Welcome to this week’s Market Wrap. April has been a fairly flat month so far in terms of market moves. In most western territories the index falls that followed Russia’s invasion of Ukraine in late February have been recovered. But how the war will continue to influence a number of important variables (not least inflation) is far from clear.

The UK’s defensive natured FTSE 100 index has fared better than most in recent months. Double-digit relative price strength over three months is well in evidence in defensive names like BAE Systems (LON:BA.), AstraZeneca (LON:AZN), Pearson (LON:PSN), Glencore (LON:GLEN), Bunzl (LON:BNZL) and SSE (LON:SSE). Meanwhile, small-caps remain very subdued, and it’s still a tricky market for individual investors with a preference for more speculative growth plays.

Index changes

This Week | 1 Month | 1 Year | |

FTSE 100 | -0.4% | +1.2% | +9.1% |

FTSE AIM All Share | -0.2% | +1.5% | -16.6% |

S&P 500 | -0.0% | -1.5% | +5.3% |

FTSEuroFirst 300 (ex-UK) | +0.2% | -1.2% | +1.9% |

S&P/ASX All Ordinaries | -1.3% | +1.9% | +6.1% |

Source: Stockopedia, London Stock Exchange

Financial headlines in what was a shorter week because of the Easter holiday weekend, seemed to focus on Elon Musk. For a start, Tesla (NSQ:TSLA) smashed analyst forecasts in the first quarter of 2022. Revenues at the EV company were up by 81% year-on-year to US$18.8 billion. Q1 operating profits came in at $3.6 billion versus analyst consensus target of $2.6 billion.

Elsewhere, Musk also raised eyebrows with further details of a possible bid for Twitter (NYQ:TWTR). After buying a 9.2% stake in the social media company earlier this month, he’s now set out details of a $46.5 billion funding package that would help him take full control.

Elsewhere, streaming service Netflix (NSQ:NFLX) saw its shares tumble 35% on news that it had lost a couple of hundred thousand subscribers during Q1 - and may lose a couple of million more this year. A subplot to this story concerned Bill Ackman, the hitherto activist investor who spent years trying to influence management at companies like Herbalife and Valeant Pharma. Ackman bought a $1 billion+ stake in Netflix in January but sold out instantly on this week’s news, taking a loss of around $400 million.

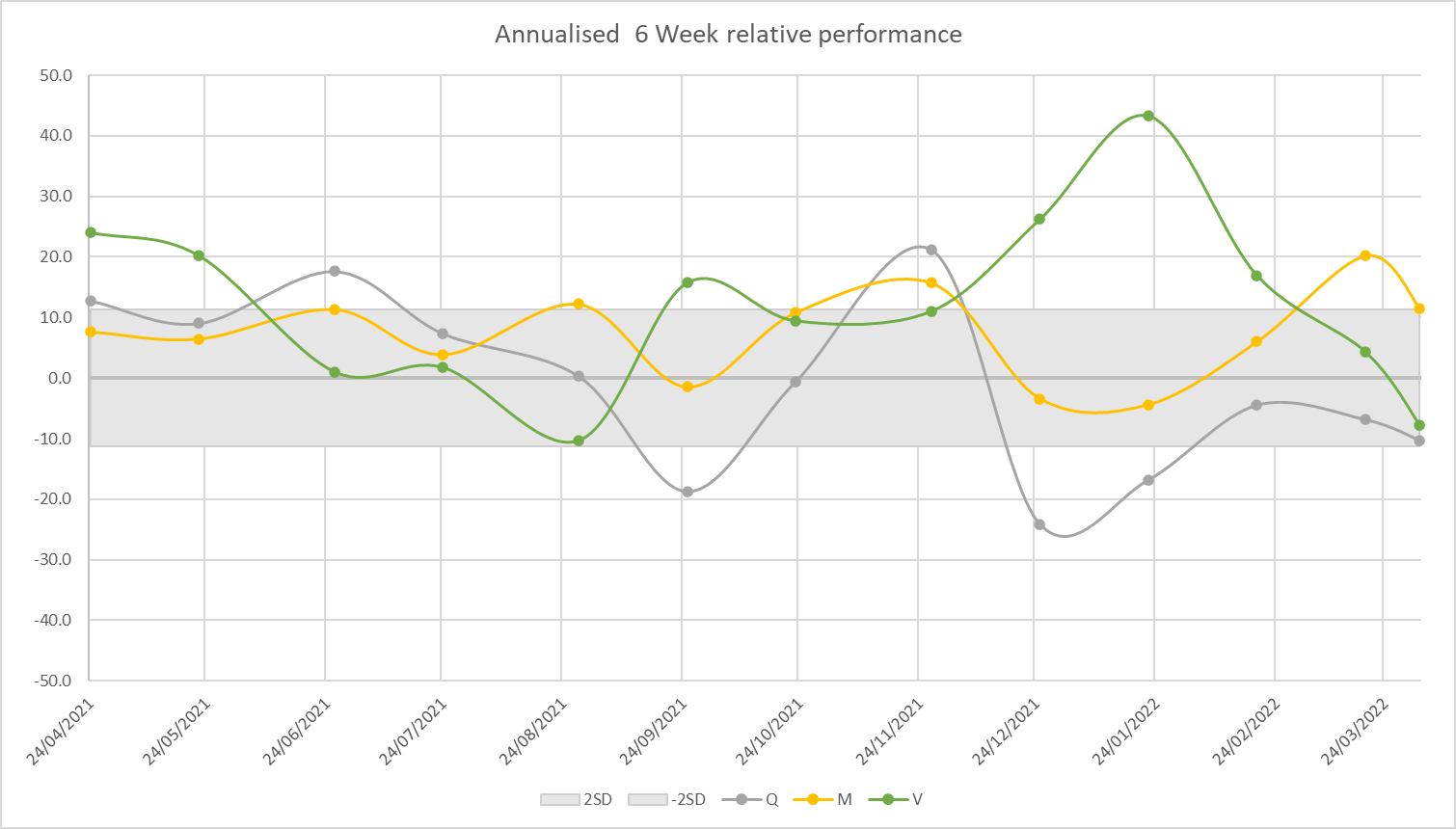

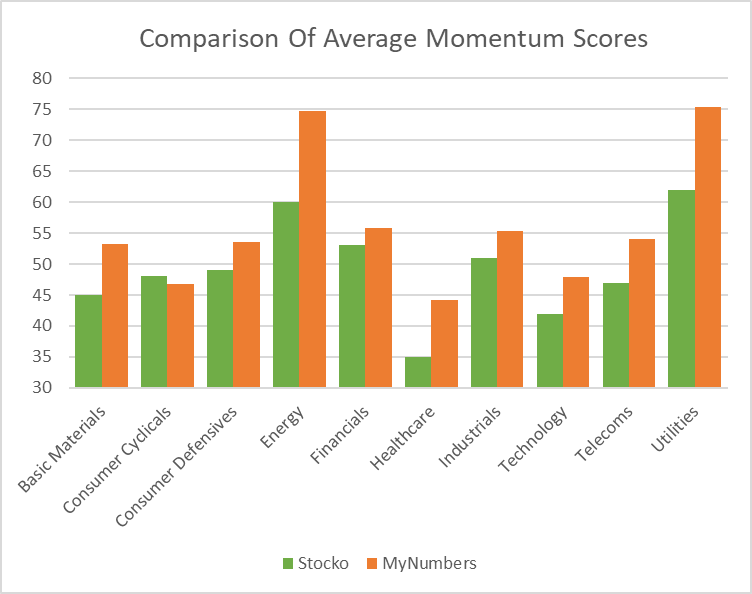

Value still the biggest influence

In terms of profit drivers, Value continues to be a persistent theme in a lot of the StockRank strategies tracked by Stockopedia. High exposure Value and Value+Momentum baskets are among the top performers on a one-year basis across the US, UK,…