Market Musings 200424: Tech profit-taking, Metals lead

- Podcast: Summarising the current impact of Israel-Gaza-Iran tensions on financial markets

- Report: BNPP WM Equity Focus April 2024

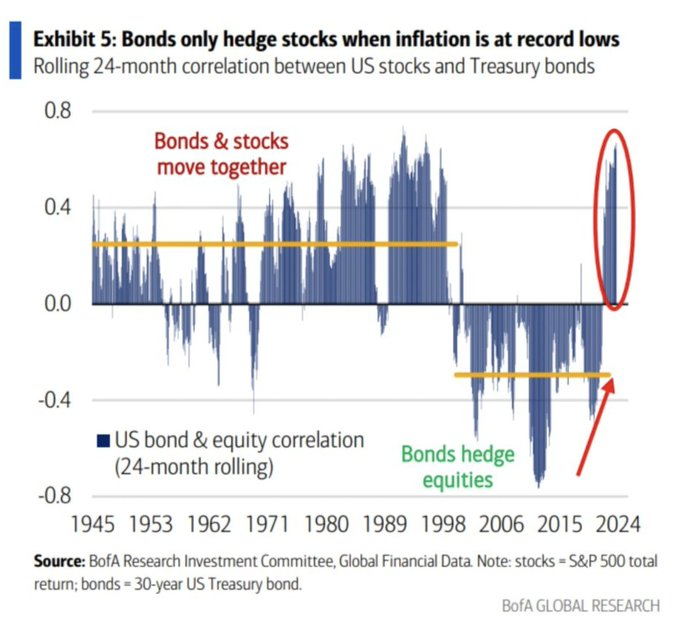

- Don't assume that bonds always hedge stocks... (from Bank of America)

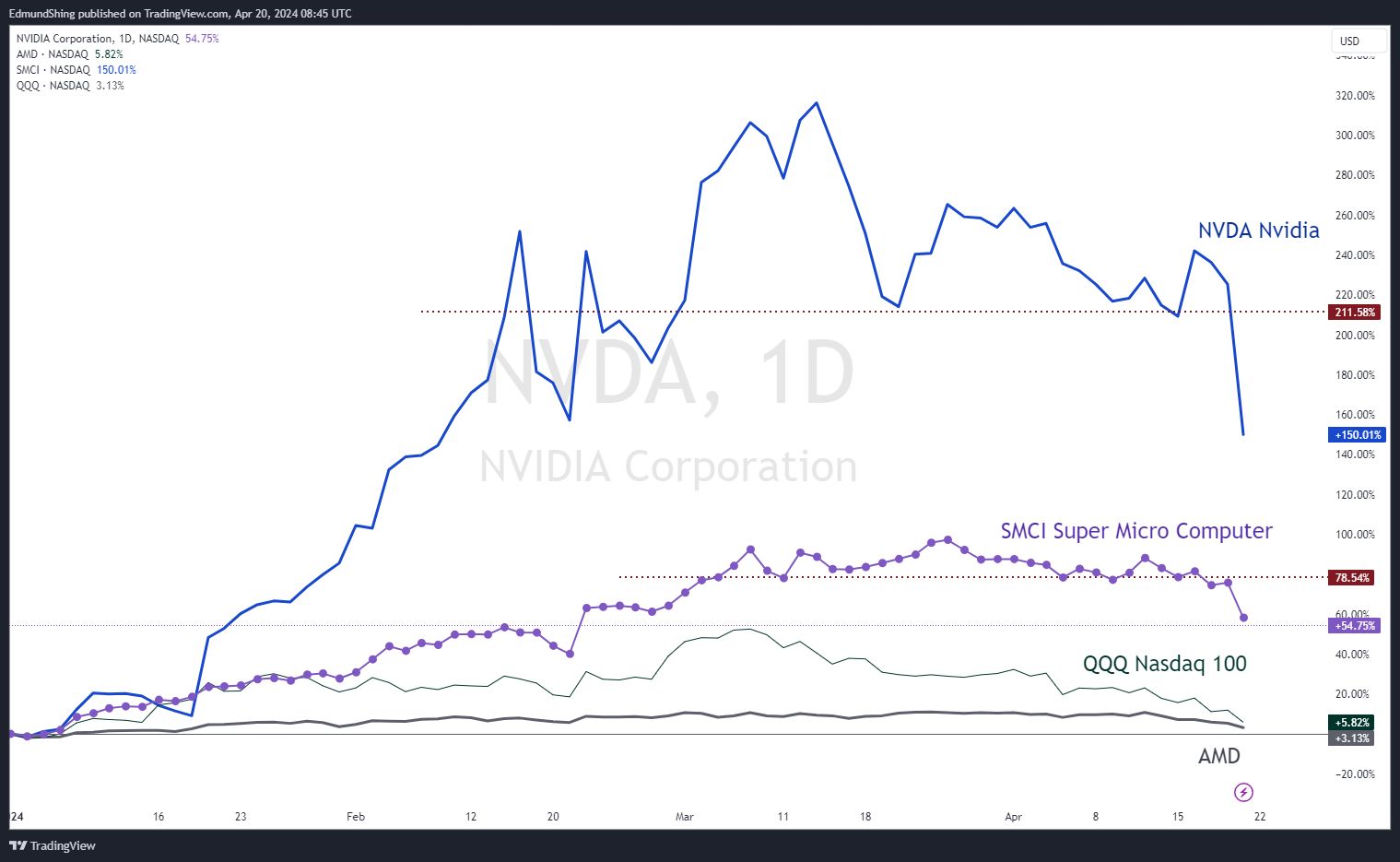

1. US mega-cap tech profit-taking correction finally starts

On Friday, pre-results Nvidia led profit-taking in 2024's high-flying tech names including Super Micro Computer and AMD.

Other tech-related names hard-hit: META Meta and NFLX Netflix.

This leaves the QQQ Nasdaq 100 ETF up less than 6% for the year to date.

Source: tradingview.com

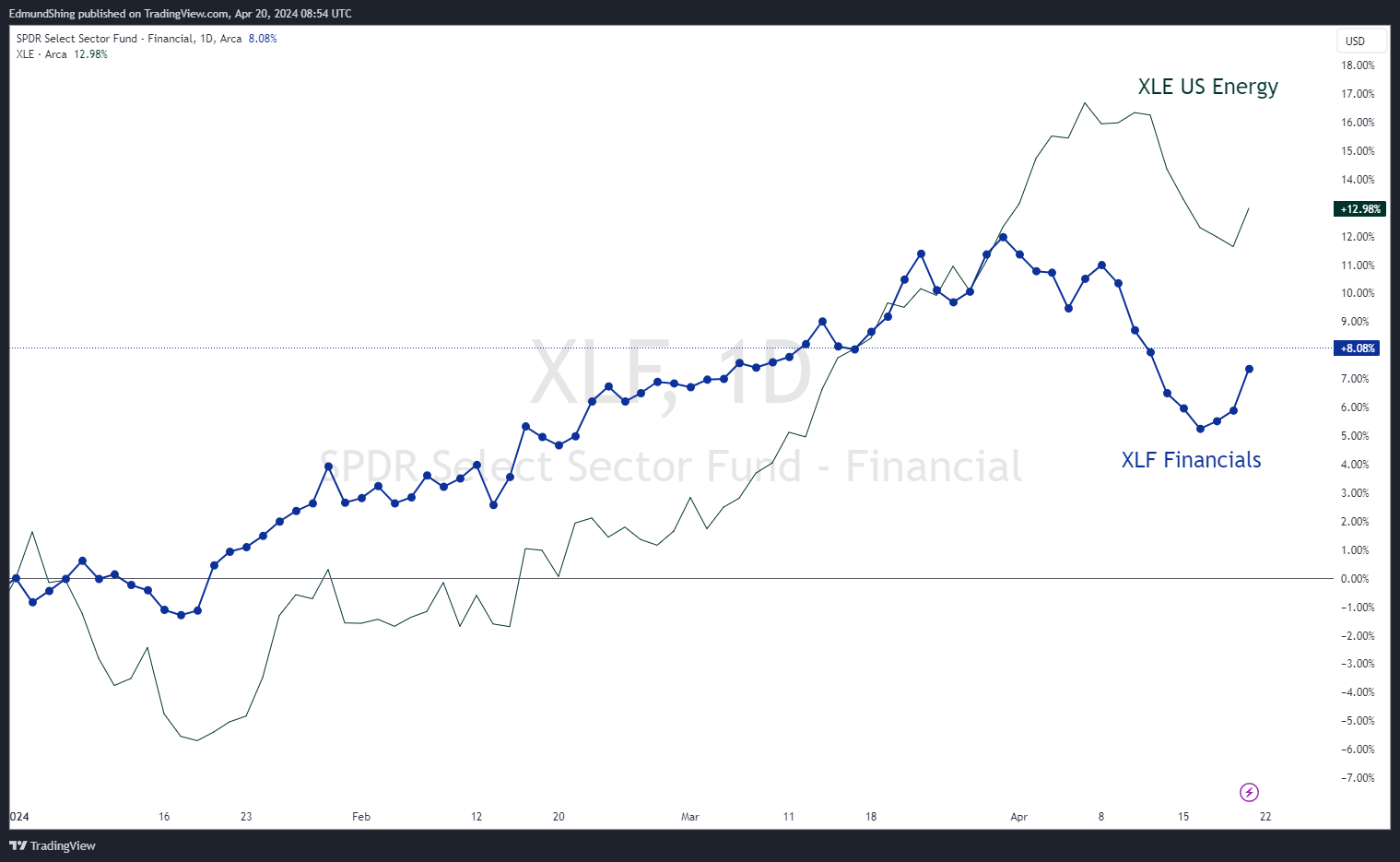

2. In contrast, US value sectors Energy and Financials rose

Despite the Brent crude oil price easing back to $87/barrel post the limited Israeli riposte to the recent Iranian missile and drone strike, XLE Energy rebounded modestly and continues to post strong year-to-date performance at +12%.

XLF Financials (banks + insurance) also rebounded after dipping post poor guidance from banking heavyweight JPM JP Morgan, offset by better results from the likes of GS Goldman Sachs and MS Morgan Stanley.

Source: tradingview.com

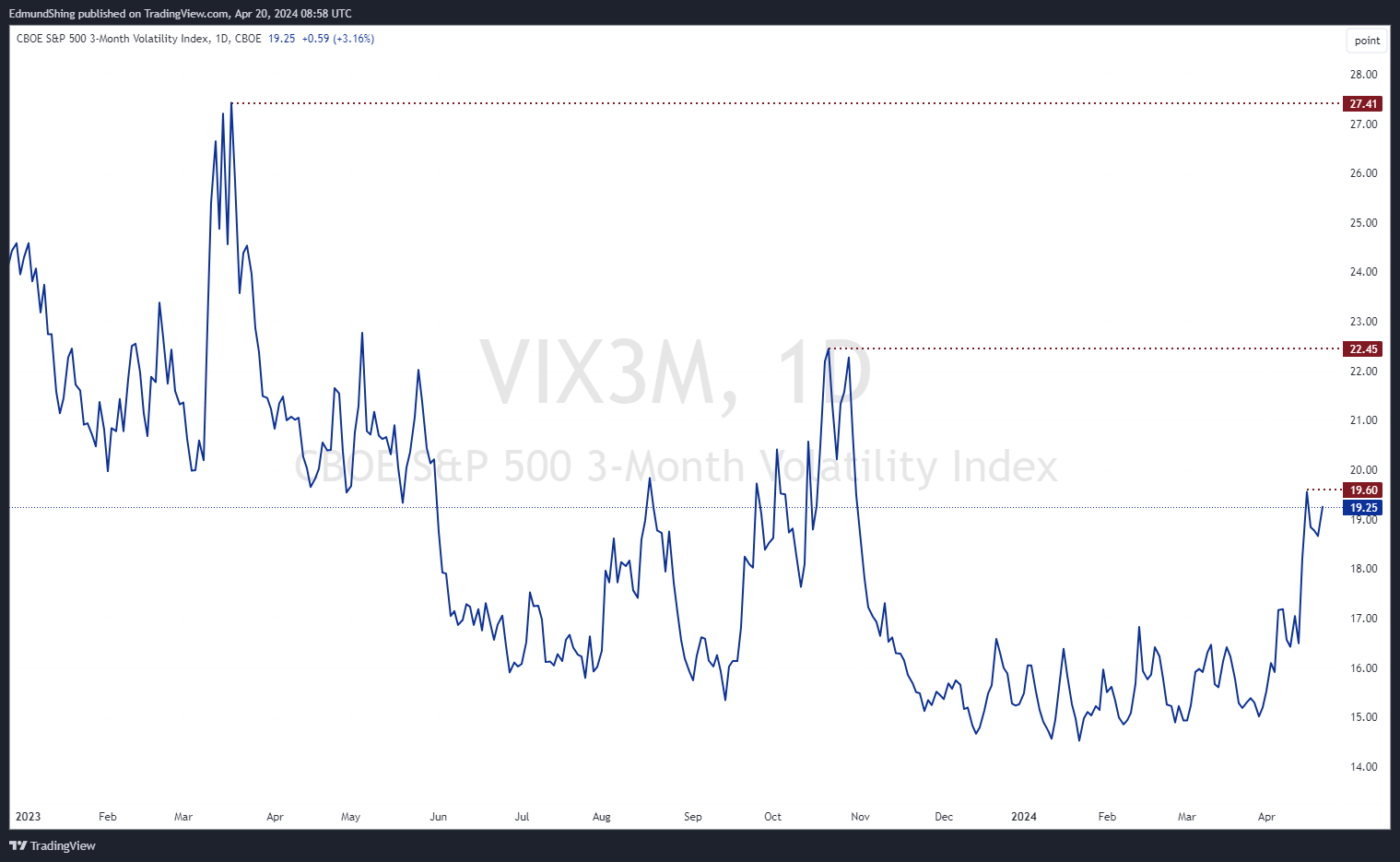

3. The VIX volatility index spikes, but still far below 2023's peaks

The reaction of the US VIX volatility index (misnamed the "fear gauge") highlights the pickup in options activity as investors rush to protect their stock portfolio gains. But the rise in the 3-month VIX index remains far below the peaks seen in 2023.

For context, in early 2022 around the time of the Ukraine invasion, this 3m VIX index spiked to 36, nearly double today's 19 level.

Early days, let's see if the Israel-Iran tensions escalate further in the weeks ahead... But for now, the oil price is pricing a calming of tensions rather than intensification.

Source: tradingview.com

4. As in the US, European banks hold onto their gains

Eurozone banks (BNKE, EXX1) continue to hold onto their sizeable gains at +18% since the start of the year, with Italian banks like UCG Unicredit leading the pack.

In the UK, BARC Barclays has gained 25% over this period, but remains very attractively valued with a 93 Value rank, a P/E of 5.4x and a…