Market Musings 240126

US dollar at a critical juncture

Weekly Podcast and Snapshot:

Infrastructure: Laying the foundation for growth

Infrastructure is the economic backbone linking people, goods, data and markets. Recent years have seen a rapid evolution of the sector sustained by robust economic growth and breakthrough technologies, sparking strong investor appetite.

Today’s demand is powered by three key forces: (i) digitalisation and electrification (AI‑driven data centers, EV‑charging networks), (ii) renewed government commitments, and (iii) the need for assets that hedge geopolitical and macro‑economic uncertainties.

AI, 5G networks, cloud computing and EV‑charging are spurring a massive build‑out of hyperscale data centers, and a resilient power grid. In parallel, the electrification of transport and heavy industry fuels unprecedented demand for both conventional and clean‑energy generation, transmission and battery storage. This propels record‑level investment across the entire infrastructure sector.

Similarly, governments are putting in place spending plans to revive and upgrade their infrastructure driving major infrastructure investment.

Finally, infrastructure is emerging as a natural inflation hedge with low correlation to the public markets providing investors the hedge they need in times of uncertainties.

US dollar: teetering on the edge of a breakdown?

This has been a potentially pivotal week for the US dollar. Several factors have driven recent weakness in the US dollar against other major currencies and against gold, including:

- Lower US rates: Further expected Federal Reserve interest rate cuts (at least 2 more cuts this year), undermining the attractiveness of holding cash on deposit in US dollars as US interest rates converge on those available elsewhere such as in Europe or the UK;

- Fed leadership uncertainty: while Trump’s choice for the next Fed President (current Fed President Jerome Powell’s term ends in May) remains unclear, there is nervousness that the new Fed President will have to bow to Trump’s wishes and lower interest rates perhaps more than is prudent from a purely economic point of view. This potentially undermines the independence of the Fed, by extension undermining the status of the US dollar as a safe haven asset to be preferred in times of crisis.

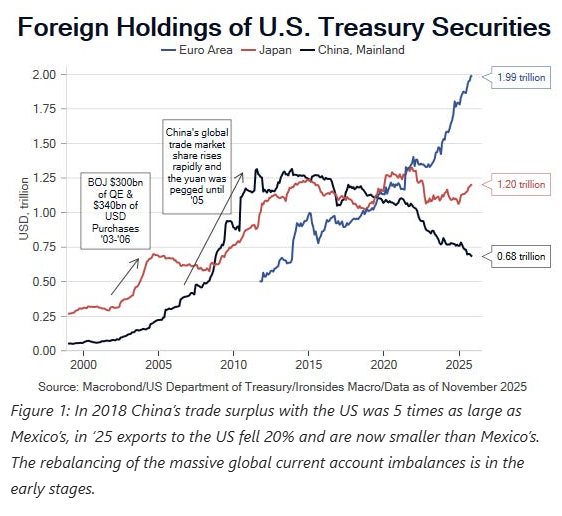

- Structural difficulties around current account and budget deficits: President Trump seems set on increasing US Federal spending in order to boost household spending, thereby picking up votes ahead of November’s crucial mid-term elections. A persistently large US budget deficit (gap between tax receipts and government spending) is expected this year, of the order…