In my last article, I looked at what investors can learn from the study of 64,000 global stocks. The key finding was that as the investment time horizon lengthens, stock market returns come from fewer and fewer stocks. It is incredibly hard to pick the big winners over the next five years, let alone the next 30 years. This is why I prefer to take advantage of shorter-term market inefficiencies available over a one-to-three-year time horizon. These are the kind of opportunities that the Stockopedia StockRanks seek to exploit.

For this screen, I am looking to take advantage of those inefficiencies by searching for mid-cap stocks that are too cheap. Investors have to be careful buying into something looking superficially undervalued. Markets are often quite efficient at pricing more liquid stocks. Hence many investors prefer to focus on the less-researched small cap markets. However, I believe opportunities may also lie in mid-cap companies in the current markets.

Why midcaps?

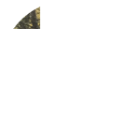

I believe there is a reason that some mid-caps may be currently undervalued, and it is to do with retail fund flows. The following is a graph of retail fund flows into Equity funds over the last eight quarters from The Investment Association:

Equity funds have been facing significant outflows since the start of 2022. This means that equity funds need to meet these redemptions by selling stocks. As a result, funds will typically sell their most liquid stocks first. Conversely, the effect of a particular fund selling will likely have a more significant impact on the smallest companies. So the idiosyncratic effect of a specific company becoming oversold is greater in the midcaps.

Why now?

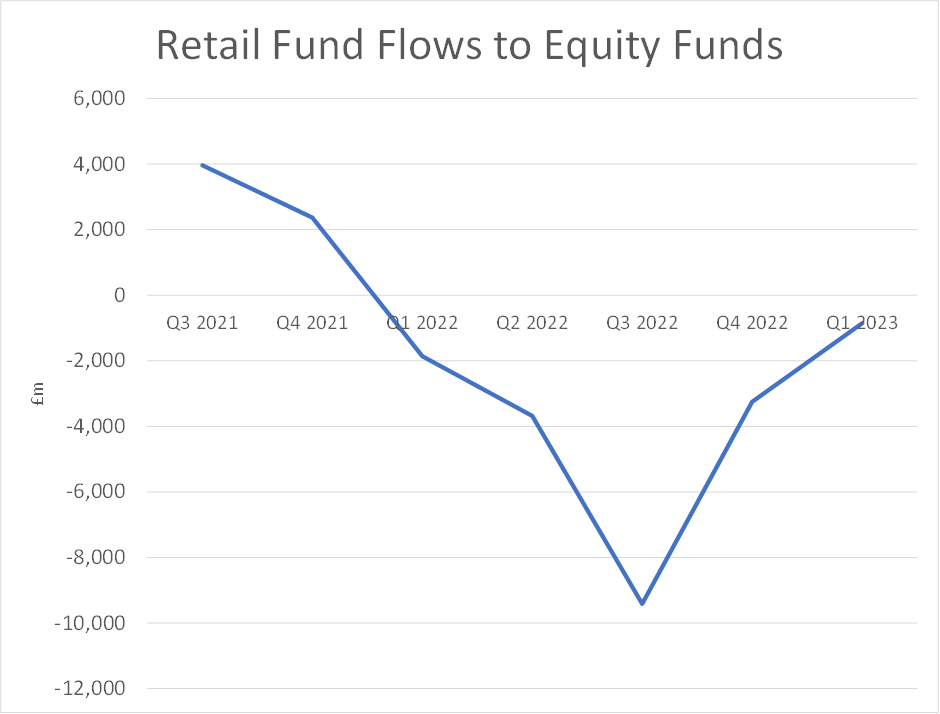

Going back to the Investment Association Data, they also publish monthly statistics. Here is the graph of monthly retail fund flows to equity funds over the last year:

The trend has been improving since the nadir in September last year, and In March of this year, fund flows became positive again. Although the amount was small and there is no guarantee that they remain positive in the future, the selling pressure on midcap companies will have at least diminished in the short term. If the trend continues, funds will start to deploy capital back into the most undervalued shares. On…

.JPG)