Market Musings 180125: Europe, UK stocks surprisingly hit new highs

Surprise surprise! European and UK stock markets hit a new all-time high this week...

Podcast:

Our Investment Strategy for January 2025

(click on title to access podcast via link)

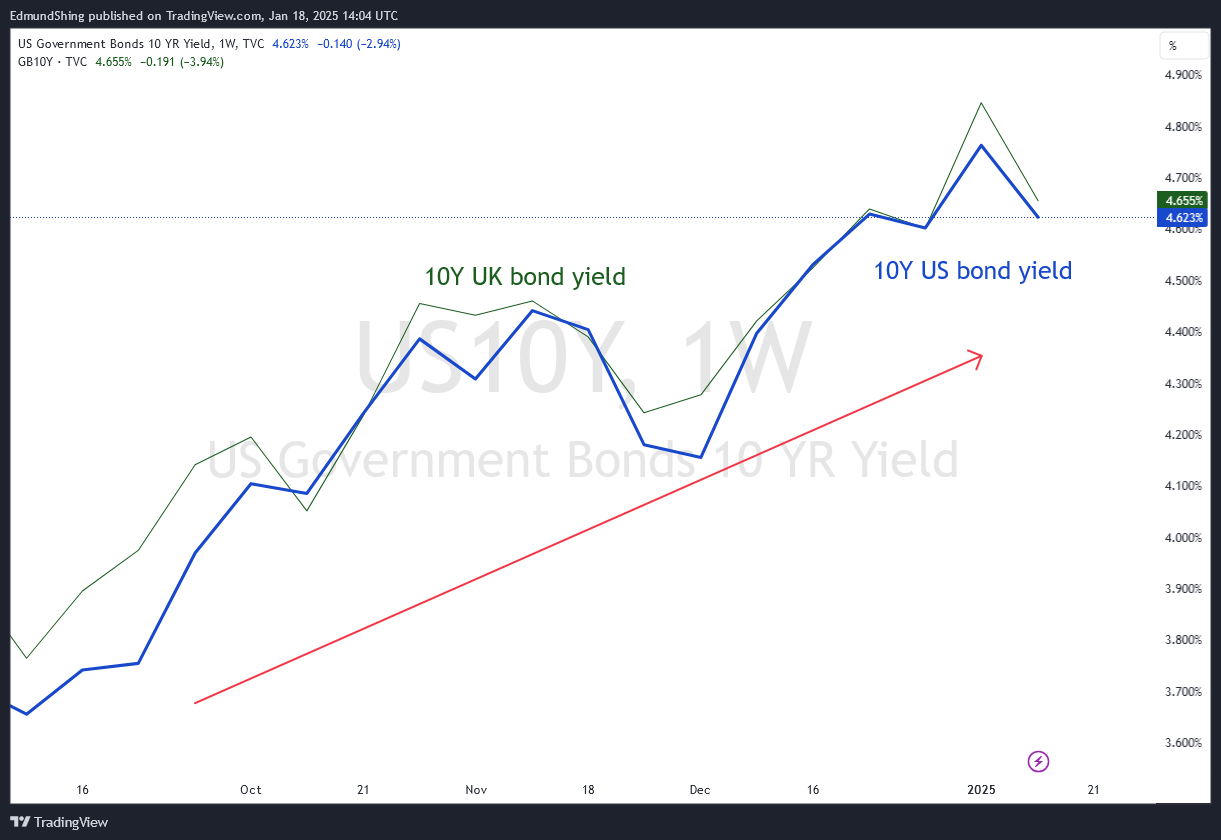

Reversing Trump Trades: Higher long-term US interest rates, stronger US dollar

From late September last year, until a week ago, one of the clear Trump trade winners has been the strength of the US dollar, reinforced by the rise in long term interest rates, ie US Treasury bond yields. The 10 year benchmark.Treasury bond yield had risen from 3.6% at the low in September to touch 4.8% at the beginning of this year, more than 1% higher. We saw a similar reaction in Europe, particularly in the UK, with a similarly sharp rise in the 10 year gilt yield, ie, the UK government bond yield.

So we had a twin movement here, which was driven principally by

- the strength of the US economy,

- the expectations that the arrival of Donald Trump in the White House will reinforce this growth, and

- the potential inflationary impact of Donald Trump's policies, which in turn, have driven interest rates higher.

We should recognize that this is an unusual series of events at a time when the US central bank, the Federal Reserve, has been cutting its benchmark Fed funds rate to 4.5% from a peak at well over 5%.

Usually when the US central bank cuts interest rates, long term interest rates, ie, bond yields, typically fall. However, in this case, the reverse has happened. While the Fed funds rate has been cut, certainly over the last few months, long term interest rates have actually risen.

This is important in the US because it has a number of impacts on certain sectors, most typical, most particularly on the housing sector, where the key source of financing is set according to the 30-year fixed mortgage rate. Typically housing activity is stimulated when this fixed mortgage rate falls below 6.5% but at the moment, given the rise in long term bond yields, the fixed mortgage rate is actually at 7%, which is clearly keeping a…