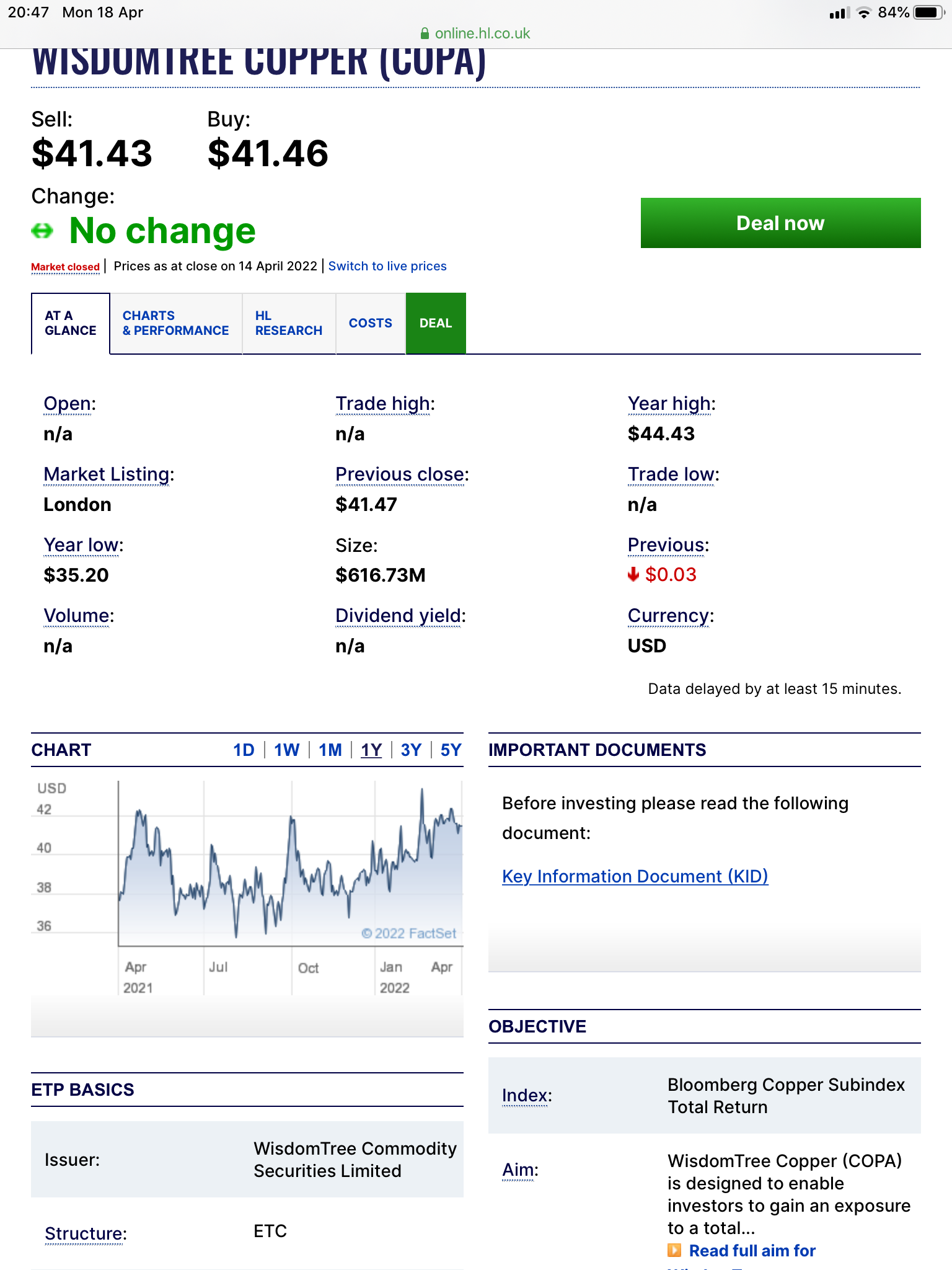

- Idea of the week: COPG Global Copper Miners ETF

Key Market Narratives

What narratives dominate the financial markets today?

1. Inflation is rampant, triggered by scarce supply of goods, strong demand and restricted supply of key commodities in energy, foods and metals.

2. The probability of economic recession is high. Growth is slowing due both to the combination of rising financing costs (making credit more expensive for financing growth investments) and to high inflation reducing consumer spending on non-essentials.

Inflation is rampant, but is it finally peaking?

Back to preferring experiences over stuff: The COVID-boosted demand for goods is finally fading as economies (ex-China) fully re-open. Consumers are being put off by the abnormally high price for all manner of physical products, and in any case, prefer experiences over stuff.

Consumer goods demand peaked in April 2021: If we exclude the effect of price, and just concentrate on the underlying volume of retail sales, we can see that the peak in the buying of stuff occurred back in April last year in the UK, Europe and the US.

UK retail sales volumes peaked a year ago

Source: UK Office for National Statistics

Plenty of stuff on store shelves now: There is plenty of stuff on the shelves now, with retail inventories back above where they were pre-pandemic lockdowns.

US retail inventories back above 2020 pre-pandemic levels

Source: St Louis Fed

The combination of weaker demand for goods, combined with the plentiful supply of goods on shop shelves today, should eventually bring down goods price inflation. However, this will take some time, as the high cost of energy used in the manufacture and transportation of goods is still being passed through to the final consumer.

More spending on essentials means…