Last week I had the good fortune of being able to attend the Mello conference.

Mello is quickly becoming the biggest day in the retail investor’s calendar. According to David Stredder - the event organiser - attendance was up by 11% this year and the Tuesday was its busiest opening day ever. What’s more, over 31% of the investors had never been to a Mello event. So if you’ve never been before do come to the next one.

I’ve typed up my notes from the speeches and panels I attended. Gervais Williams’ talk (towards the end of the notes) was a particular highlight.

David Page and Nick Wong, The Fulham Shore Plc

(Please note that I have a long position in FUL.)

After a cramped, bad-tempered, delayed 50-minute tube journey, I got to this one a little late. It’s never fun being the guy that bursts into a room halfway through a presentation, bumping and sidling along rows of seats, whispering ‘Sorry’ to people as they hug their knees to their chests to let you past...

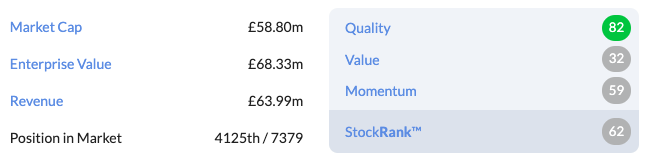

Fulham Shore (LON:FUL) is a small cap Leisure stock made up of two brands: Franco Manca and The Real Greek. The former attracts a mixed crowd of typically (but not exclusively) 16-35 year-olds, while the latter attracts more female diners. It has recently launched a loyalty program for its customers.

The Board owns around 50% of the shares and friends and family hold another 25%. It’s safe to say management has a lot of skin in the game.

Operations - management plans to keep debt down by funding site openings with operating cash flow.

FUL’s food sourcing expertise allows it to generate good margins despite offering its product at a lower price point than many of its competitors. It is a low-cost operator.

The group has its Half-Year results out in December and is comfortable with analyst forecasts of £8.5m EBITDA (HY18: £4.1m). It will comment on its plans for the next three years or so in these results.

Q&A

What makes Franco Manca different?

Big chains freeze their product (cheese, dough, etc.). Franco Manca makes everything on site. It has a short menu of seven pizzas.

Leases?

FM sites have around a 2.5 year payback. They generate £250k of profit per year and cost £700k to set up. Landlords are in a terrible…

.jpg)