The FTSE 100 features the 100 largest UK listed companies and are referred to as large cap or blue chip stocks. The next 250 largest listed companies form the FTSE 250 and are referred to as mid-cap stocks. Investors tend to focus on the FTSE 100 but the FTSE 250 has handsomely outperformed its larger rival.

In December 1999 the FTSE 100 hit a peak of 6,930 and currently stands 7% below this level at around 6,400. Over the same 15 year-year period the FTSE 250 has increased by 165% from 6,400 to around 17,000.

Both performances exclude dividends and the FTSE 100 has delivered a higher dividend yield than the FTSE 250. Nevertheless, the total return of the mid-cap index still trumps that of the FTSE 100.

FTSE 250 since 2000: worth looking toward mid-caps?

It is easy to buy into the FTSE 250 through low cost Exchange Traded Funds (ETFs) that are listed on the LSE. Vanguard’s FTSE 250 ETF (LSE: VMID), for example, has an ongoing charge of only 0.1%.

The key issue for investors is whether the FTSE 250 is set to continue to outperform the FTSE 100. To help answer this question we need to evaluate the drivers of the both indices and see if they are set to remain in place.

Drivers of FTSE 100 underperformance

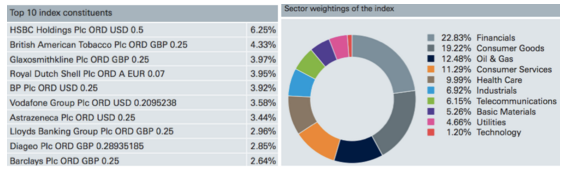

The weakness of the FTSE 100 is typically attributed to its sector exposure with banks and resources two overweight areas. The five largest FTSE 100 stocks include two oil companies, a bank and a mature pharmaceutical company.

FTSE 100 makeup at September 2015

Source: Deutsche Bank FTSE 100 ETF factsheet

We have seen the banking sector face major headwinds since 2007 with Royal Bank of Scotland and Lloyds having to be bailed out. The resource sector is also currently seeing weakness on the back of lower commodity prices.

The FTSE 100’s exposure to cyclical sectors has meant that it suffers during downturns and takes a long-time to recover. This was evident in both the post-2000 downturn and also the post-2007.

FTSE 100 since 2000

The FTSE 100 is also exposed to the fortunes of its largest companies with the top ten stocks dominating the index. As such issues at individual companies, such as BP, can have a meaningful impact.

It is also worth noting that FTSE 100 companies generate around 70% of their revenue from…