Market Musings 19/03/22:

What if oil prices hit $200?

Podcasts that might interest you:

What do hot energy markets mean for you?

- Is the conflict solely to blame for rising energy prices, or are there more fundamental reasons?

- Will this oil price spike lead to a recession?

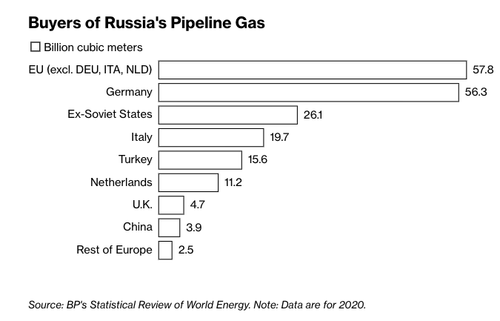

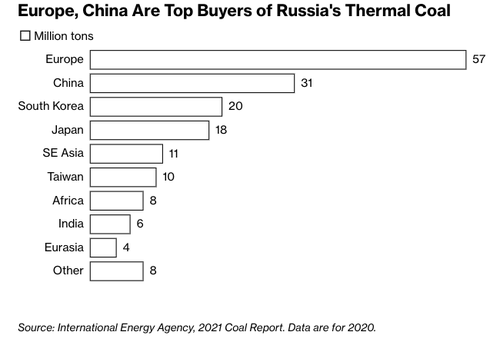

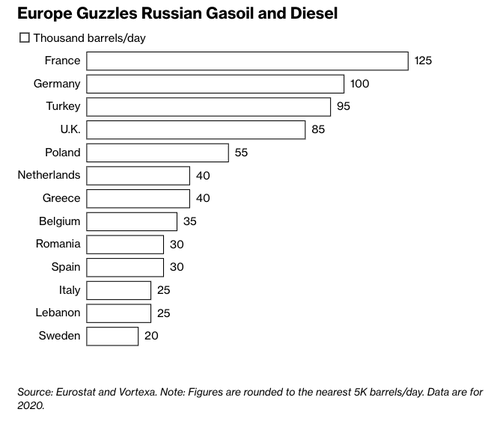

- How dependent is Europe on Russia’s oil and gas?

- Would countries struggle to meet climate change targets if we reduce our dependence on Russian energy?

- How can we invest in the energy space?

Also available in Apple Podcasts, Podcast Addict, Spotify podcast platforms

(search for “BNP Paribas Wealth”)

Weekly Summary:

- Could oil prices really hit $200? What could drive them there?

- Would higher oil prices guarantee a global recession?

- The IEA’s 10 emergency proposals to reduce global oil demand

- What does this mean for alternative energy sources?

- Potential investment opportunities in energy

1. Could oil prices really hit $200?

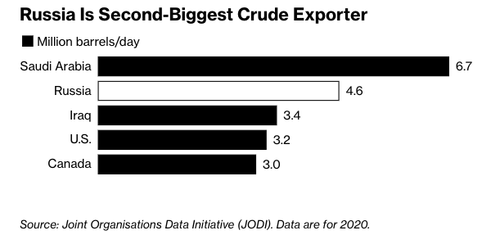

In a recent Odd Lots podcast from Bloomberg, oil hedge fund manager Pierre Andurand suggested a path for crude oil to get to $200 by the end of the year, as historically tight markets struggle to ramp up production and replace lost supply from Russia.

Even if Russia and Ukraine were to agree to a ceasefire right now, Russian oil would not return to international markets in the near term, according to Andurand.

“I don’t think that suddenly they stop fighting, the oil comes back. It’s not going to be the case. The oil’s going to be gone for good”

“We’ll have to live with higher prices to keep demand down, for it to be treated a bit more as a luxury product and also to accelerate the energy transition”

“I feel like there’s no demand destruction at $110 a barrel and we’ll have to go significantly higher before demand can go down by enough”

My first observation is the obvious caveat: one should beware investors who are clearly talking their own book. Andurand’s hedge fund is reputed to have already made a huge return year to date from the surge in oil prices, so he is likely still very long in terms of positioning on crude oil.

But now that I have stated the obvious, let’s examine his assertion.

Even with a modest pullback in the Brent crude oil benchmark price from the $139/barrel high hit on 7 March, oil prices remain a long way above the 2000-2022 average of $65.…