Apologies!

First of all, I must apologise for not posting sooner on Stockopedia,. I had started to put up weekly posts on markets and macro trends, and then stopped abruptly once the current COVID-19 crisis hit.

Two reasons for this: firstly, I was actually busy with my work! Secondly, I didn't feel that I had a lot of value to add, nor did I have much confidence in my thoughts on the markets.

But now I plan to restart my weekly musings on macro and markets... So here goes:

1. Anatomy of bear markets and recoveries

This market sell-off (and partial recovery) have clearly been event-driven, and very sudden.

We know from looking at Bank of England monthly dataset ("A millennium of macroeconomic data") that this current sell-off in UK stocks (-33% in the FTSE 100 from 19 February 2020 to 23 March) was the fastest fall of 30% or more in 300 years, since the bursting of the South Sea bubble that cost Sir Isaac Newton so much of his wealth.

In the wake of a 10+ year bull market, this is actually a typical bear market move if we look at history, which is all we can really call on for now.

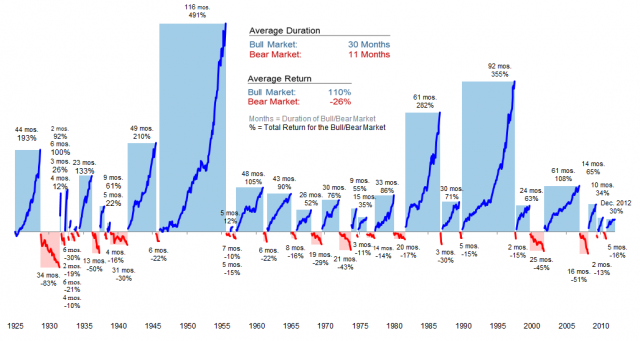

The chart below for the US stock market illustrates that the average bear market (decline of 20%+ from the highs) has lasted 11 months and seen stocks lose on average 26%.

US bull and bear markets back to the 1920s: average bear market = -26%

As I said, as this is an event-driven bear market and recession, we can at least surmise that the bear market will last less time than this average, possibly half as much time.

But note that the "time to recovery" to regain losses registered during a bear market is far far longer than the time taken for the stock market to fall - it takes the elevator down, but climbs the stairs back up. There is no hard and fast ratio we can apply to determine reliably the time to reocover to pre-crisis stock market levels, but we do know that the time taken is proportional to the scale of the bear market decline, i.e. the more that the stock market declines, the longer it will take to regain its pre-crisis level.

Post the 2007-09 Great Financial Crisis, for…