Market Musings 210226:

The HALO Effect Intensifies

Podcast: European Banks: further to go (click on link to listen)

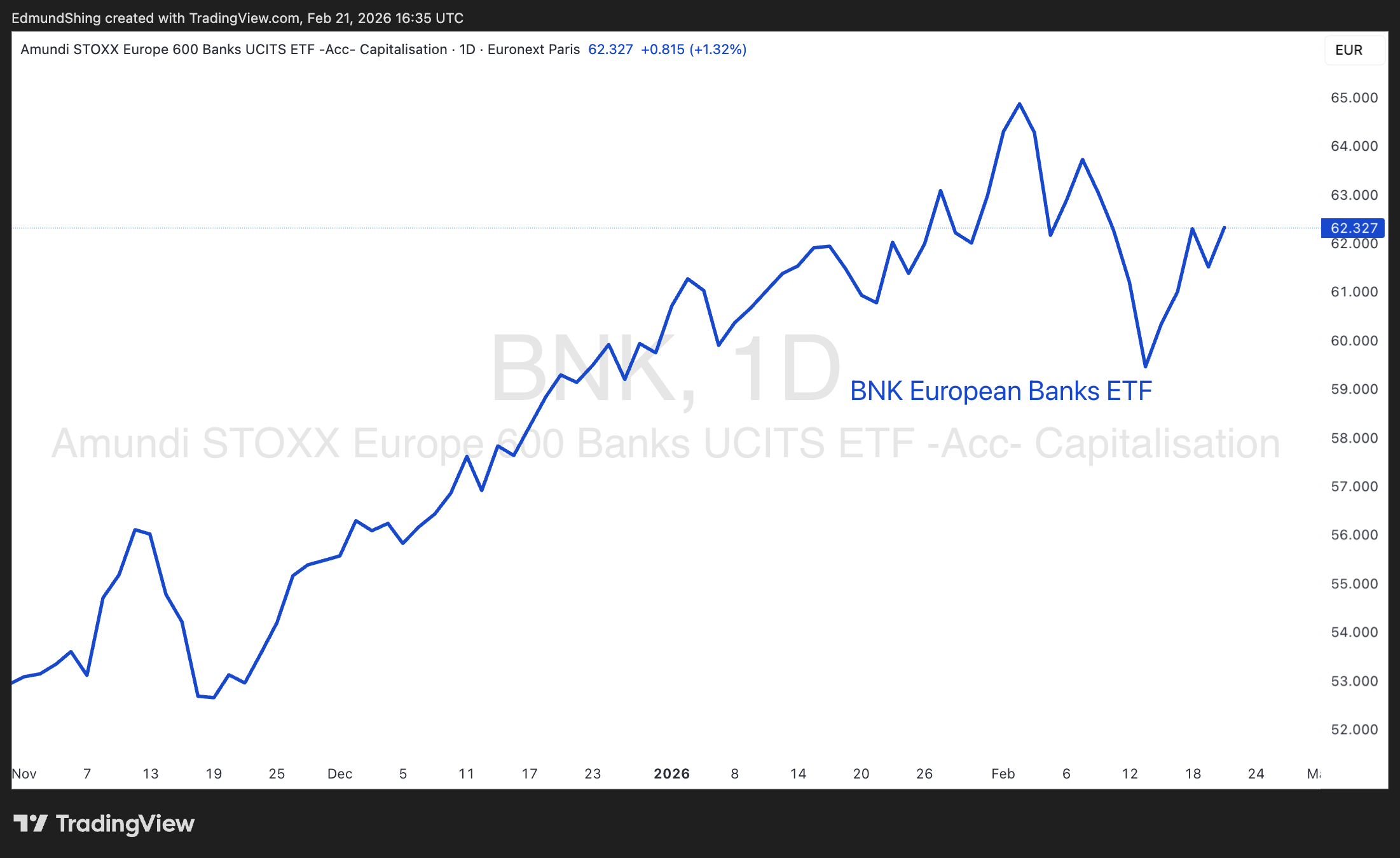

European banks delivered an exceptional stock market performance in 2025, averaging +67% in EUR, far outpacing all other European and American sectors.

What are the outlook and prospects for 2026?

European banks remain undervalued and one of our preferred sectors.

New opportunities and efficiency gains emerge, with limited risks.

Estimated upside potential for the European sector in 2026: +15% on average.

US banks are also healthy, but their appreciation potential is more limited.

Rotation to HALO: Heavy Assets, Low Obsolescence

The prevailing theme in the stock market at present is the rotation away from digital assets back towards physical assets.

With investors increasingly worried about which companies and industries are at risk from disruption from Artificial Intelligence, they have instead begun to favour companies and industries where the risk of AI disruption is low to none.

Sectors such as software and even logistics have suffered from dramatic falls in stock prices following the launch of Anthropic’s Claude Code AI coding agent, which can allow much faster development of custom software applications even potentially by non-programmers, thus posing a threat to the recurrent revenue streams of Software As A System (SAAS) companies. Cybersecurity software companies have been the latest technology subsector to be caught up in these “AI disruption” fears with the recent launch of Claude Code Security, which is aimed at helping programmers detect potential security flaws in their software code during the development phase.

Since November 2025, the IGV US software ETF has fallen 30% on the back of this perceived AI threat to software companies, with even Microsoft not escaping the pressure on the sector with a 23% fall over this period.

At a broader level, the sector rotation away from former US technology market leaders and towards asset-heavy industries such as Metals & Mining and Energy has accelerated since November. The XLK US technology sector ETF has fallen 6% and the Nasdaq 100 has lost 3%. In contrast, the XLE US Energy ETF has gained 25% and the PICK Global Mining ETF has risen 32% since November.

On this same HALO rotation…