Marks and Spencer always seems to either need or be in the middle of a turnaround. However, despite all the endless talk of turnarounds, one thing that hasn’t turned around yet is its results.

Admittedly the recent 2016 results weren’t terrible, but they weren’t exactly brilliant either.

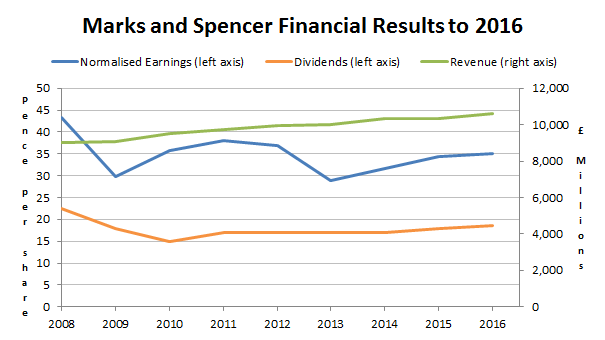

Revenues, normalised earnings and dividends were all, but only by low single digit percentages, and that has more or less been the story for most of the last decade:

Growth is slow but reasonably steady

After suffering a decline in profits and dividends after the financial crisis the company has found it impossible to mount a rapid recovery.

Over the period covered by the chart above Marks and Spencer’s growth statistics, compared to the FTSE 100, are:

- 10-Year growth rate = 0.1% (FTSE 100 = 1.6%)

- 10-Year growth quality (consistency) = 67% (FTSE 100 = 50%)

The 10-year growth rate is an average across revenues, earnings and dividends, and 0.1% per year is very low. In fact it’s so low that it breaks one of my many rules of thumb:

- Only invest in a company if its growth rate is above 2%

To some extent its growth rate is extremely low because of the decline in earnings and dividends at the start of the period.

Perhaps a fairer estimate of the company’s historic growth rate, and perhaps its future growth rate, is its historic revenue growth rate.

Looking only at revenue, Marks and Spencer’s 10-year growth rate is 2.1%, which is slightly above my rule of thumb minimum growth rate of 2%.

However, 2.1% is still low and is not significantly different from the rate of inflation. In other words, Marks and Spencer has simply maintained its size in inflation-adjusted terms, but has not actually grown at all.

To be fair, this unexciting growth rate is not exactly a surprise; Marks and Spencer operates almost exclusively in the UK and within the UK it already has a store on every street corner (or at least it can feel that way sometimes).

It’s going to be difficult for the company to open lots of new stores without cannibalising sales from its existing stores. As a result, growth within the UK is more likely to be in line with growth in the UK’s aggregate wages, i.e. population growth plus inflation.

There is of course the option of international growth, but historically Marks and Spencer has not exactly set the world alight with its overseas adventures, and…