My preferred investment methodology involves building a detailed valuation model. This projects the full financial statements for up to two and a half years ahead. I make various adjustments to my earnings projections (normalise tax, add back amortisation, add back share-based payments, etc.), multiply them by a self-selected PE ratio, and then make further adjustments for balance sheet and other items (surplus cash, pension deficit, pipeline dividends, options, etc.) to arrive at a valuation.

Every part of this process is rigorous apart from the selection of the valuation PE ratio, which is entirely judgmental but a critical driver of the valuation. I am exploring approaches that would allow me to apply more rigour to that pick.

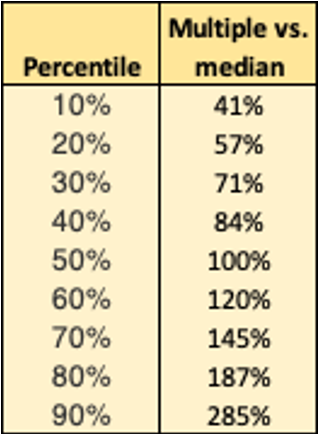

At present, I derive my PE ratio as a multiplier of the median market PE ratio provided on the home page of Stockopedia (old site). For some businesses (cyclical, ex-growth, poor record, etc.) I will pick a multiplier below 100% and for others (high growth, good outlook, strong management record, etc.) I will pick one above 100%. I think it is important to maintain this link with the wider market valuation, since each potential investment is competing with the rest of the market for my money, but would like to calibrate my selection more effectively than I am doing at present.

It strikes me that a good way to achieve this would be to look at the distribution of market PE ratios and use that as a basis for calibration. A full distribution would do the job but, in practice, the decile figures would be perfectly adequate. For example, if the 90th decile PE ratio was x25, and the median was x14, I might apply a multiplier of 179% (25/14) to my adjusted earnings figure in valuing a high growth business with a very favourable outlook.

Since Stockopedia publish a median PE ratio, they must hold the full distribution that could be used tor derive the deciles. Does anyone know how to access that information on this site? Or elsewhere?

Also, i would be very interested in other people's ideas on how best to select a PE multiplier for valuation purposes.

Here's a flavour of the quantiles on a few dates over the years.

This is derived from some data I collect. But I tend to only track stocks with MCAP > £100M.

(Note: this uses current P/E -- not forecast P/E)

Also note that any stock with negative earnings does not appear in the table at all. If you were to take all the stocks with negative earnings into account then the median would be increased.

| | 0% | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% |

| 2016-01-06 | 0.47 | 7.344 | 10.48 | 12.52 | 14.68 | 17 | 20.72 | 23.8 | 28.56 | 39.28 | 2206 |

| 2017-01-07 | 1.08 | 7.752 | 10.6 | 13.1 | 15.08 | 17.5 | 19.92 | 23.4 | 28.76 | 45.18 | 2835 |

| 2018-01-27 | 0.52 | 8.04 | 10.8 | 13.4 | 15.6 | 17.8 | 21.4 | 25.36 | 32.54 | 51.4 | 6981 |

| 2019-01-07 | 0.3 | 5.884 | 8.208 | 9.952 | 12.2 | 14.1 | 17.2 | 20.59 | 26.8 | 41.27 | 2193 |

| 2020-01-12 | 0.67 | 7.344 | 10.18 | 12 | 14.1 | 17.2 | 20.74 | 24.2 | 31.6 | 47.76 | 2144 |

| 2020-03-01 | 0.59 | 6.24 | 8.73 | 10.7 | 12.6 | 15.3 | 18.6 | 22 | 27.9 | 43.7 | 636.6 |

| 2020-05-03 | 0.25 | 4.47 | 6.63 | 8.768 | 10.8 | 13.1 | 15.7 | 19.22 | 25.88 | 40.3 | 1308 |

| 2020-07-26 | 0.44 | 4.848 | 7.37 | 9.401 | 11.3 | 14.25 | 16.84 | 21.89 | 30.42 | 44.33 | 1305 |

| 2020-09-22 | 0.58 | 5.896 | 8.742 | 10.94 | 13.4 | 16.2 | 20.38 | 25.46 | 34.2 | 53.22 | 1336 |