Market Musings 26/03/22:

Time to look again at US stocks?

Podcasts that might interest you:

Investing when the market is in the doldrums

- Why is it important to watch investor sentiment?

- How is it measured?

- Can we anticipate future trends on the basis of historical data?

- What is a good way to invest when sentiment is very low?

Also available in Apple Podcasts, Podcast Addict, Spotify podcast platforms

(search for “BNP Paribas Wealth”)

Weekly Summary:

- US fundamental drivers remain solid including earnings, share buybacks.

- Potentially past peak uncertainty, according to the Citigroup Global Macro risk index

- Post recent lows in sentiment surveys eg AAII bull-bear survey, stocks typically rebound over the following 6 months

- But too early to declare market correction phase over already - previous deep bear markets have contained several periods of double-digit market rallies, before the downtrend then resumed.

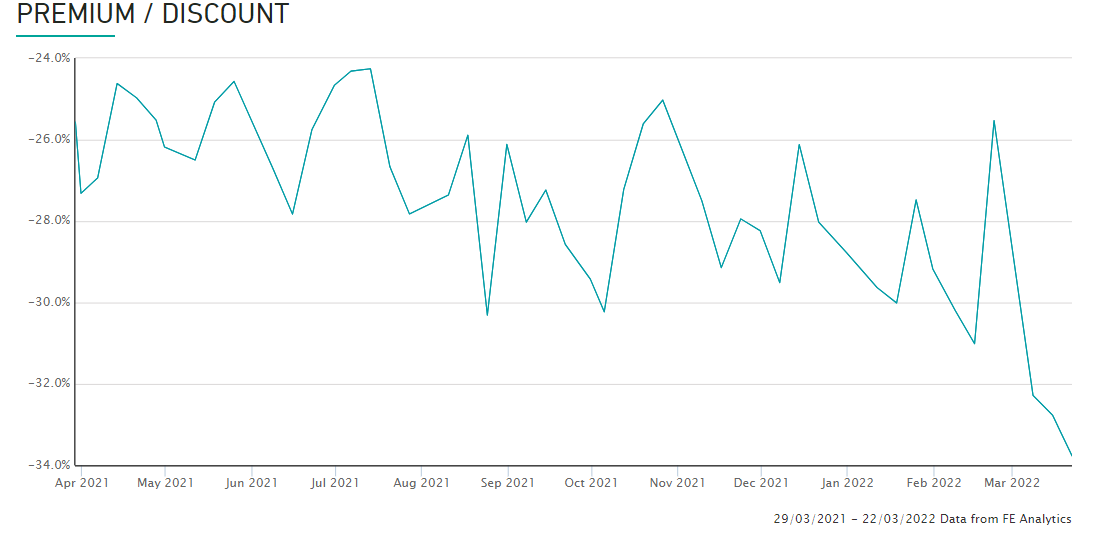

- Idea of the week: PSH Pershing Square (investment trust focused on US stocks)

Time to look at US stocks anew?

Fundamental drivers remain solid: four fundamental factors support US stocks, including easing financial conditions, positive earnings momentum, robust share buybacks and more reasonable valuation levels.

For now, forward S&P 500 earnings forecasts continue to rise

Source: BNP Paribas, Bloomberg

Potentially past peak uncertainty: oil and gas prices have fallen back significantly from February 2022’s peak levels, easing inflationary pressures on the global consumer. Financial market measures of uncertainty have equally declined from recent peaks. This easing stress in the global economy and markets suggests better days ahead for stocks, real estate, corporate credit, and private equity.

Peaks in perceived risk have been historically followed by positive stocks returns

Source: BNP Paribas, Bloomberg

Investor confidence surveys have recently hit long-term lows: surveys, such as the American Association of Individual Investors (AAII) bull-bear survey and the Investors’ Intelligence Investor Sentiment index, measure the confidence of investors. These surveys highlight that investor sentiment was extremely depressed at end-February 2022.

On 24 February, AAII bull-bear sentiment survey hit a -30 low

Source: BNP Paribas, Bloomberg

The 8-year low in the AAII survey suggests a 12% return to stock markets over the next 6 months: the extreme -30 AAII bull-bear reading on 24 February suggests a potential +12% return to global stocks over the next 6 months, based on past performance post sentiment lows.

After…