Market Musings 16/10/21:

Consider the ultimate stock rotation:

Tech to Commodities

Recent podcasts you may care to listen to:

Recent reports you may be interested to peruse:

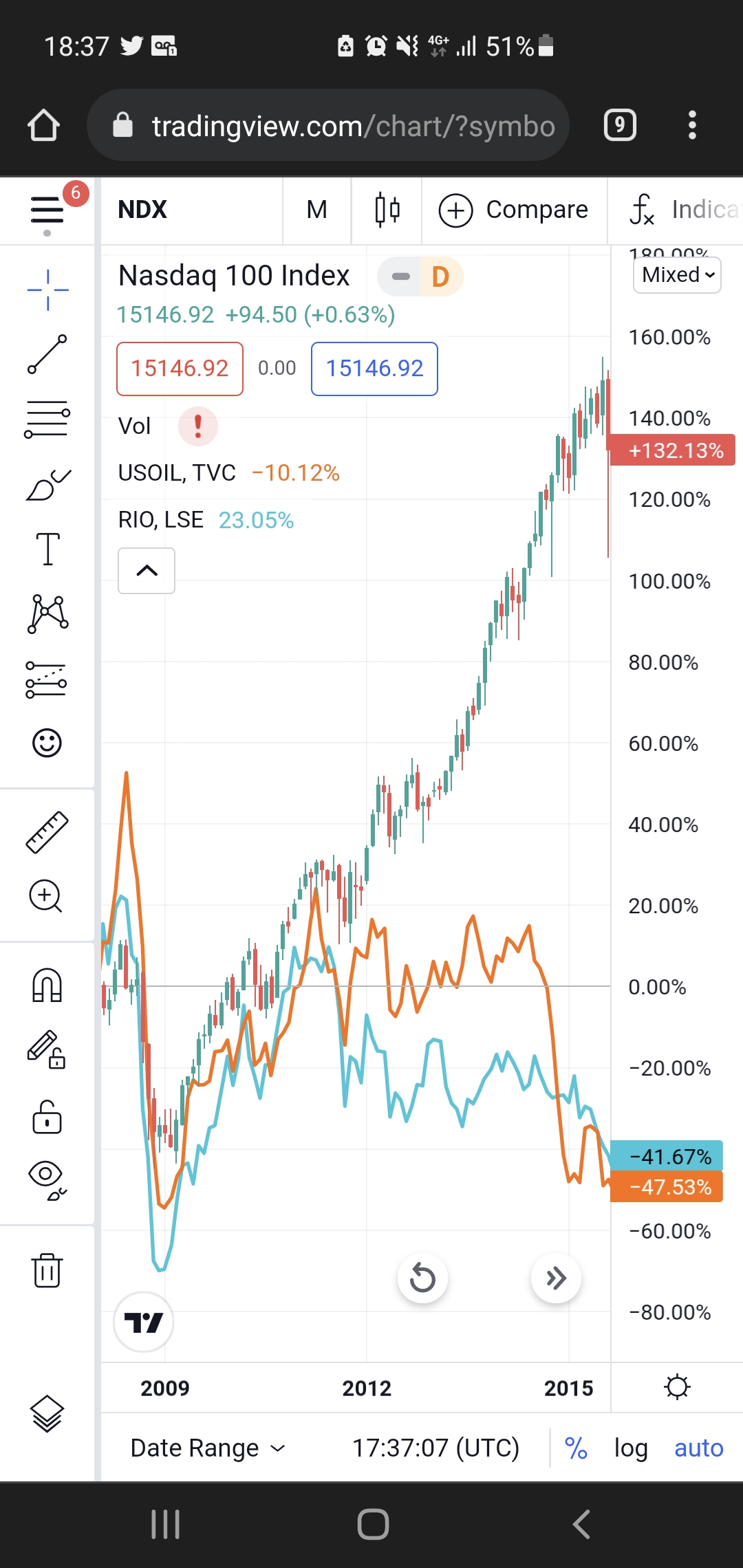

Commodities have been a terrible investment since 2008

Quite clearly looking at the chart below, commodities have been a terrible investment since the middle of 2008, falling 75% over these 12 years. So why should we consider investing in commodities today?

Commodities have been an awful investment from 2008 to 2020

Source: BNP Paribas, Bloomberg

Well as I like to say, every dog has its day. Just as I believe that cyclical value stock indices such as the UK stock market will be a long-term winner from here, I also believe that this will continue to be the case for the commodities asset class.

Since early 2020 in the depths of the COVID-19 pandemic, the Bloomberg commodity index has already recovered some 72%. But we also know that from 1999, commodity prices tripled to their peak in mid-2008. If we were to see a similar recovery in commodity prices today, that would suggest that we still have a very long way to go.

Metals are on a roll

With all the worries about supply chains and provision of inputs from manufacturing and services, one of the bottlenecks is evidently commodity production. This is exactly why today we not only see an exponential rise in energy prices (crude oil and natural gas), but also a set of multi-year highs in a number of base metals including nickel, aluminium, copper, and tin. It is therefore unsurprising to see that the LMEX index of 6 major tradable metals has indeed surpassed its early 2000 peak to reach new highs as of today.

LMEX major metals index hits a new all-time high

Source: BNP Paribas, Bloomberg.

Note: LMEX index includes copper, nickel, zinc, aluminium, lead, tin

Ultimately, we are presented today with the combination of a) strong rebound in demand post pandemic and lockdowns, combined with b) the difficulties of companies to invest in new production to satisfy this growth in demand. Added to this of course, logistics problems both in shipping and trucking only make these issues more acute in the short-term.

But the…