Market Musings 170525:

Soft v Hard US data, an energy tailwind, Infrastructure shines

Podcast:

Switzerland: navigating the consequences of risk aversion

(click link in title to listen)

Is the US stock market pricing in too rosy an economic outlook?

I want to talk today about the potential disconnect between the stock market rebound on the one hand and the risk to US economic growth slowing down on the other, and finish with a little commentary on what I find very interesting and possibly underappreciated asset class which is performing well at the moment, namely infrastructure.

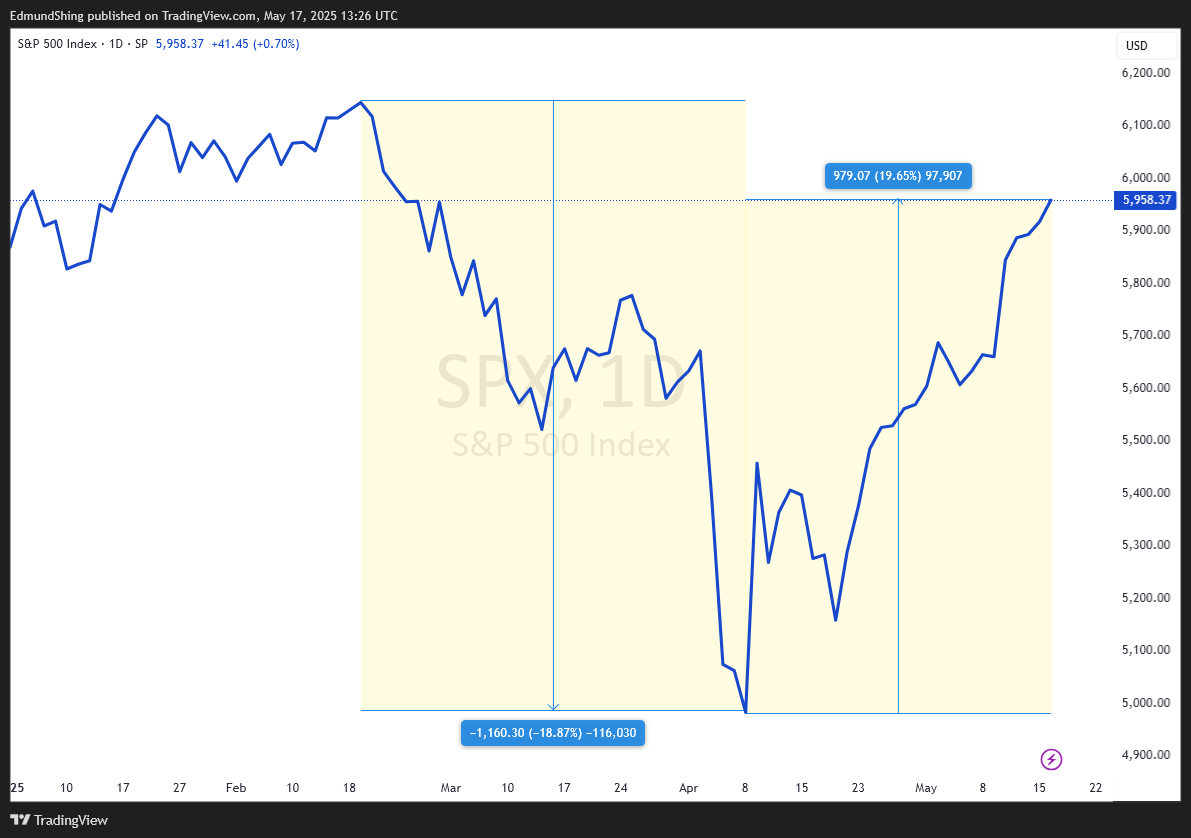

To start, over the last month or so, we've seen clearly a very big relief rebound unfolding in the stock market, not only in Europe but particularly in the US. Remember that the S&P 500 index from peak had fallen by 20% in the aftermath of the April 2nd reciprocal tariff announcement by Donald Trump to the recent lows. It has now rebounded by 20% from that low point over the last few weeks.

S&P 500 index now +2% year to date in US dollars (but still down substantially in euros or pounds)

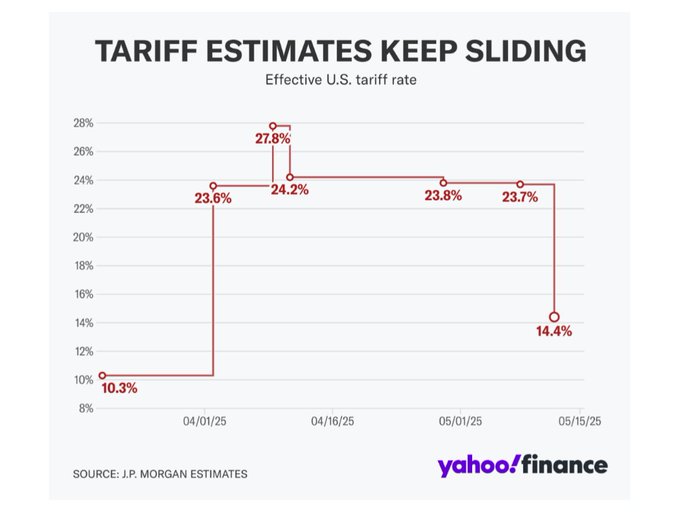

This implies in my view no long-lasting damage to the US economy from these higher tariffs and from the uncertainty unveiled by Donald Trump. Donald Trump has since stepped back from the brink, particularly with trade deals starting to be unveiled notably so far with the UK, but with others likely following very shortly. But most importantly, trump also stepped back in terms of the tariffs being levied on Chinese exports, with a 90-day agreement to lower the US tariff from 145% on Chinese exports to the US now to 30%,. The Chinese have in return lowered their tariff level on US exports to China to 10%.

Nevertheless, even with this 30% level on Chinese exports to the US, the US tariff level overall on goods imports is going to average something over 14%, up from below 3% before Trump's second mandate began in January. This constitutes a big extra tax on US consumption whichever way you look at it, certainly looking at the goods sector.

If we look at the economic side of the picture, surveys do not reflect this very sanguine outlook on the US economy. In…