When we started the Stockopedia staff investment club two years ago, we included a ‘market review’ as part of our regular meetings. The idea was to look at index direction (to help us rate our own performance), the influence of different factors (like size, quality, value and momentum) and economic and industry trends.

Ultimately, the market wraps are about trying to understand what might influence our performance and how that might guide future stock pitches - and what we buy and sell.

This week, we’re bringing that thinking to the platform in what might become a regular market wrap. Hopefully you’ll find it useful…

A quiet start to 2022

A good place to start is this eye-catching five-year chart of large-cap indices around the world.

The decade-long bull run on the US S&P 500 has been quite something to witness, but valuations in the States are causing concern in places. A recent note by Jeremy Grantham (of US asset manager GMO) talks about the market being in “superbubble” territory (Let the Wild Rumpus Begin). That said, both the S&P and the Nasdaq have come under pressure this week.

Just as remarkable is how underwhelming the UK’s FTSE 100 has been relative to the US, Europe and Australia over five years. But is that trend changing…?

Well, it’s extremely early days, but the UK blue chip index has performed better on a six-month basis against international peers (see chart below). To an extent, that could be down to two themes we’re hearing a lot about recently.

- There has been a shift from growth to value over the past year, in part driven by concern about the impact of rising inflation on growth stock valuations.

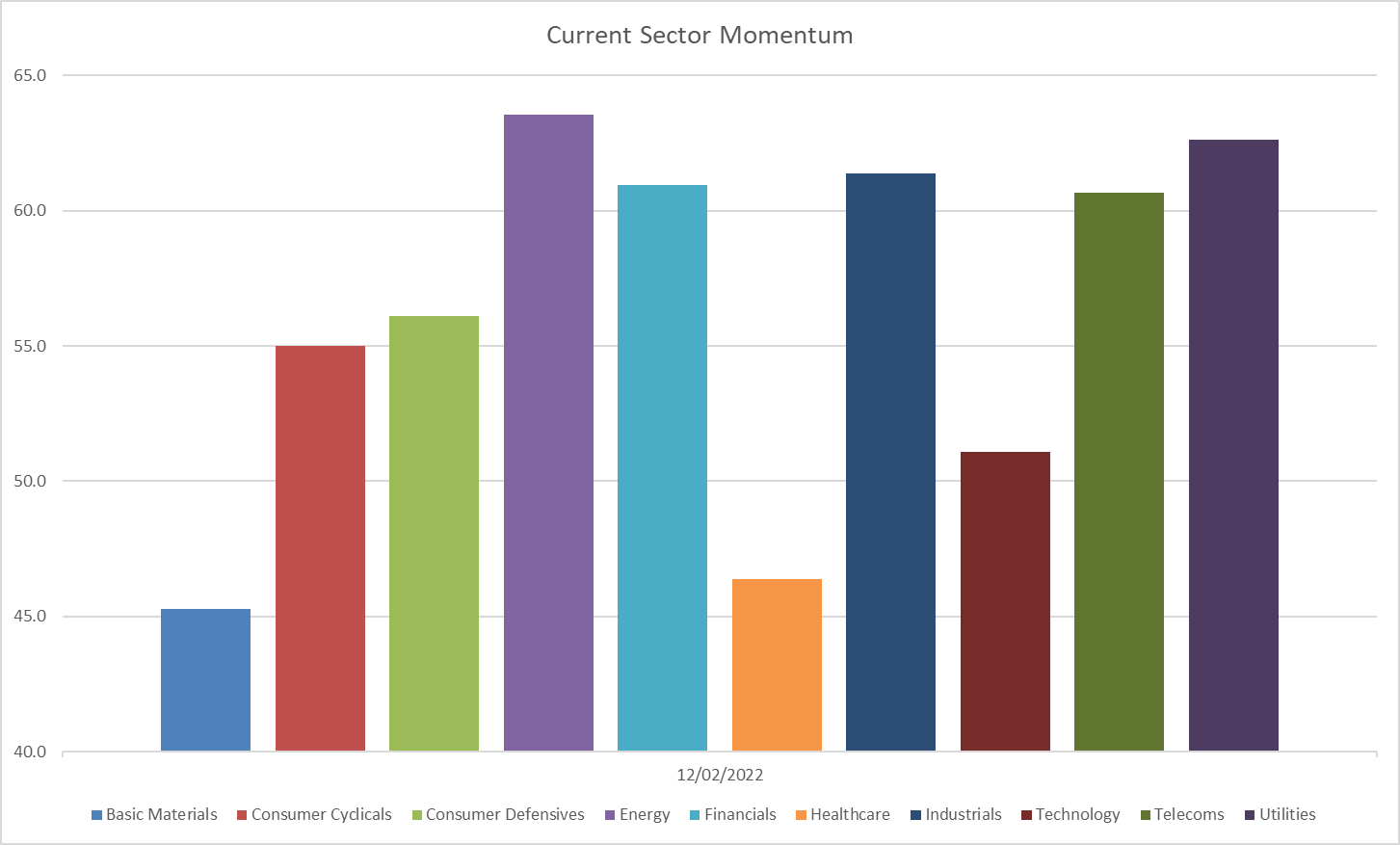

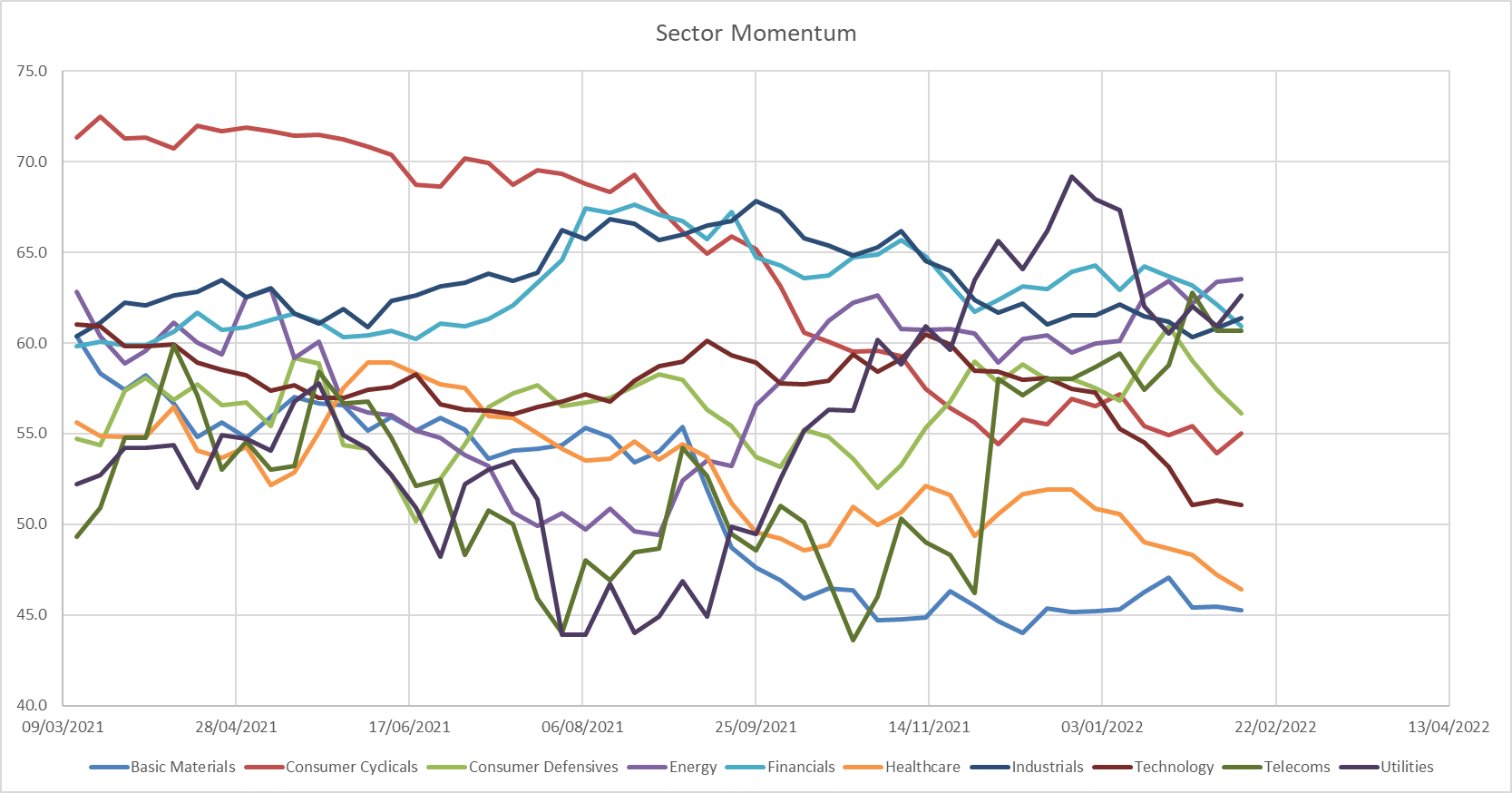

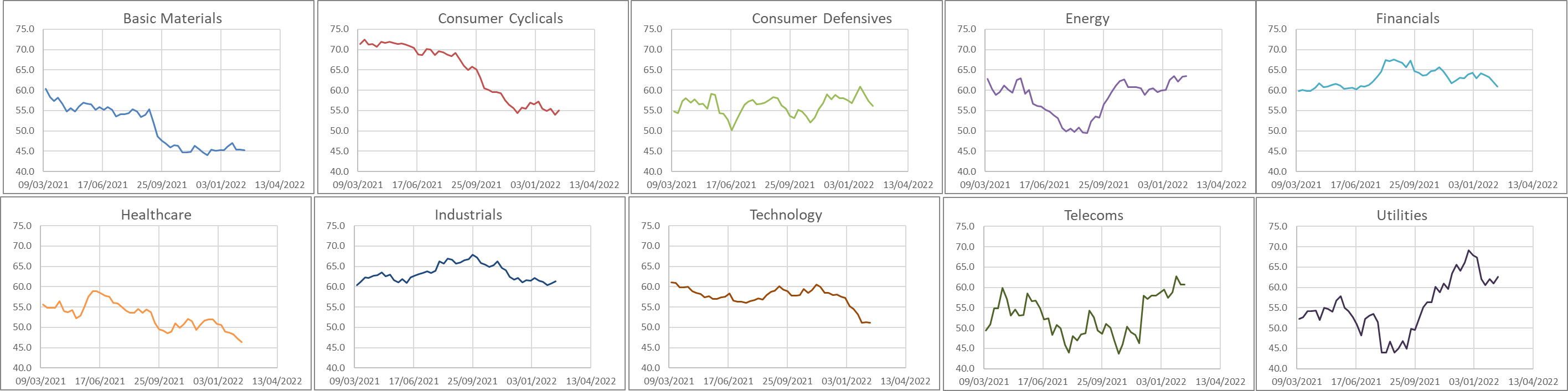

- The FTSE 100 has a skew to sectors where stocks are A) in ‘value’ territory, and B) potentially well placed to benefit from rising inflation (see below).

In particular, energy and utility companies (which have been cheaply rated for some time) could do well from rising prices. We’ve certainly seen solid gains in oil & gas stocks this year (both in the UK and around the world). Meanwhile, banks will likely benefit from the rising interest rates that will be used to try and control this inflation.

A note about inflation

Inflation continues to dominate financial…