Market Musings 221124: US retail euphoria

Podcast this week:

Trump Trade 2.0 starts to fade

- The "Trump trade 2.0" has led to a stronger US dollar, higher bond yields, a sell-off in gold, and higher US stocks, particularly benefiting US small cap stocks.

- The main drivers are expectations of lower corporate taxes, deregulation, and higher tariffs on imports, especially from China and Europe.

- There is uncertainty about the actual impact of these policies, as Trump will not take office until 20 January 2025, and the current Biden administration remains in power until then.

- Investment opportunities may lie in US agency bonds, short-term investment-grade corporate bonds, and gold, with a 12-month target of $3,000 an ounce.

Summary:

US stocks higher, other markets struggle to follow

Post-election winners start to stutter: bond yields, small-caps

But others continue to surge; US dollar, bitcoin

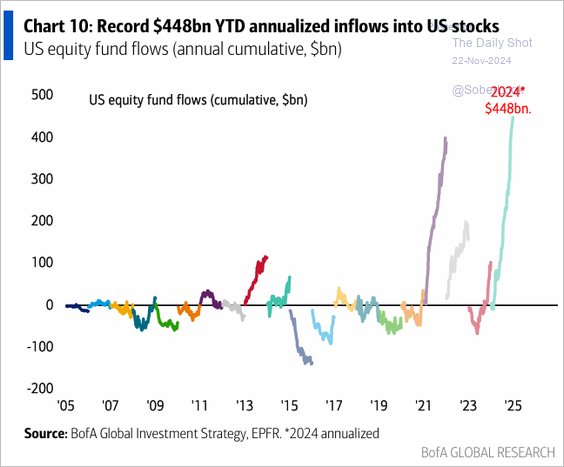

Boosted by massive inflows into US stocks, ETFs

Favoured US sectors: Financials inc. Insurance, Financial services, Industrials

Tech, Semis lag leading sectors

Gold starts to recover from post-election sell-off

Australia, Canada leads world ex US

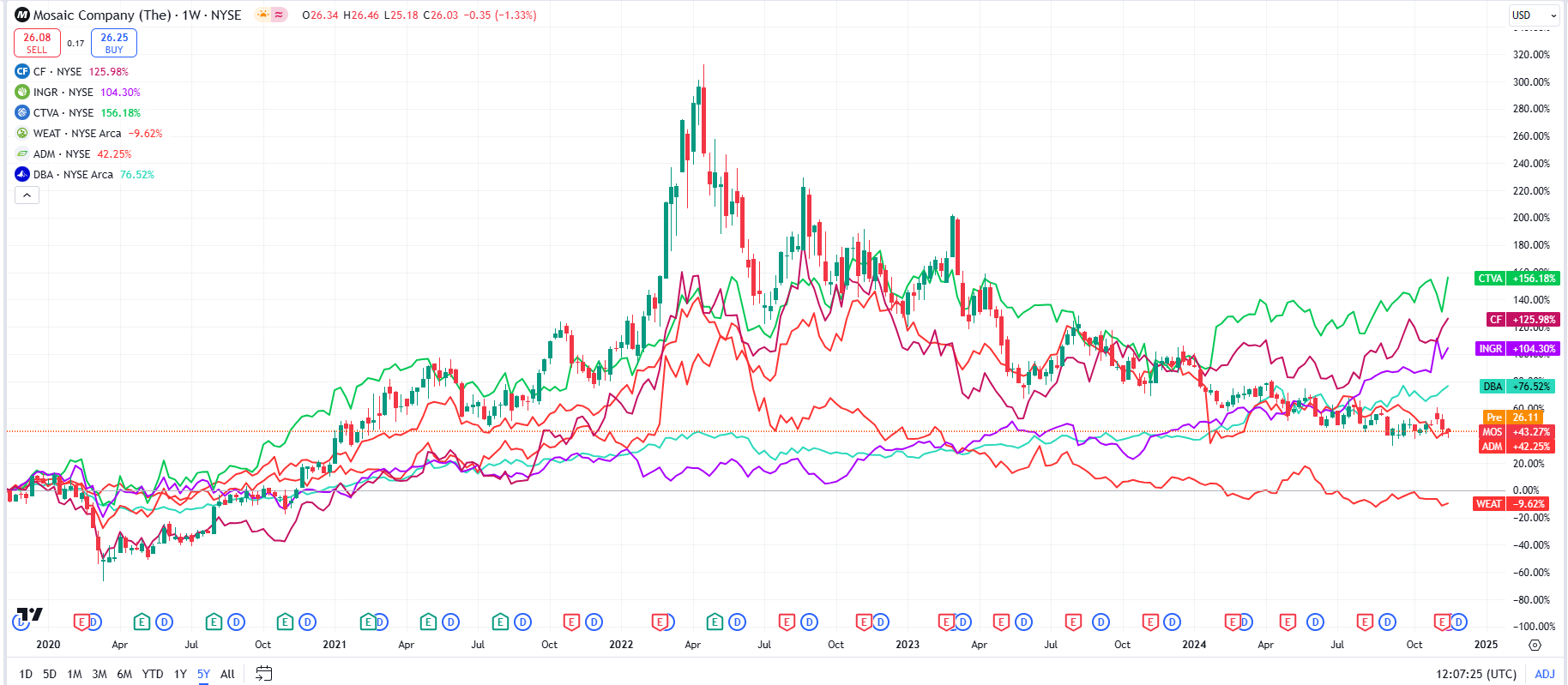

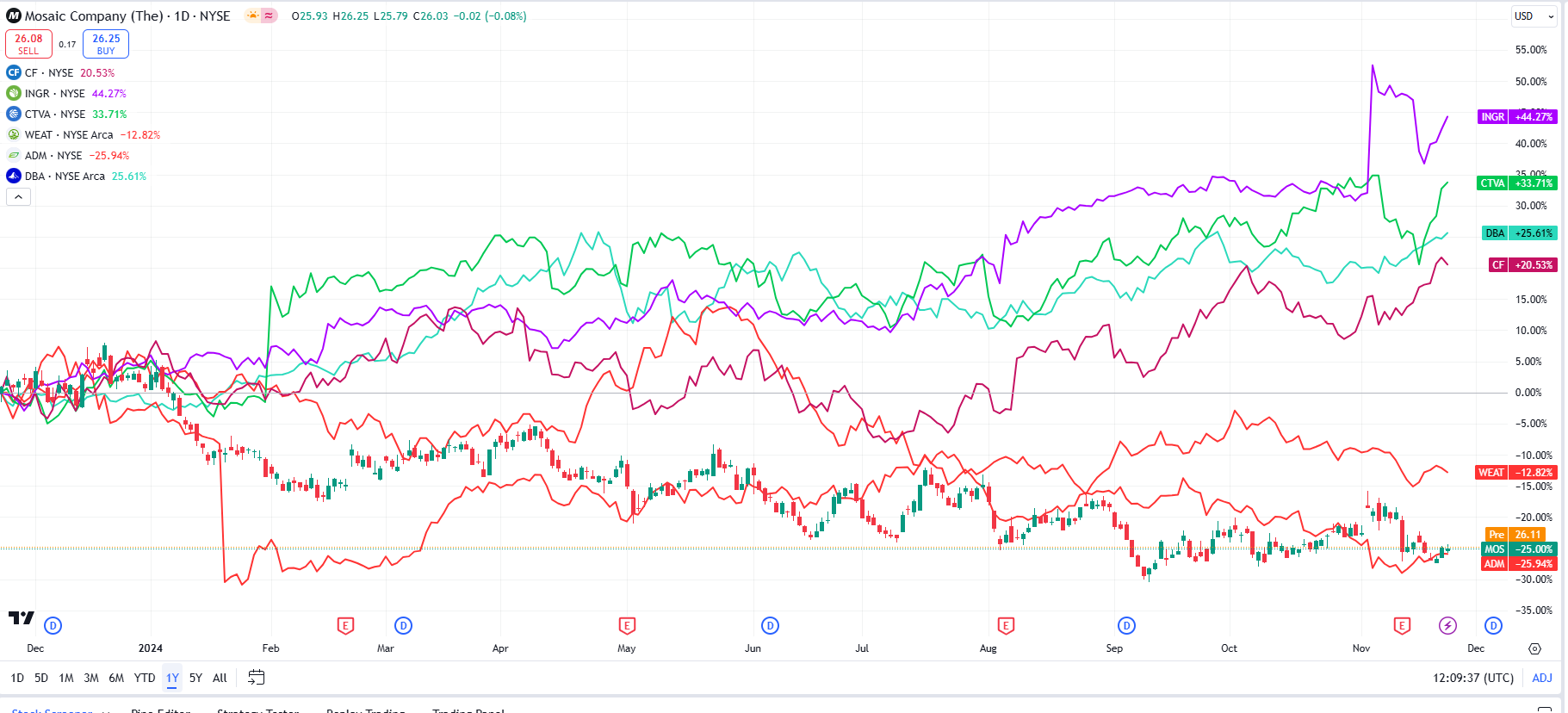

Agricultural commodities hit 10-yea high

Chart of the week: Europe Financial Services

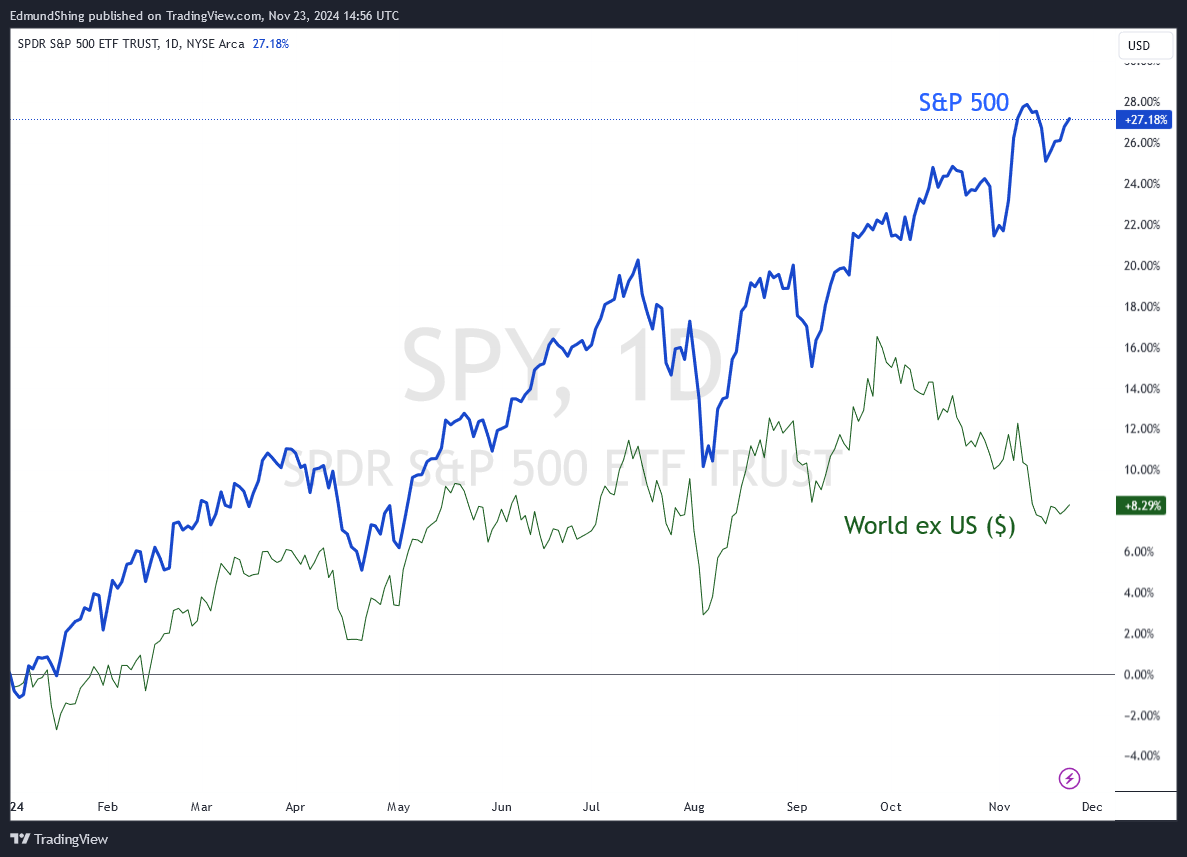

1. Post-election euphoria continues in US stocks, but World ex US struggles to follow

Concerns over economic growth prospects and potential new trade tariffs weigh on World ex US, while US stocks benefit despite very high 22x prospective P/.E valuation. It is all about momentum, at least for now...

2. US Small-Caps pause after fast post-election surge: US government bonds stabilise

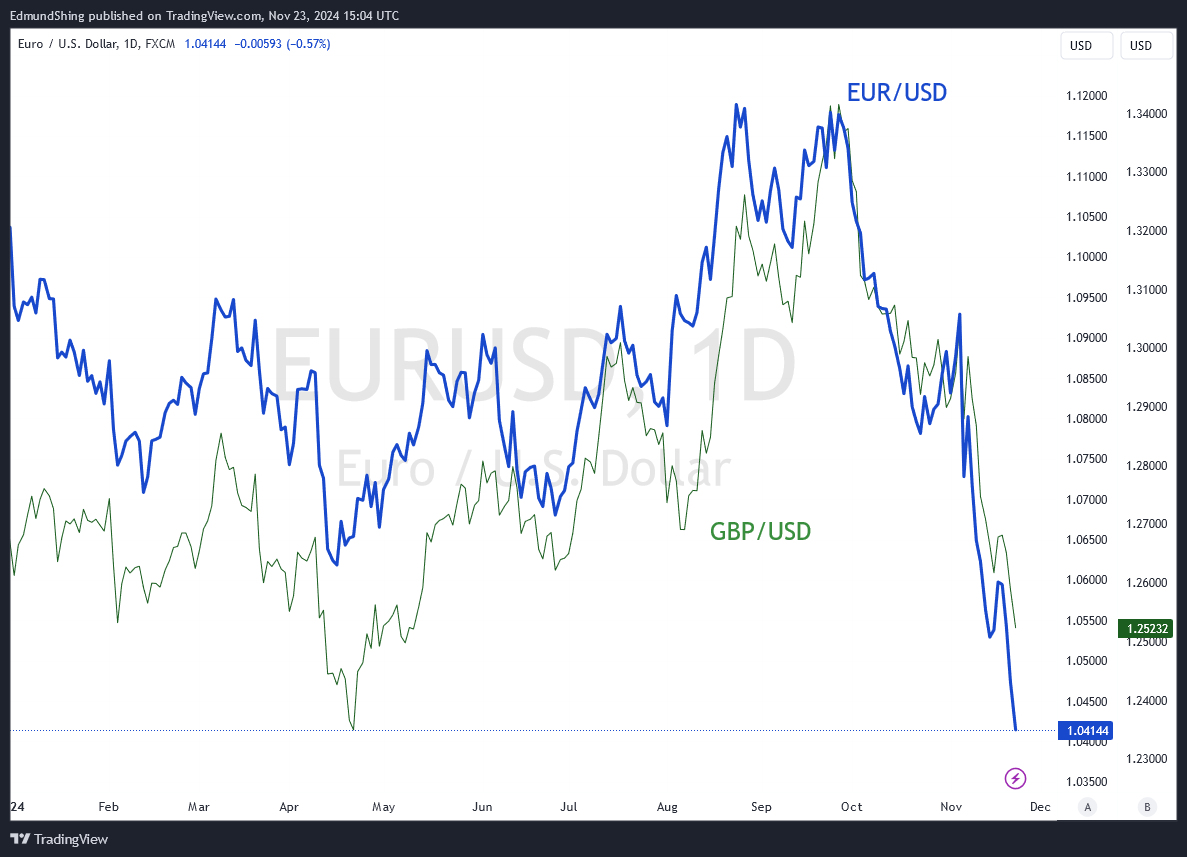

3. Two seeming unstoppable Trump trades: stronger US dollar, bitcoin rises to nearly $100,000

The US dollar just continues to gain on the back of stronger expected US growth, higher import tariffs. Trump really is seen as the first pro-crypto President.

Note the weakening euro versus USD (EUR = $1.04),

with a number of brokers suggesting a 1:1 parity as target:

4. BUT: Record flows into US stocks in 2024: euphoria peaking soon?

Similar euphoria in crypto…