Market Musings 22/01/22:

Tracking the Tech Wreck

Recent podcasts you might like to lsiten to:

Can conservative investors still buy stocks today?

Summary:

- No respite yet for the Nasdaq index, with the selloff spreading further outside the tech sector.

- Technical indicators for the Nasdaq Composite already look extended, getting close to the 2008 extremes

- US retail investor margin debt is one key reason for the flight of liquidity from the stock markets, as margin calls force investors to close positions

- Cryptocurrencies fall in sympathy with tech/growth stocks, again driven by retail investor selling

- Don’t panic, but equally, don’t rush to seize a falling knife. Patience now is key…

- FTSE 100 and French CAC-40 indices have still managed gains since early December, versus the 15% drop in the Nasdaq…

- Other stock indices up over the last month and strong since November 2020: Eastern Europe ex Russia (Poland, Hungary etc.)

The Tech Wreck continues

It continues to be a tough period for investors heavily invested in technology and growth stocks, with the Nasdaq Composite now 15% below its early December highs, and heavily growth- and tech-oriented funds like the ARK Innovation ETF and Scottish Mortgage Trust still moving lower in sync.

Nasdaq index 15% off the highs, tech-focused funds still suffer

Source: BNP Paribas, Bloomberg

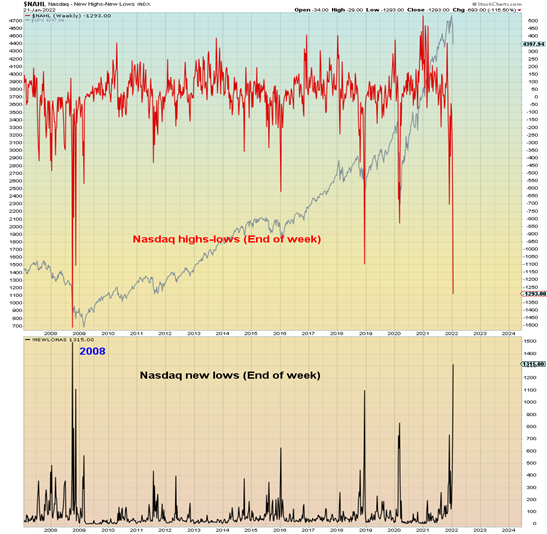

On the Nasdaq exchange, 42% of stocks have now been cut in half from their 52-week highs. Since the 2008 financial crisis, only Mar 12 - Apr 8, 2020, saw more stocks down 50% or more. To reinforce this fact, here is a second fact - the number of new 52-week lows hit by Nasdaq stocks was the highest last week since 2008, during the depths of the Great Financial Crisis. Worse even than was observed during the March 2020 COVID-19 recession and bear market…

Nasdaq index new lows: highest since 2008 (Great Financial Crisis)

Source: stockcharts.com

One reason for this retail investor-inspired sell-off are the reflexive effects of high levels of leverage - both in terms of owning out-of-the-money call options (e.g. via Robinhood) and via margin debt on their stock trading accounts. As their assets shrink in value, these leveraged investors are forced either to add more money to cover the margin call (if they can) or to sell down their positions and…