Market Musings 220423:

US recession hides in shadows of strong Q1

Don’t be fooled by today’s strength in US consumption

Summary

Strong Q1 economic activity globally, led by Europe, China…

But US recession still expected by H2 2023

Inflation is falling, led by the US

Q1 results season: okay so far in the US

Corporate profit margin boom in Europe

A word on precious metals

Podcast this week: Unravelling the impact of banking stress on the global economy

Edmund Shing and Guy Ertz discuss the events leading to the banking stress and the ensuing impact.

· The background

· The events contributing to the banking stress

· The economic impact

· Investment recommendations

Recession lurks in the shadow of a strong Q1

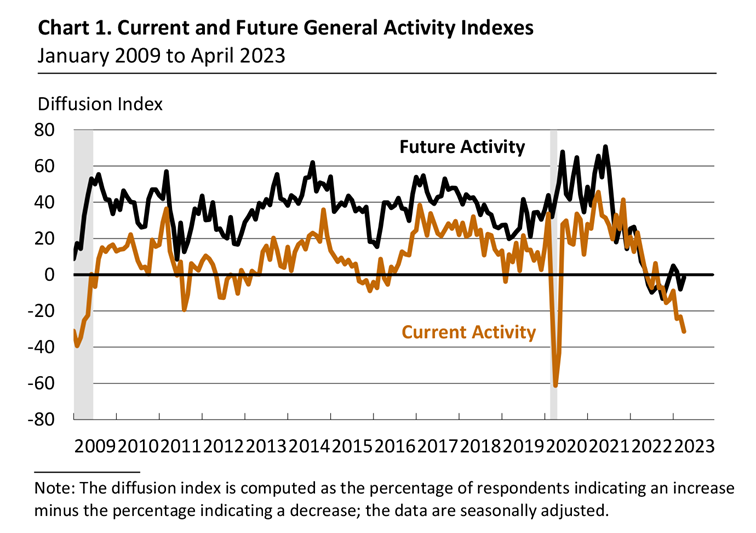

A US recession in the second half of 2023 is now becoming the consensus. This is something I've believed in for quite a while now. This week, key indicators such as the US Leading Economic Indicator (from the Conference Board) and the Philadelphia Fed manufacturing business outlook survey point to a looming US recession.

Philadelphia Fed manufacturing survey points to US recession

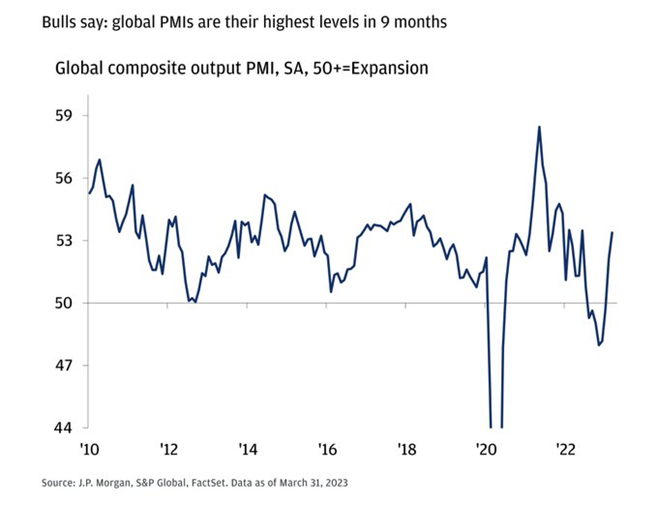

However, Q1 2023 data has been surprisingly strong. US, Europe and UK economic activity data have all surprised to the upside in economic terms, led by services rather than manufacturing. Clearly, the consumer remains in good health despite the sharp rises in interest rates that we've seen in the US, UK and Europe over the last few months.

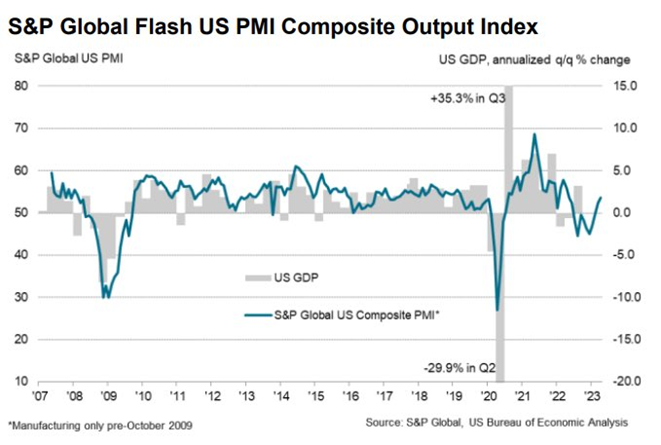

S&P Global composite PMIs turn up, lead GDP growth

As does the S&P Global US PMI (for now)

Source: S&P Global

UK consumer confidence rises to highest level in 1 year

Source: GfK

Remember that manufacturing tends to lead and services tend to follow. So the fact that services are so strong today but manufacturing is weak everywhere suggests that at least a modest US recession is still coming.

Of course, another point helping the global economy in the first quarter has been…