Market Musings 290325:

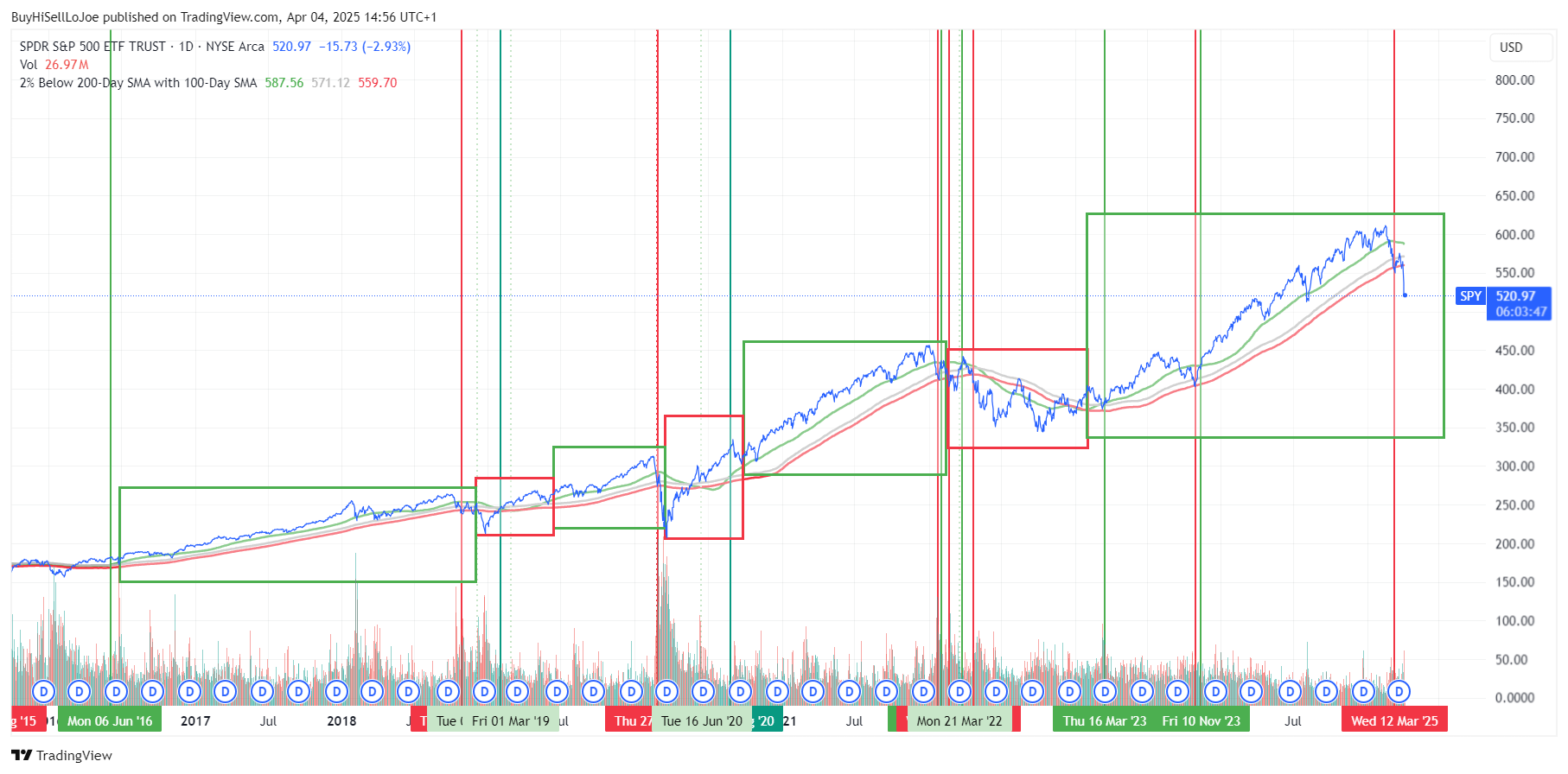

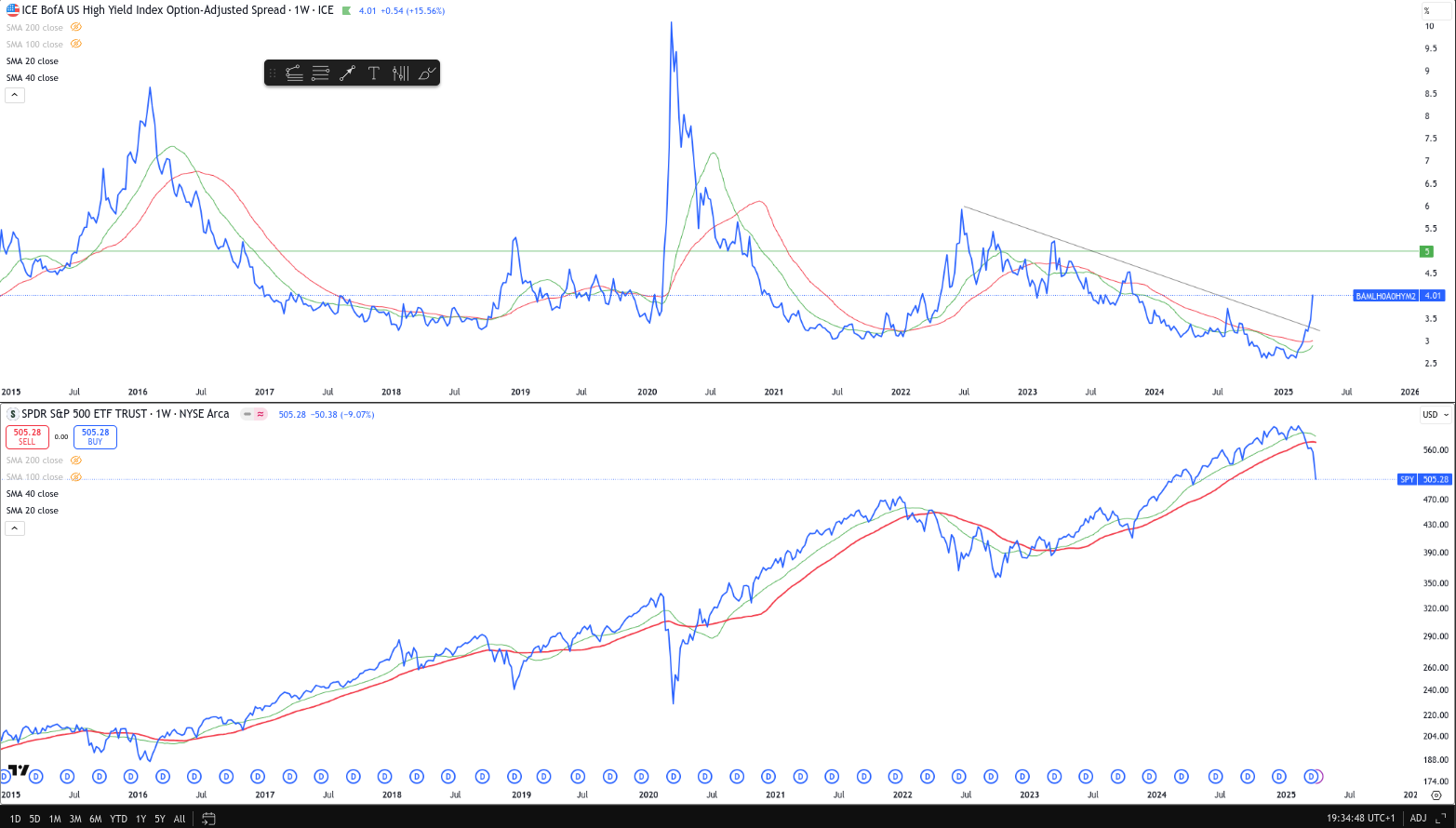

Stock market ETF timing with the high yield spread

This week, we are returning to the challenge that my friend Tony gave me. He is looking for a simple, fairly reliable system for investing for the long term without incurring high trading costs.

In designing an ETF portfolio system for Tony that can be easily followed month by month, we first need to set the objectives of any system that we're going to use consistently.

The biggest challenge for investors is typically themselves, and in particular their behavioural biases. Many people believe that they can time the markets, but this is in reality very difficult to do.

1. The goal of the system is not to optimise performance necessarily, but more to keep in line, or generate performance in line with the major stock indices when they're going up, but To reduce risk at times when the stock markets are going down. Simply said, the idea is to capture the majority of uptrends when they occur and to avoid the bulk of down trends when they occur. The idea of this is then to allow the investor to stay invested, using this system rather than panic.

The problem is that once you sell in a falling market, it's very difficult psychologically to buy back in, especially when that market may have risen back above the level you sold it at. However, using a system, firstly, hopefully reduces the times when you sell, and then also makes it easier to buy back in because you're following the system rather than trying to use your own judgement

2. It has to be easy to use.

3. It should use indicators that are easily available and don't take long to check.

The choice of indicators can be either economic or financial market-based indicators. Economic indicators seem seductive, because in general, stock bear markets occur around economic downturns, typically around economic recessions when the economy is contracting (shrinking) rather than growing.

4. We should not see too many transactions in a 12-month period, because we want to keep the costs of running such a system low.

Economic indicators: a timing issue

The difficulty with using economic indicators to time the stock market is that the stock market itself is a predictive…