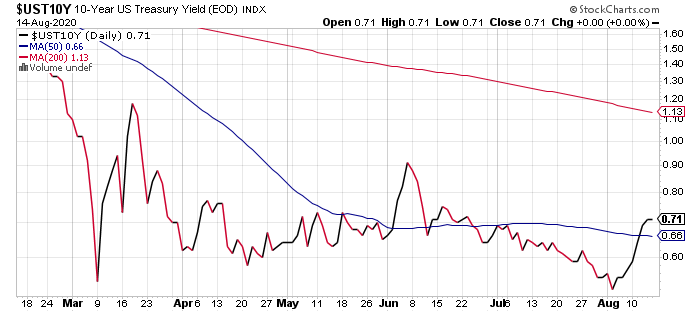

Bonds defy their usual seasonal pattern

Over the last week, sovereign bonds in the US and Europe have been falling, reflecting rising long-term yields as the US 10-year bond yield has climbed back from a 0.50% low in early August, to 0.69% currently. This is still, however, a very far cry from 1.9% yield that 10-year US Treasuries offered at the beginning of this year.

August bounce in US Treasury yields

This movement higher is entirely due to the repricing higher of long-term inflation expectations; from a 1.4-1.5% range for the expected US medium-term (5-year) inflation rate between April and June, a 1.73% inflation rate is now expected, driving nominal bond yields higher.

A similar movement can be found in UK and European bond yields too, with the UK 10-year gilt yield now standing at 0.24% versus under 0.1% in early August.

The real question is this: Is this move the beginning of a bigger move higher in long-term interest rates globally, or merely a short-term blip that does not change the underlying trend of lower yields?

Personally, I do not believe that the recovery in the global economy warrants a sharp repricing of bond yields, as the current recovery remains, in my view, fragile and heavily dependent still on a combination of central bank (Federal Reserve, Bank of England) help through buying of bonds directly, and of government spending to support employment, consumer spending and infrastructure projects.

For this reason, I believe that bond yields will remain marooned at very low levels, condemning savers and long-term investors to hunt elsewhere for any semblance of reasonable income in the future.

This also reinforces my belief that alternative asset classes like precious metals (gold, silver, platinum) and even cryptocurrencies like bitcoin will continue to attract investors, keen to hedge against the rapid pace of paper money creation that continues around the world.

The US Dollar struggles to rally

Tied to this is the fate of the US dollar, the world's de facto reserve currency.

The decline in the US dollar is another trend that i believe will continue in the medium-term, as we lead up to November's Presidential election. The Federal Reserve continues to create US dollars via a rapid expansion of the US money supply, while the US Treasury…